A Basic Guide to Resident Tax in Japan (Juminzei)

Juminzei: Guide to Japanese Resident Tax for Expats

Navigating taxes in a new country can feel like deciphering a complex code. You’ve likely heard of income tax, but there’s another important one you’ll encounter: the Juminzei, or Japanese Resident Tax.

Unlike national income tax (which you might pay via withholding every month), the resident tax is a local tax. It’s calculated based on your previous year’s income and helps fund services in the city or ward where you live as of January 1st. For many expats, the first time you truly notice it is when you receive a notification slip or see a larger deduction starting in June.

Feeling a bit lost? You’re not alone! This guide is designed specifically for expat workers like you. We’ll break down what Juminzei is, who pays it, how it’s calculated, and most importantly, how and when you need to pay. By the end, you should have a much clearer picture of this essential aspect of living and working in Japan.

Understanding Juminzei: The Basics

The Japanese Resident Tax (Juminzei) isn’t just one tax; it’s actually a combination of two prefectural and municipal taxes levied by your local government. Think of it as your contribution to the public services right in your neighborhood and prefecture – from schools and infrastructure to welfare services.

Two Components: Prefectural and Municipal Tax

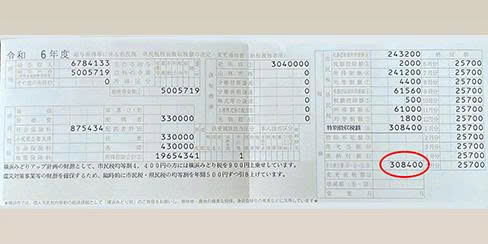

When you look at your tax statement or pay slip, you’ll see the total Juminzei amount. This sum is divided between the prefecture you live in (e.g., Tokyo-to, Osaka-fu) and the municipality (city, ward, town, or village) within that prefecture. The split is typically 40% for the prefecture and 60% for the municipality, though this can vary slightly by location.

The “Per Capita” and “Income-Based” Levy

Juminzei has two parts:

- Per Capita Levy (均等割 – Kintowari): A fixed rate that everyone residing in the municipality as of January 1st pays, regardless of income (though low-income earners may be exempt). This is usually a small, fixed amount per year (e.g., ¥5,000 – ¥6,000 total).

- Income-Based Levy (所得割 – Shotokuwari): This is the larger portion and is calculated based on your income from the previous year. It’s a percentage of your taxable income after deductions.

Most of the Juminzei you pay comes from the income-based levy, making it crucial to understand how your income from the prior year impacts your current tax bill.

Who Pays Juminzei in Japan?

This is a key question for expats. The rule is simple but often leads to confusion:

Residence Status and Tax Liability

You are generally liable for Juminzei if you are registered as a resident in a municipality in Japan as of January 1st of the current year.

The January 1st Rule

Here’s why the January 1st date is critical: Your Juminzei liability for the current year (e.g., 2024) is determined by where you were living and registered on January 1st, 2024. The tax amount itself is then based on your income earned throughout the previous year (2023).

This means if you arrived in Japan in, say, March 2023, you likely had little or no income in Japan during 2023. As of January 1st, 2024, you were a resident. So, in June 2024, you’ll receive a Juminzei bill based on your minimal income from 2023. However, come June 2025, your bill will be based on your full income from 2024, which will be significantly higher. This sudden jump in the second year’s Juminzei is a common surprise for expats!

How Juminzei is Calculated

As mentioned, the bulk of your Juminzei bill comes from the income-based levy, which is calculated based on your earnings from the previous calendar year (January 1st to December 31st).

Based on Your Previous Year’s Income

Your employer reports your annual income to your local municipality after the year ends. If you have other income sources (like freelance work, rentals, etc.), you might need to file a separate tax declaration (Kakutei Shinkoku) by March 15th to report everything accurately. This ensures the municipality has the correct income figure to calculate your Juminzei.

The Calculation Formula (Simplified)

The income-based levy is typically calculated as a flat percentage of your “taxable income.”

