Japan Cabinet Approves Pension Reform Bill: 1.06 Million Yen Income Cap Set for Debate in Parliament

On May 16, 2025, the Japanese Cabinet approved a bill to partially amend the National Pension Act and related laws, aiming to strengthen the pension system in response to social and economic changes. The bill will now move forward for deliberation in the National Diet.

This proposed reform seeks to address the increasingly diverse range of working styles, lifestyles, and family structures in Japan. Its goal is to enhance the pension system’s ability to ensure income security and stability in old age—for both current and future recipients. Below, we’ll break down the key points of the reform, including the scheduled dates for implementation.

Table of contents

I. Overview of the Pension System Reform Bill and Implementation Dates

- Expansion of Social Insurance Coverage (Removal of the 1.06 Million Yen Income Cap)

- Revision of the In-Employment Old-Age Pension System

- Changes to Survivor’s Pension System

- Increase in the Wage Cap Used to Calculate Premiums and Pension Amounts

- Revision of the Child Addition Benefit

II- Other Key Revisions

- Revisions to the Private Pension System

- Changes to the Lump-Sum Withdrawal Payment System

- Allowing Deferral of Old-Age Pension for Survivor’s Pension Recipients

- Extension of the National Pension Payment Grace Period

- Expansion of Eligibility for Voluntary Enrollment in the National Pension for Seniors

- Extension of the Deadline to Claim Pension Division at Divorce

I. Overview of the Pension System Reform Bill and Implementation Dates

According to the official website of the Ministry of Health, Labour and Welfare, the proposed amendments cover a wide range of areas, with the main points outlined as follows:

- Expansion of social insurance coverage (removal of the 1.06 million yen income cap)

