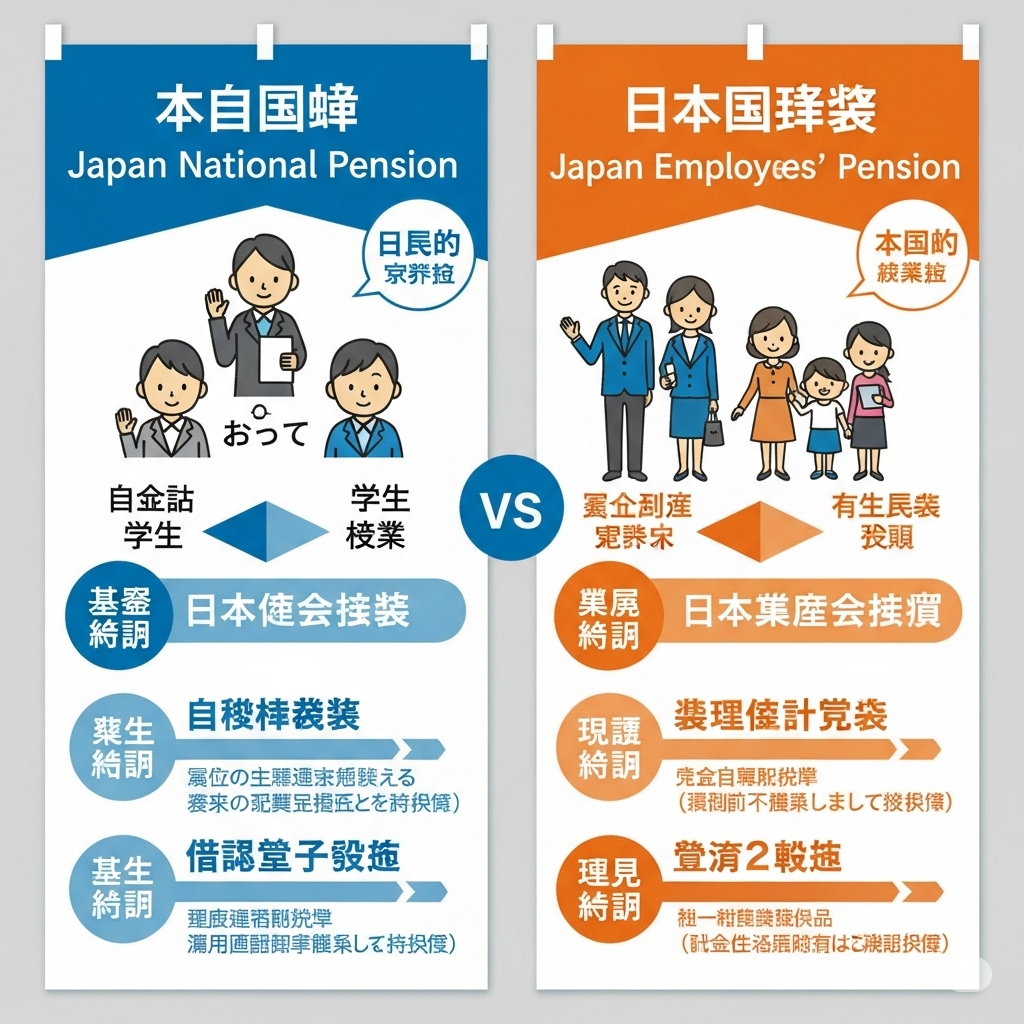

Comparing Japan National Pension and Japan Employees’ Pension in Japan

Understanding Japan’s Pension System: National vs. Employees’

Navigating Japan’s pension system as an expat can feel overwhelming. Are you confused about the difference between the National Pension (国民年金, Kokumin Nenkin) and the Employees’ Pension (厚生年金, Kosei Nenkin)? Don’t worry, you’re not alone! Many expats struggle to understand which pension plan they’re enrolled in and what benefits they’re entitled to. This guide will break down the key differences between these two systems, making it easier for you to understand your pension obligations and plan for your future in Japan.

What is the Japan National Pension (国民年金, Kokumin Nenkin)?

The National Pension is a mandatory, basic pension plan for all residents of Japan between the ages of 20 and 59. Think of it as the foundation of Japan’s pension system.

Who is Required to Enroll?

- Self-employed individuals

- Students

- Unemployed individuals

- Spouses of those enrolled in the National Pension

- Foreign residents aged 20-59 residing in Japan

Contribution Amounts

The National Pension requires a fixed monthly contribution. As of 2024, the contribution amount is ¥16,980 per month. This amount is subject to change annually.

Benefits

The National Pension provides a basic level of pension benefits, including:

- Old-age pension (retirement pension)

- Disability pension

- Survivor’s pension

The amount of your pension benefit depends on the number of years you contributed to the plan. You generally need to contribute for at least 10 years to be eligible for the old-age pension.

What is the Japan Employees’ Pension (厚生年金, Kosei Nenkin)?

The Employees’ Pension is an earnings-related pension plan for employees of companies and organizations. It’s essentially an addition to the National Pension.

Who is Required to Enroll?

- Full-time employees

- Part-time employees who work at least 3/4 of the hours of a full-time employee

Contribution Amounts

The Employees’ Pension contribution is a percentage of your monthly salary and bonuses. Importantly, your employer pays half of the contribution amount, and you pay the other half. The contribution rate also includes the National Pension portion.

Benefits

The Employees’ Pension provides enhanced pension benefits compared to the National Pension. These benefits include:

- Old-age pension (retirement pension): This is higher than the National Pension old-age pension because it is based on your earnings.

- Disability pension

- Survivor’s pension

Similar to the National Pension, you generally need to contribute for at least 10 years to be eligible for the old-age pension. However, the amount you receive will be significantly higher because it’s based on your salary history.

Key Differences: National Pension vs. Employees’ Pension

Contribution Structure

- National Pension: Fixed monthly contribution paid entirely by the individual.

- Employees’ Pension: Contribution is a percentage of salary, shared equally between the employee and employer, and includes the National Pension.

Benefit Levels

- National Pension: Provides a basic, fixed level of pension benefits.

- Employees’ Pension: Provides higher, earnings-related pension benefits, in addition to the National Pension.

Enrollment Requirements

- National Pension: Mandatory for all residents aged 20-59 who are not enrolled in the Employees’ Pension.

- Employees’ Pension: Mandatory for employees of companies and organizations.

What Happens When You Leave Japan?

If you contributed to the National Pension or Employees’ Pension for more than six months but less than ten years, you may be eligible for a lump-sum withdrawal payment (脱退一時金, Dattai Ichijikin) when you leave Japan. The amount you receive depends on the length of your contributions. You must apply for this payment within two years of leaving Japan.

Conclusion

Understanding the Japan National Pension and Employees’ Pension is crucial for planning your financial future in Japan. Remember that the National Pension is a basic, mandatory plan, while the Employees’ Pension offers enhanced benefits for employees. Knowing which system you’re enrolled in and your contribution history will help you estimate your potential pension benefits and plan for your retirement. Need help understanding your pension situation?

Get FREE CONSULTANTS today to help navigate the process!