Taxable Income = Total Income (from previous year) – Income Deductions

Common income deductions include basic deductions, employment income deductions, spousal deductions, dependent deductions, social insurance contributions, medical expense deductions, etc. These are similar to those for national income tax.

The standard tax rate for the income-based levy is usually around 10% (6% for municipal tax, 4% for prefectural tax), although this can vary slightly by municipality and prefecture.

Deductions and Allowances

Just like with national income tax, various deductions can reduce your taxable income, thereby lowering your Juminzei bill. Make sure your employer is aware of your dependents, insurance payments, etc., or include them if you file a tax declaration.

Unique Insight: Many expats are surprised that their first Juminzei bill is often quite low. This is because it’s based on their income in the year they arrived, which might only be a few months’ worth of salary. The shock comes in the second year when the bill is based on a full 12 months of higher income. Budgeting for this increase is crucial!

How and When to Pay Juminzei

There are two primary methods for paying your Japanese Resident Tax, usually determined by your employer or your filing status.

Method 1: Special Collection (特別徴収 – Tokubetsu Choshu)

If you are a company employee, your employer will likely handle your Juminzei payment through “Special Collection.” This means your Juminzei is automatically deducted from your monthly salary, similar to how income tax is withheld.

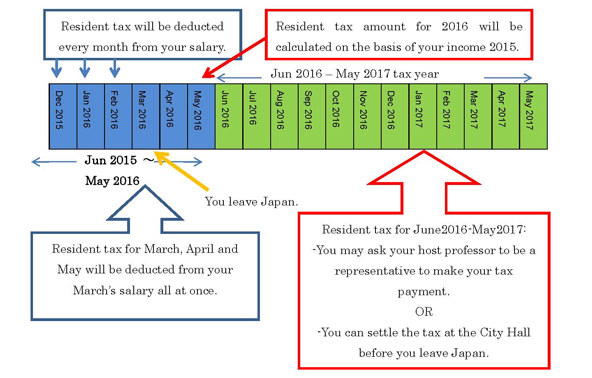

The annual Juminzei amount calculated by the municipality is divided into 12 installments, which are deducted from your salary from June of the current year until May of the following year. This is the most common and convenient method for employed expats.

Method 2: Regular Collection (普通徴収 – Futsu Choshu)

If you are self-employed, retired, or if your employer doesn’t use special collection, you will pay through “Regular Collection.” In this case, your municipality will send you a Juminzei notification slip (or multiple slips) in June.

The total annual amount is typically divided into four installments, payable by specific deadlines:

- End of June

- End of August

- End of October

- End of January (of the following year)

You can use the payment slips to pay at banks, post offices, convenience stores, or via online banking/payment apps in some municipalities.

Pro-Tip: Don’t ignore the Juminzei notification! Missing deadlines can result in delinquency charges.

Got questions about payment methods? Check our FAQs!

Resident Tax vs. Income Tax: What’s the Difference?

It’s easy to get confused between these two taxes, but they serve different purposes and are handled differently.

Key Distinctions

- Levying Authority: Income tax (Shotokuzei) is a national tax collected by the National Tax Agency. Juminzei is a local tax collected by your municipal and prefectural governments.

- Calculation Basis: Both are based on income, but national income tax is calculated on your current year’s income and often paid via monthly withholding, with a potential year-end adjustment or tax filing. Juminzei is calculated on your previous year’s income and paid in the current year.

- Payment Timing: Income tax is usually withheld monthly or paid in one go via filing. Juminzei is typically paid in 12 monthly installments (special collection) or 4 quarterly installments (regular collection) from June to May of the following year.

While they are different taxes, the income information you report for national income tax filing (Kakutei Shinkoku) is automatically shared with your local municipality, which is then used to calculate your Juminzei bill. If you file income tax correctly, you usually don’t need a separate filing just for Juminzei.

Leaving Japan? Don’t Forget Your Juminzei!

If you plan to leave Japan permanently or for an extended period (usually meaning you cease to be a tax resident), your Juminzei obligations don’t necessarily end the moment you leave.