- Revision of the in-employment old-age pension system

- Changes to the survivor’s pension system

- Increase in the wage cap used to calculate premiums and pension amounts

- Revision of the child addition benefit

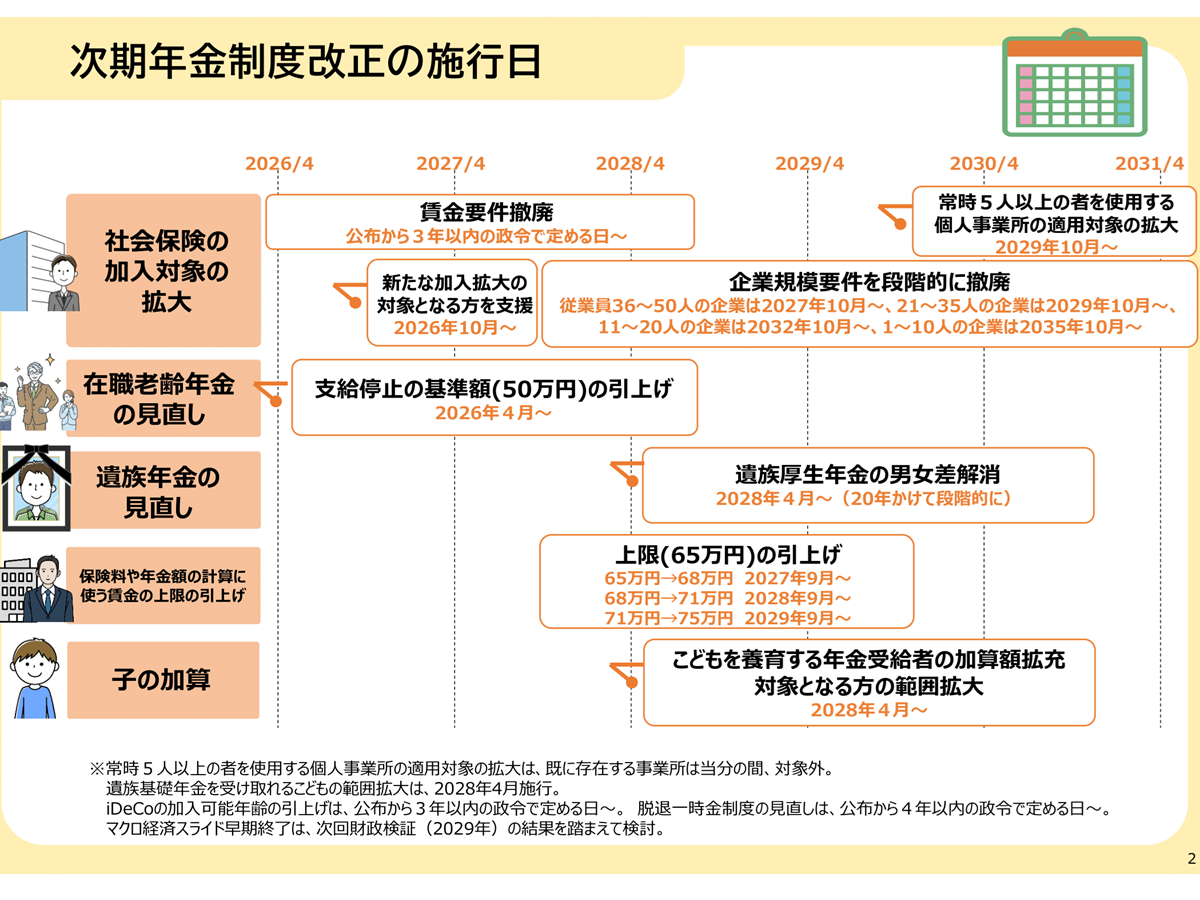

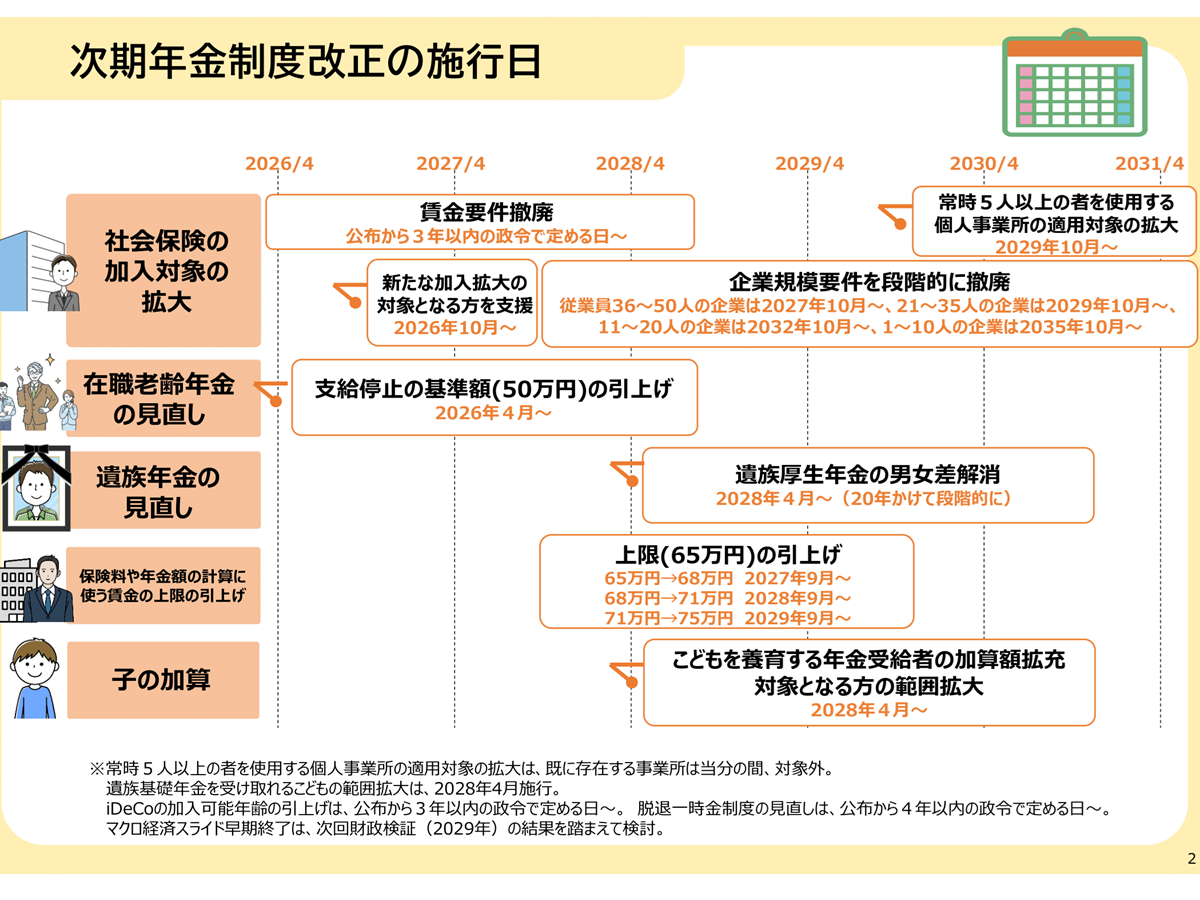

It’s important to note that each of these changes has a different scheduled implementation date.

Regarding the purpose of the reform, the Ministry explains:

“The aim is to strengthen the functions of the pension system in light of social and economic changes by creating a system that is neutral to working styles and gender differences, and responsive to the diversification of lifestyles and family structures. At the same time, the reform seeks to ensure financial stability in old age through enhanced income redistribution and the expansion of private pension systems.”

1. Expansion of Social Insurance Coverage (Removal of the 1.06 Million Yen Income Cap)

The government is reviewing the eligibility requirements for enrollment in Employees’ Pension Insurance and Health Insurance for part-time workers at small and medium-sized enterprises and for those working at sole proprietorships.

Until now, the conditions for part-time and short-hour workers to join social insurance included prescribed weekly working hours, monthly wages of 88,000 yen or more, employment at companies with more than 50 employees, and not being a student.

Under the current revision, these requirements will be simplified.

