How to get pension exemption in Japan?

Nenkin Exemption Japan: Get Your Pension Payment Waived

Welcome, expats living and working in Japan! Navigating the administrative side of life here, especially finances, can sometimes feel overwhelming. One aspect that often raises questions is the mandatory National Pension system, known as Kokumin Nenkin (国民年金). While contributing is essential for your future and eligibility for various benefits, sometimes financial circumstances make paying the monthly fee a challenge. The good news? Japan has a system in place called Nenkin exemption (or pension waiver) that can provide much-needed relief. This guide is specifically for you, the expat community, to understand how to navigate this process.

In this post, we’ll break down everything you need to know about getting a nenkin exemption in Japan. We’ll cover who is eligible, the different types of waivers available, the step-by-step application process, required documents, and the potential impact on your future. Our goal is to make this complex topic easy to understand and empower you to take the right steps if you’re facing financial difficulty. Let’s dive in!

Understanding the Japan National Pension System

First, a quick recap. The Japan National Pension (Kokumin Nenkin) is a mandatory social insurance system. Generally, all residents aged 20 to 60 must contribute, regardless of nationality. These contributions are the basis for receiving a basic pension (kiso nenkin) in retirement. It also provides coverage in case of disability or death, offering disability pensions or survivor pensions to eligible individuals or their families.

For company employees, your pension contributions are usually handled automatically through your employer as part of the Employees’ Pension Insurance (Kosei Nenkin), which includes the basic Kokumin Nenkin. However, if you are self-employed, a student, unemployed, or in certain other situations, you are likely enrolled directly in the Kokumin Nenkin system and receive monthly bills you need to pay yourself.

What is Nenkin Exemption (Pension Waiver)?

Nenkin exemption is a formal system that allows individuals facing financial hardship to have their mandatory National Pension contributions reduced or waived entirely for a specific period. It is *not* the same as simply not paying your bills. Applying for and receiving an exemption ensures that your period of non-payment is officially recognized, offering several key benefits compared to simply defaulting on payments (which we’ll discuss later).

The system recognizes that life can bring unexpected challenges – job loss, illness, low income, or being a student with limited funds. The goal of the waiver system is to maintain your connection to the pension system and allow you to continue accumulating contribution periods, even when you can’t afford the full payment.

Who is Eligible for Nenkin Exemption?

Eligibility for Japan pension waiver for foreigners and Japanese citizens alike is primarily based on income and specific life circumstances. The criteria are set by the Japan Pension Service (Nihon Nenkin Kikou). Here are the main categories that often qualify:

Low Income or Unemployment

This is the most common reason for eligibility. If your previous year’s *annual income* falls below a certain threshold, you may be eligible for a full or partial exemption. The exact threshold depends on the number of dependents in your household. This applies if you are self-employed, unemployed, or working part-time with income below the minimum threshold for mandatory employee insurance.

If you’ve recently lost your job and are receiving unemployment benefits, you may also be eligible, often under slightly different conditions that consider your current lack of income.

Students

Japan has a special system called the “Special Payment System for Students” (Gakusei Tokurei Seido). If you are enrolled in an eligible educational institution and are under 60, you can apply to have your pension payments deferred. This isn’t a full waiver initially, but defers payment until a later date, allowing you to focus on your studies. While deferred, the period is still counted towards your eligibility for disability or survivor pensions, but you would need to pay the deferred amounts later to have them counted towards your retirement pension amount.

Youth (Under 30)

For individuals under 30 who are not students but are facing financial difficulty, there’s a “Special Payment System for Youth” (Wakamono Nofu Yuyo Seido). Similar to the student system, this allows you to defer payments, offering temporary relief while maintaining certain pension rights.

Disaster or Hardship

In cases of natural disaster, significant illness, injury, or other unavoidable circumstances causing severe financial hardship, you may also be eligible for an exemption.

Key Insight for Expats: The eligibility criteria apply equally to foreign residents who are mandatory contributors to the National Pension. Your nationality does not prevent you from applying for or receiving a nenkin exemption if you meet the income or status requirements.

