A Guide to Filing Kakutei Shinkoku (確定申告) Tax Returns in Japan

The tax declaration period in Japan, known as 確定申告 (kakutei shinkoku), takes place annually from mid-February to mid-March.

So, what is kakutei shinkoku? Who is required to file this tax declaration? What documents need to be prepared, and how should the tax declaration be carried out? In this article, HSB JAPAN will help you gain a clearer understanding of these questions.

① What is 確定申告 (kakutei shinkoku)?

This is the process of calculating and declaring taxes based on income earned within a one-year period from January 1 to December 31. The tax declaration for the previous year is conducted between mid-February and mid-March of the following year. During this time, the required documents must be submitted to the local tax office. Depending on the case, some individuals may receive a refund for overpaid taxes during the year.

② Who is required to file a tax declaration?

- Individuals with an annual income exceeding 20 million yen (2000 man yen).

- Individuals with a side job in addition to their main job, where the side job income exceeds 200,000 yen.

- Employees working at multiple companies who receive more than 200,000 yen from a secondary employer (the one that does not conduct year-end tax adjustments).

- Directors or family members of family-run companies who earn interest from loans or real estate rentals from the company.

- Individuals receiving pension income exceeding 4 million yen after deductions.

- Freelancers and self-employed individuals with an income exceeding 380,000 yen.

- Individuals earning rental income or interest from real estate.

③ Who is exempt from filing a tax declaration?

- Self-employed individuals with income below 380,000 yen.

- Employees (both full-time and part-time) whose companies have completed the year-end tax adjustment on their behalf.

- Individuals with side jobs earning less than 200,000 yen.

- Pensioners with income below 4 million yen (after deductions) and no additional income over 200,000 yen.

- Part-time workers (arubaito) with total annual income below 1.03 million yen.

④ Who should consider filing a tax declaration?

Although not mandatory, these individuals could benefit by filing, as they might receive tax refunds:

- Self-employed individuals who have incurred losses and could benefit from local tax reductions (住民税 jyuminzei).

- Those with medical expenses exceeding 100,000 yen or who have suffered property losses due to natural disasters.

- Individuals who resigned mid-year without completing year-end tax adjustments.

- Those who received severance payments that were not declared.

- Part-time workers who had taxes deducted at source (源泉徴収 gensen choushuu) by an employer that is not their primary job.

- Individuals who made charitable donations (e.g., Furusato Nozei tax donation program).

- Employees whose company completed year-end adjustments but forgot to declare deductions such as remittances to family, medical expenses, insurance, maternity costs, etc.

Note: Filing tax declarations is an obligation. Additionally, it allows individuals to claim refunds for overpaid taxes. Failure to file, whether intentional or not, may result in significant penalties. It is important to file within the designated period to avoid overdue penalties.

⑤ Difference between 確定申告 (kakutei shinkoku) and 年末調整 (nenmatsu chousei)

The key difference is:

- 確定申告 (kakutei shinkoku): A tax declaration process conducted by the individual.

- 年末調整 (nenmatsu chousei): A year-end tax adjustment handled by the employer, calculating, adjusting, and submitting taxes on behalf of employees.

Employees with a single source of income from their company do not need to file 確定申告. However, those listed in section ② must still file even if their employer conducted the year-end tax adjustment.

⑥ How to file a tax declaration

1. Required documents:

The documents needed may vary depending on individual circumstances, but common ones include:

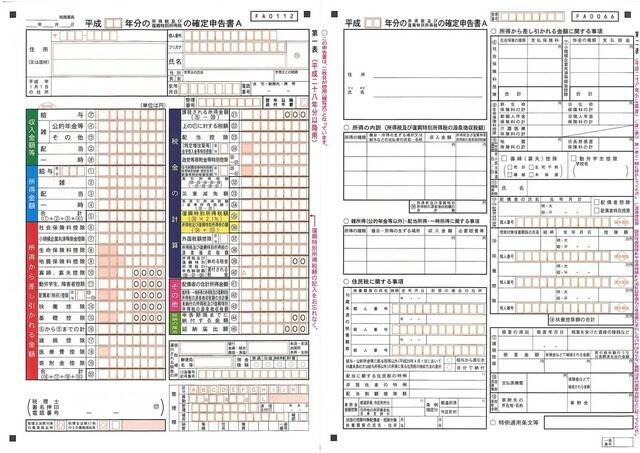

- Tax return forms: Form A (for salary and pension income) and Form B (for all income types). These can be downloaded, printed, and filled out manually.

- 源泉徴収票 (gensen choushuu hyou): This certificate summarizes your income and withheld taxes, usually provided by your employer around December or January.

- Personal identification documents: My Number card (both sides) or alternative ID such as a driver’s license, passport, residence card, or insurance card.

- Expense receipts and proof documents: For medical expenses, remittances to family abroad, freelance income, etc.

2. Submission methods:

You can submit documents through:

- Mailing to the local tax office.

- In-person submission at the tax office.

- Online filing via the e-Tax system.

Check the nearest tax office location here.

Common Japanese Tax-Related Terms

- 確定申告 (kakutei shinkoku): Tax declaration (filing for a tax refund)

- 年末調整 (nenmatsu chousei): Year-end tax adjustment

- 源泉徴収票 (gensen choushuu hyou): Income and tax withholding statement

- 税務署 (zeimusho): Tax office

- 所得税 (shotokuzei): Income tax

- 扶養家族 (fuyou kazoku): Dependent family member (without income)

- 扶養控除 (fuyou koujo): Tax deduction for dependents

- 医療費控除 (iryouhi koujo): Medical expense deductions

- 提出 (teishutsu): Submission (of documents)

Above is an overview of the kakutei shinkoku tax declaration process.

If you need assistance with your tax refund application, let HSB JAPAN handle it for you! We ensure a professional, fast, and accurate process so you can reclaim your rightful benefits with peace of mind.

HSB JAPAN PROMISES:

✅ Direct communication with tax authorities, ensuring ACCURATE and FAST processing.

✅ Assistance with complex cases and challenging scenarios.

✅ Clear and transparent contracts, with no hidden fees.

✅ Helping you MAXIMIZE your tax refund.

📩 Contact HSB JAPAN today for a detailed consultation and claim your benefits with confidence!