Japan Resident Tax: What Happens If You Don’t Pay?

Japan Resident Tax: Don’t Pay? Consequences & Resident Tax Exemption

Navigating taxes in a foreign country can feel daunting, especially as an expat worker in Japan. Among the various obligations, the local Resident Tax (住民税 – Juminzei) often brings questions. It’s different from national income tax and is based on your income from the previous year. But what exactly happens if you find yourself unable to pay, or simply forget? Are there ways to get a resident tax exemption? Let’s break down the potential consequences and explore avenues for relief to help you stay compliant and stress-free in Japan.

What is Japan Resident Tax (Juminzei)?

Think of Juminzei as your contribution to the local services in the municipality where you live. This includes things like schools, infrastructure, welfare services, and more. Unlike national income tax, which is calculated and paid on your income from *this* year, resident tax is calculated based on your total income from the *previous* calendar year (January 1st to December 31st). Everyone legally residing in Japan as of January 1st of a given year is generally subject to resident tax for that year, based on their previous year’s earnings, regardless of their nationality or visa status.

How is Resident Tax Calculated?

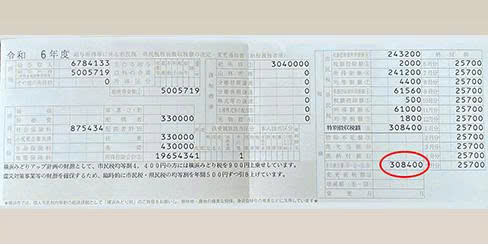

Resident tax consists of two main parts: an income-based portion (所得割 – shotokuwari) and a per-capita portion (均等割 – kintowari). The income-based portion is typically 6% levied by the prefectural government and 4% by the municipal government (a total of 10% on your taxable income after deductions). The per-capita portion is a fixed amount, usually around ¥5,000 – ¥6,000 per year, varying slightly by municipality. Your municipality sends you a tax notice (納税通知書 – nozei tsūchisho) in June detailing the amount owed and payment deadlines.

The Consequences of Not Paying Your Resident Tax

Ignoring tax obligations in any country comes with risks, and Japan is no exception. The consequences for not paying resident tax Japan are designed to escalate, encouraging prompt payment. It’s crucial not to simply ignore the notices you receive.

Initial Notices and Warnings

If you miss a payment deadline (often quarterly or in a lump sum), you’ll first receive reminder notices (督促状 – tokusokujō) from your municipal tax office. These aren’t just gentle nudges; they are formal warnings that indicate you are in arrears and outline the original amount due plus potential late fees.

Late Payment Penalties (Delinquent Tax)

Along with reminder notices, you will start incurring a late payment penalty (延滞金 – entaikin), sometimes referred to as delinquent tax. The exact percentage varies by municipality and the duration of the delay. Initially, the rate is lower (e.g., around 2.4% per year for the first month or so), but it increases significantly for longer periods of non-payment (e.g., up to 8.7% per year). These penalties are calculated daily, so the longer you wait, the more you owe on top of the original tax amount.

Interest Charges (Late Payment Interest)

Separate from or combined with the late payment penalty depending on the specific rules, interest charges apply. This further increases the total amount you owe. The rates are determined based on official interest rates and fluctuate slightly year to year. Again, the longer the debt remains unpaid, the more interest accrues.

Property Seizure and Bank Account Freezing

This is where things become very serious. If you continue to ignore notices and fail to pay, the municipal tax office has the legal authority to initiate compulsory collection procedures. This can include:

- Salary Seizure: A portion of your monthly salary can be directly garnished from your employer and sent to the tax office.

- Bank Account Freezing: Your Japanese bank account(s) can be frozen, and funds up to the amount owed can be seized. This can severely disrupt your ability to live and work in Japan. Consequences could include a bank account frozen Japan tax situation becoming a major hurdle in daily life.

- Seizure of Other Assets: While less common for smaller resident tax debts, authorities can seize other assets like vehicles or property.

This process doesn’t happen overnight, but once initiated, it can be swift and impactful. They don’t need a court order; the tax office’s delinquency notice holds the legal power to seize assets.

Impact on Your Visa/Residency

While not paying resident tax doesn’t *automatically* revoke your visa, it can have serious implications, especially for longer-term residency or visa renewals. Immigration authorities consider whether you have fulfilled your tax obligations as part of their assessment. Having outstanding tax debts can be a significant negative factor when applying for visa extensions, changes of status, or permanent residency. A history of visa status and Japan tax non-compliance signals a potential lack of adherence to Japanese laws and regulations.

Can You Get a Resident Tax Exemption?

Yes, under specific circumstances, you might be eligible for a resident tax exemption. It’s important to understand that this isn’t automatic; you usually need to meet certain criteria based on your income from the *previous* year or your status.

Eligibility Criteria

The most common criteria for a resident tax exemption are related to low income. If your total income (specifically, your total income amount, 合計所得金額 – gokei shotoku kingaku) in the previous year was below a certain threshold, you might be exempt from either or both the income-based and per-capita portions.

- Low Income Exemption: This threshold varies significantly depending on your municipality, the number of dependents you have, and whether you have other sources of income. Generally, if your income was below the minimum required for basic living expenses, you might qualify. Look up “low income resident tax exemption Japan” for your specific city/ward.

- Specific Situations: Exemptions can also apply in specific hardship cases, for individuals receiving certain welfare benefits, or possibly for certain students (though rules vary).

Remember, eligibility is based on *last year’s* income, not your current income situation. If you arrived in Japan mid-year and had little or no income *in Japan* the previous year, you might automatically be exempt from the income-based portion for your first full tax year, but potentially still owe the per-capita portion.