Need help determining your eligibility? While this guide provides general information, your specific situation and income thresholds can vary. The best next step is to consult the official resources or visit your local office.

Types of Nenkin Exemption Available

The exemption isn’t always an all-or-nothing situation. Depending on your income level and household situation, you may qualify for different levels of waiver:

- Full Exemption (全額免除 – Zen’gaku Menjo): Your payment is reduced to ¥0 for the approved period. The full period is counted towards the required contribution period for receiving a basic pension and qualifies you for disability/survivor pensions. However, the amount of future basic pension you receive will be reduced by half for the period exempted.

- Partial Exemption (一部免除 – Ichibu Menjo): You pay a reduced amount (e.g., 1/4, 1/2, or 3/4 of the standard fee). The contribution period is counted, and your future basic pension amount is adjusted based on the portion you paid and the portion exempted.

- Payment Deferral (納付猶予 – Nofu Yuyo): This applies mainly to the Student and Youth systems. You don’t pay the contribution during the approved period. The period *is* counted for disability/survivor pension eligibility. However, it is *not* counted towards your retirement pension amount *unless* you choose to pay the deferred amounts later (within 10 years).

Choosing the right type, or understanding which one you qualify for, is crucial. Even partial payment is better for your future pension amount than a full exemption, assuming you can afford it.

The Application Process: Step-by-Step

Wondering how to apply for nenkin exemption? The process generally involves your local municipal office (ward office or city hall) and the Japan Pension Service.

- Identify Your Office: Go to the National Pension section of your local ward office (kuyakusho) or city hall (shiyakusho).

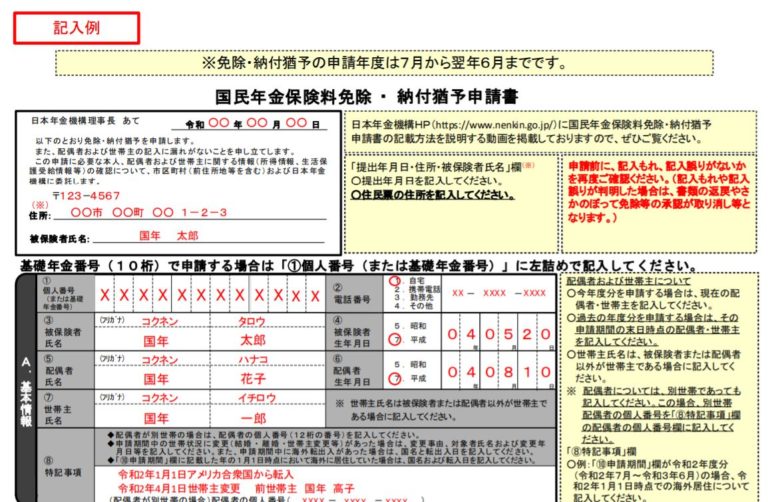

- Obtain the Application Form: Ask for the “Application for National Pension Contribution Exemption/Payment Postponement” (国民年金保険料免除・納付猶予申請書 – Kokumin Nenkin Hokenryo Menjo/Nofu Yuyo Shinseisho). These forms are primarily in Japanese. It’s highly recommended to bring a Japanese-speaking friend, colleague, or translator if your Japanese is not strong.

- Fill Out the Form: Provide details about yourself, your household (spouse’s income is also considered if applicable), and your income situation. Be accurate and honest.

- Gather Required Documents: (See next section for details). Have everything ready.

- Submit the Application: Hand in the completed form and documents at the office. They may ask you clarifying questions.

- Wait for Notification: Your application will be reviewed by the Japan Pension Service. This can take anywhere from a few weeks to a couple of months. You will receive an official notification by mail stating whether your application was approved, the period of exemption/deferral, and the type (full, partial, or deferral).

You can usually apply for exemption for the current fiscal year (April to March) and often retroactively for periods within the last 2 years. If your situation changes significantly during the year (e.g., you lose your job), you can apply mid-year.

What Documents Do You Need?

