Pension Lump Sum

Nenkin is a pension insurance, everyone regardless of nationality, occupation, gender, between the ages of 20 and 60, residing in Japan, is obliged to contribute a monthly amount (年金保険料) is called a pension. ▼

When participating and paying the full number of years as prescribed, when old age (after 65 years old), participants will be entitled to a monthly pension allowance. In addition, participants can also receive support in case of injury or death before the age of 65. For interns – because they are foreigners working in Japan, after returning home after a few years, they cannot enjoy the same pension benefits later as Japanese people when they get old. Therefore, for foreign workers working and living in Japan who have fulfilled their tax obligations, when returning home, they will be refunded the tax (called Nenkin money).

HSB JAPAN Company and Japanese associates will represent you and complete the procedures to get 100% of the tax and pension amount paid by the employee during the working process in Japan.

Lump Sum withdrawal payments (Japanese Pension Refund)

Non-Japanese persons who worked and paid pension contributions in Japan (Kosei Nenkin / Kokumin Nenkin / Kyosai Nenkin)can claim refunds of their contributions within 2 years since leaving Japan. This payback system is called “Lump sum Withdrawal Payments”. Details are shown on the guidance pages of Japan Pension Service

Persons who fulfill the following conditions can claim their pension refunds:

- They are not a Japanese citizen

- They have paid Japanese pension contributions from 6 months to 10 years

- They left Japan less than two years ago

- They don’t reside in Japan now

※ Minimum period for a qualification to claim old age pension (basically after 65 years old) is currently 10 year’s enrollment. Most of foreigners who worked in Japan in a short period with working visas are to get qualified to claim their pension refunds after leaving Japan. When the social insurance office (Japanese Pension Service) reimburses your pension payments, it deducts 20% income tax on the refunded amount. However, we will help you reclaim the 20% tax charged on the Lump-sum withdrawal.

※ We carry out TOTAL PROCESS of claiming pension refunds legally. We examine all your documents before claiming and help you succeed in your refund surely.

Requirements to get Pension Lump Sum

You are eligible for lump-sum withdrawal payment if you satisfy all the following seven requirements.

- You are not a Japanese citizen

- You are not a resident in Japan

- You have coverage periods of six months or more under the EPI system

- You are not eligible for Old-age Employees’ Pension period (see note below)

- You have never been entitled to receive a pension (including disability allowance)

- It has been within two years of losing your membership of the National Pension if you have never possessed residency in Japan after the loss of your membership of the National Pension and the Employees’ pension.

- It has been within two years of losing your residency in Japan if you have possessed residency in Japan after the loss of your membership of the National Pension and the EPI system.

How to calculate your Pension Lump Sum?

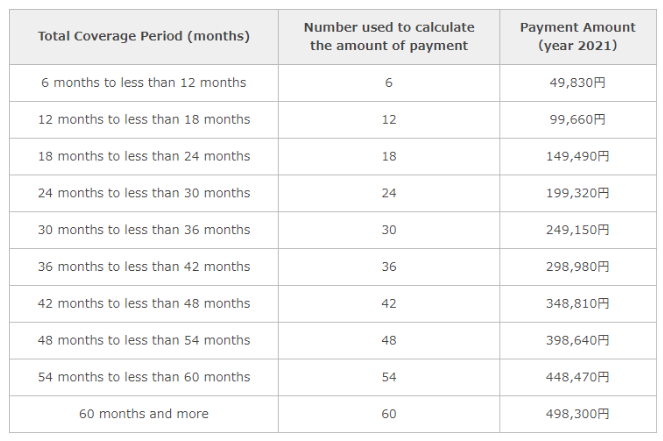

The amount to be paid is calculated and increases on a 6-month basis up to a maximum of 12 periods or 60 months (5years). Any payment made after the 60th month is to be excluded. Therefore, the amount to be received will be the same whether one is enrolled in the system for 5 years or 9 years.

※ This new rule will be applied from April 2021.

① National Pension (KOKUMIN NENKIN)

Starting April 2021, for members whose final payment of insurance premium is due after April 3rd of year 2021, the amount of lump sum withdrawal payment will be calculated according to the year in which the last month of payment of insurance premium belongs and the periods for which insurance premiums have been paid.

※For those whose final payment of insurance premium is due before March 2021, the amount of lump-sum withdrawal payment is calculated up to a maximum of 36 months (3 years) as in past calculations.

[Calculation Formula for Lump Sum Withdrawal Payment]

The amount of insurance premiums for the year to which the last month of payment of insurance premiums belongs x 1/2 x the number used to calculate the amount of lump sum withdrawal payment. (See table)

② Employees’ Pension (KOUSEI NENKIN)

Starting April 2021, members whose final payment (the month before the month to which the day of disqualification belongs) is April or after, the amount of lump-sum withdrawal payment is calculated up to a maximum of 12 periods or 60 months.

※ But for those whose final payment of insurance premium is due before March 2021, the amount of lump-sum withdrawal payment will be calculated up to a maximum of 36 months (3 years) as in past calculations.

If you want to calculate how much is your Pension Lump sum, kindly refer to the Lump sum pension withdrawal payment calculator below.