Process for Applying

If you believe you qualify for a resident tax exemption based on low income or another reason, you typically don’t “apply” in the same way you might apply for a benefit. Your eligibility is usually determined when your municipality calculates your tax based on your previous year’s tax filing (or lack thereof, which still informs them of your income). However, if you receive a tax notice and believe it’s incorrect or you should be exempt due to a specific situation not captured by standard filing, you should contact your municipal tax office immediately to inquire. Sometimes, filing a municipal resident tax declaration (住民税申告 – juminzei shinkoku) is necessary, even if you didn’t file a national tax return, to claim dependents or declare income/lack thereof for exemption purposes.

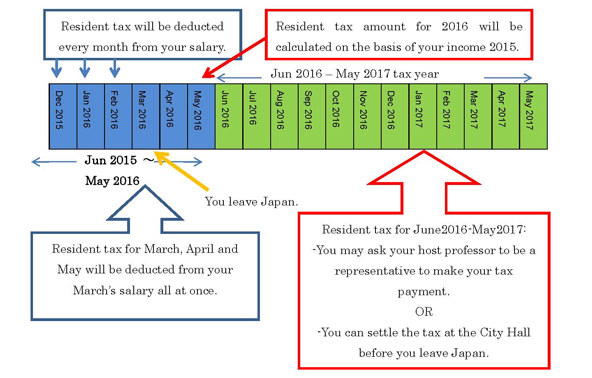

Resident Tax When Leaving Japan

A common situation for expats is dealing with leaving Japan and resident tax. Since resident tax is based on the previous year’s income but paid starting in June of the current year, you will owe resident tax for the year you leave, based on your income from the year *before* you left. For example, if you leave in July 2024, you will still owe resident tax for the tax year 2024 (covering Jan 1 – Dec 31, 2024), which is calculated on your income from 2023.

- If you leave *before* January 1st of a year, you are generally *not* liable for resident tax for that year (as you weren’t a resident on Jan 1st), but you still owe any unpaid tax from previous years.

- If you leave *after* January 1st, you *are* liable for the full year’s tax. You must designate a tax agent (納税管理人 – nōzei kanrinin), who is a resident in Japan responsible for receiving your tax notices and paying on your behalf after you’ve left. Failure to do so can lead to significant complications and potentially impact future entry into Japan.

What to Do If You’re Struggling to Pay

If you receive a resident tax bill and know you cannot pay it on time, the *worst* thing you can do is ignore it. Proactive communication is key.

- Contact Your Municipal Tax Office: Reach out to them *before* the deadline or as soon as you realize you’ll miss it. Explain your situation. They may be willing to discuss payment plans (分割払い – bunkatsu barai) or temporary deferrals depending on your circumstances. Don’t be afraid to ask for help; they are often more understanding if you communicate. Find your Tax office contact Japan information for your specific ward or city.

- Explore Exemption Eligibility: Review the criteria for a resident tax exemption eligibility with the tax office. While low income is the primary factor, they can confirm if any other conditions apply to you based on your registered information.

- Seek Professional Advice: If your tax situation is complex, especially concerning income from multiple sources, dependents, or leaving Japan, consider consulting a tax advisor or accountant who specializes in foreign residents.

Remember, even if you can’t pay the full amount, paying a portion or arranging a plan is far better than paying nothing and facing escalating penalties and potential asset seizure.

Need Help with Japan Taxes? Contact Us!

Quick Takeaways

- Japan Resident Tax (Juminzei) is a local tax based on your previous year’s income, paid starting in June.

- Not paying leads to escalating consequences: reminder notices, late payment penalties, interest charges, and potentially asset seizure (like bank accounts or salary).

- Non-payment can negatively impact your visa status or future visa applications/renewals.

- A resident tax exemption is possible, primarily based on low income from the previous year.

- Eligibility for exemption is usually determined during tax calculation based on your filing.

- If you’re leaving Japan after Jan 1st, you likely owe the full year’s resident tax and need a tax agent.

- If you cannot pay, *immediately* contact your municipal tax office to discuss options like payment plans.

- Ignoring tax notices is the worst possible action. Seek professional help if needed.

Frequently Asked Questions (FAQs)

Conclusion

Understanding your Japan Resident Tax obligations is essential for a smooth life as an expat. While the idea of non-payment might cross your mind if finances are tight, the potential consequences – from escalating penalties to impacting your visa and assets – are significant. However, remember that options like a resident tax exemption or payment plans exist if you meet the criteria or communicate proactively with your municipal tax office. Don’t let tax worries linger. Take informed action, explore your options, and seek professional guidance if your situation is complex.

Get a Free Tax Consultation for Expats

Reader Feedback & Engagement

We hope this guide has clarified what happens if you don’t pay your Japan Resident Tax and the possibilities of a resident tax exemption. Tax rules can be complex, especially in a foreign country. What was the most surprising thing you learned from this article?

Feel free to share your thoughts below or share this article with other expats who might find it helpful!

References

- National Tax Agency of Japan: Taxes on income / No.12013 Scope of taxpayer (Note: This covers national tax, but NTA website provides general tax concepts. Municipal tax details are local.)

- JapaneseTaxes.com: Individual Income Tax & Resident Tax (Juminzei) (Provides expat-focused overview)

- Tokyo Metropolitan Government Tax Office: FAQs about Taxes in Tokyo (Example of a major municipal tax resource – rules vary by location)

- Consultation with local municipal tax office websites (Highly recommended for specific details relevant to your location)

Note: Tax laws are subject to change. Consult official sources or a qualified tax professional for advice specific to your situation.

“`