While requirements can vary slightly depending on your specific situation and local office, here are the common documents for pension exemption Japan:

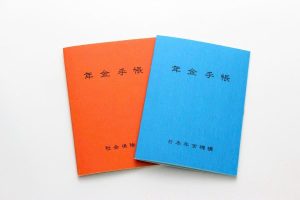

- Your National Pension Handbook (年金手帳 – Nenkin Techo) or any document showing your basic pension number.

- Proof of identity (Residence Card, passport, etc.).

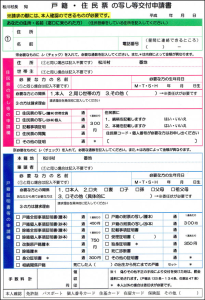

- Your Residence Certificate (住民票 – Jyuminhyo) – though sometimes the office can access this internally.

- Documents proving your income/financial situation:

- If low income/unemployed: Tax documents from the previous year (e.g., Tax Payment Certificate – 納税証明書 – Nozei Shomeisho, or Tax Exemption Certificate – 課税証明書/非課税証明書 – Kazei Shomeisho/Hikazei Shomeisho). If recently unemployed, proof of job separation and eligibility for unemployment benefits.

- If student: Your Student ID (学生証 – Gakuseisho) or enrollment certificate.

- If other hardship: Documents supporting your situation (e.g., medical certificate, disaster victim certificate).

- (If applicable) Documents related to your spouse’s income.

It’s always wise to check your local ward office’s website or call them in advance to confirm the exact documents required for your situation. Bringing originals and copies is usually a good practice.

Benefits and Drawbacks of Getting an Exemption

Getting a nenkin exemption is a formal process with pros and cons compared to simply not paying.

Benefits:

- Financial Relief: The most immediate benefit is freeing up funds when you are facing hardship.

- Maintains Contribution Period: Crucially, exempted periods are counted towards the minimum 10 years needed to be eligible for a basic pension upon retirement. Simply not paying does NOT count these periods.

- Eligibility for Disability/Survivor Pensions: If you become disabled or pass away during the exempted period, you (or your family) may still be eligible for the respective pension payments, provided you meet certain contribution criteria before the exemption. If you just didn’t pay, you lose this coverage.

- Avoids Penalties: Applying for and receiving an exemption means you avoid late fees, reminder notices, and potential forced collection actions that can occur if you simply ignore the bills.

Drawbacks:

- Lower Future Pension Amount: While exempted periods count towards eligibility, they typically result in a lower monthly *basic pension* payment in retirement compared to paying the full contribution. Full exemption reduces the future pension amount for that period by half (for the basic pension portion). Payment deferral periods don’t count towards the retirement amount unless paid later.

- Need to Reapply: Exemptions are usually granted for one fiscal year (April-March) or less. You generally need to reapply annually or when your situation requires it.

Unique Perspective: For expats, maintaining your contribution period through exemption can be vital. Even if you don’t plan to retire in Japan, the system allows for a “Lump-sum Withdrawal Payment” if you leave Japan permanently after contributing for at least 6 months (though the maximum payout period is 5 years). Having approved exemption periods counts towards the *total period* required for eligibility for this lump sum, even if those specific exempted months don’t increase the payout amount itself. It’s significantly better than having gaps due to non-payment.

After the Exemption: What You Need to Know

Once your application is approved, you will receive an official notification. Keep this document safe!

- Exemption Period: Note the start and end dates of your approved exemption or deferral period.

- Reapplication: If your financial situation doesn’t improve by the end of the period, remember to reapply before the next fiscal year (usually starting April 1st) or when prompted.

- Change in Circumstances: If your income significantly increases during the exempted period, you are technically supposed to notify the Pension Service, though many people wait until the next application cycle.

- Catch-Up Payments (追納 – Tsuino): You have the option to pay the exempted or deferred amounts within 10 years of the exemption/deferral date. Paying these amounts retroactively increases your future basic pension amount to what it would have been had you paid originally. There might be a small interest added after a certain period (usually the third year).