Tax Agent Requirement

If you leave Japan before paying all your Juminzei installments for the year (especially if you pay via Regular Collection), you are required to appoint a Tax Agent (納税管理人 – Nozei Kanrinin). This person (who must be a resident in Japan) will receive your tax notices and pay your taxes on your behalf.

Paying Before You Leave

Alternatively, depending on your municipality, you may be able to pay all outstanding Juminzei installments before your departure date. Check with your local city or ward office well in advance of your planned departure to understand their specific procedures.

Ignoring outstanding taxes can lead to issues, so it’s best to settle everything or appoint an agent before you depart.

Navigating Juminzei as an Expat

Dealing with taxes in a foreign language can be intimidating, but help is available.

Dealing with Language Barriers

Tax forms and notices are often only in Japanese. Don’t hesitate to seek assistance. Many city and ward offices have support desks or interpreters available, especially during peak tax season (Feb-Mar for income tax, May-June for Juminzei notices).

Where to Find Help (City Hall, Tax Advisors)

- Local City/Ward Office: This is your primary point of contact for Juminzei issues. They handle the calculation and collection. Bring your notification slip (if you have one) and identification.

- National Tax Agency (NTA) Offices: While primarily for national income tax, they can sometimes offer general tax advice.

- Professional Tax Advisors (Zeirishi): For complex situations, especially involving different income types, deductions, or international tax implications, consulting a qualified, English-speaking tax advisor (Zeirishi) is highly recommended. While there’s a fee, their expertise can save you stress and potential errors.

Quick Takeaways

- Juminzei is a local tax (prefectural + municipal) in Japan.

- It’s based on your income from the previous calendar year.

- Your liability is determined by being a resident on January 1st.

- It has two parts: a small fixed “Per Capita” levy and a larger “Income-Based” levy (around 10%).

- Payment methods: Salary deduction (Special Collection) or payment slips (Regular Collection).

- Payment is typically from June to May (Special) or quarterly (Regular).

- Plan for a potentially higher bill in your second year based on a full year’s income.

- If leaving Japan, you may need to appoint a tax agent or pay in full.

- Don’t hesitate to seek help from your local city/ward office or a tax professional.

Frequently Asked Questions (FAQs)

- Q: I arrived in Japan in September. Do I have to pay Juminzei this year?

A: Your first Juminzei bill will arrive the following June. It will be based on the income you earned in Japan from September to December of your arrival year. Your bill the year after that will be based on a full year’s income and will likely be much higher. - Q: Where can I pay my Juminzei using the regular collection slips?

A: You can usually pay at banks, post offices, convenience stores (check which ones are listed on the slip), or through online banking/payment apps if your municipality supports it. The payment locations are usually listed on the back of the slip. - Q: What happens if I lose my Juminzei notification slip?

A: Contact your local city or ward office immediately. They can issue a replacement payment slip or provide instructions on how to pay without it. Don’t wait until the deadline passes! - Q: Is Juminzei calculated on my gross income or net income?

A: Juminzei (the income-based part) is calculated on your taxable income, which is your gross income minus various deductions and allowances (like employment income deduction, social insurance premiums, dependents, etc.). - Q: How much is the Juminzei rate?

A: The standard income-based rate is approximately 10% (6% municipal, 4% prefectural). On top of this, there’s a small fixed per capita levy (around ¥5,000-¥6,000 total) unless you are exempt based on low income.

Conclusion: Your Next Steps

Understanding Juminzei is a key part of managing your finances as an expat worker in Japan. While the system might seem daunting at first, remember that it’s a standard process all residents go through. Knowing that your bill is based on last year’s income and how the payment methods work can help you budget and avoid surprises.

If you receive a Juminzei notification and are unsure, or if your income situation is complex, don’t hesitate to reach out for help. Your local city office is there to assist, and professional tax advisors can provide tailored guidance.

Stay informed, keep track of your income, and handle your Juminzei responsibly for a smoother financial life in Japan!

Learn more about Japanese taxes on the NTA website (English)