Receiving an exemption is a temporary measure. Planning for how you will handle your pension contributions once your situation improves, potentially by utilizing the catch-up payment system, is a wise financial strategy for maximizing your future benefits.

Considering catch-up payments or have questions about your future pension? While this guide covers exemptions, planning for retirement in Japan can be complex. Consider seeking professional financial advice tailored to expats.

Quick Takeaways

- Nenkin Exemption is a formal process to reduce or waive National Pension payments for those facing financial hardship.

- Eligibility is primarily based on low income, student status, or unemployment, applying to expats just like Japanese citizens.

- There are types like Full Exemption, Partial Exemption, and Payment Deferral (for students/youth).

- Apply at your local ward office (kuyakusho) or city hall (shiyakusho) with required documents like income proof and pension handbook.

- Exemption helps maintain your contribution period and eligibility for disability/survivor pensions, unlike simply not paying.

- The main drawback is potentially lower future pension payment upon retirement compared to full contribution.

- You can often apply retroactively (up to 2 years) and have the option to pay exempted amounts later to boost your future pension.

Frequently Asked Questions (FAQs)

Can I get a Japan pension waiver for foreigners if I just arrived and have no income?

Yes, if you are newly arrived, over 20, and have no income or very low income in Japan, you are likely eligible based on the low-income criteria. You’ll need to apply at your local ward office and provide documentation showing your current financial status or lack thereof.

How does partial exemption affect my future pension payment?

Partial exemption means you pay a percentage (e.g., 1/4, 1/2, 3/4) of the standard contribution. The portion you pay contributes fully to your future pension amount. The exempted portion counts towards your contribution period (for eligibility), but the exempted part reduces the amount of the future basic pension proportionate to the waiver percentage.

Is applying for nenkin exemption mandatory if I can’t pay?

No, applying is not mandatory, but it is highly recommended. Simply not paying leads to penalties, potentially forced collection, and means those months do not count towards your pension eligibility or benefits like disability/survivor coverage. Applying for exemption is the proper legal way to handle inability to pay.

How long does it take to hear back after I apply for nenkin exemption?

The processing time varies, but it typically takes 1 to 3 months to receive the official notification by mail from the Japan Pension Service (Nihon Nenkin Kikou). Be patient and make sure your registered address is correct.

Can I apply for exemption for past periods I didn’t pay?

Yes, you can generally apply for retroactive exemption for periods within the last 2 years and 1 month. You’ll need to provide income documentation for those specific periods.

Conclusion

Dealing with mandatory payments like the National Pension when your finances are tight is stressful. However, ignoring your pension bills is rarely the best solution in Japan. The nenkin exemption system exists precisely to help individuals like you navigate these challenges without losing crucial pension coverage and eligibility.

By understanding the eligibility criteria, knowing the application process, and being aware of the benefits (like maintaining your contribution period and eligibility for disability/survivor pensions) and drawbacks (like a potentially lower future pension amount), you can make an informed decision. Taking the proactive step to apply for a pension waiver is a responsible way to manage your financial situation in Japan while staying connected to the vital social security system.

Don’t let financial difficulties lead to larger problems down the road. If you are struggling to pay your National Pension contributions, explore the possibility of getting a nenkin exemption.

Ready to take the next step? Visit your local ward office or city hall’s National Pension section, or check the official Japan Pension Service website for detailed information and forms. Don’t hesitate to ask for assistance if needed!

References

- Japan Pension Service (Nihon Nenkin Kikou) – National Pension (English)

- Japan Pension Service (Nihon Nenkin Kikou) – Contribution Exemption/Payment Postponement (Japanese)

- Ministry of Health, Labour and Welfare (MHLW) – Policy Information (English)

Note: Official forms and the most detailed, up-to-date information are primarily available in Japanese. The English links provide an overview.

Found this guide helpful? We’d love to hear from you! Share your experience navigating the Nenkin exemption process in the comments below. What was your biggest challenge?

Please share this article with other expats who might benefit from understanding the nenkin exemption in Japan!

“`