Specifically, the “wage requirement” (monthly earnings of 88,000 yen or more) will be abolished. This change responds to concerns over the so-called “1.06 million yen annual income barrier.” The timing of enforcement will be decided by a government ordinance within three years after the law is promulgated, based on the situation of regional minimum wage increases across the country.

In other words, once the wage requirement is removed, anyone working 20 hours or more per week will be eligible for social insurance coverage. However, since minimum wages continue to rise, trying to earn less than 88,000 yen per month while working 20 hours or more would mean earning an hourly wage of 1,015 yen or less. Considering ongoing minimum wage increases, this effectively means the wage requirement has already been practically abolished.

Next, the company size requirement will be gradually eliminated. Currently, only part-time workers at companies above a certain size are eligible for social insurance. This will be phased out over 10 years, so that ultimately, part-time workers who work 20 hours or more per week will be covered regardless of their employer’s size.

The eligibility expansion schedule is as follows:

-

Companies with 36 to 50 employees: from October 2027

-

Companies with 21 to 35 employees: from October 2029

-

Companies with 11 to 20 employees: from October 2032

-

Companies with 10 or fewer employees: from October 2035

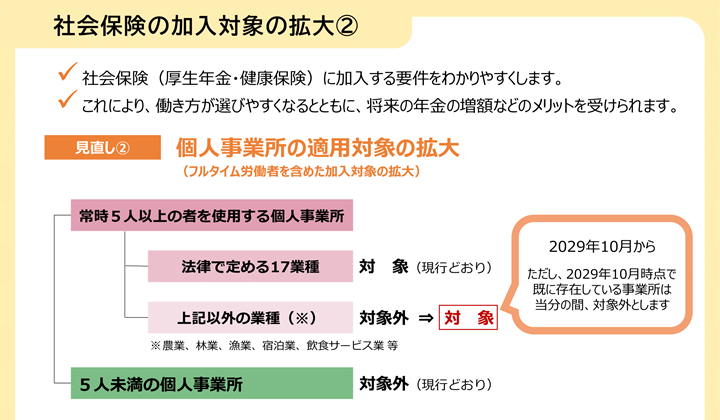

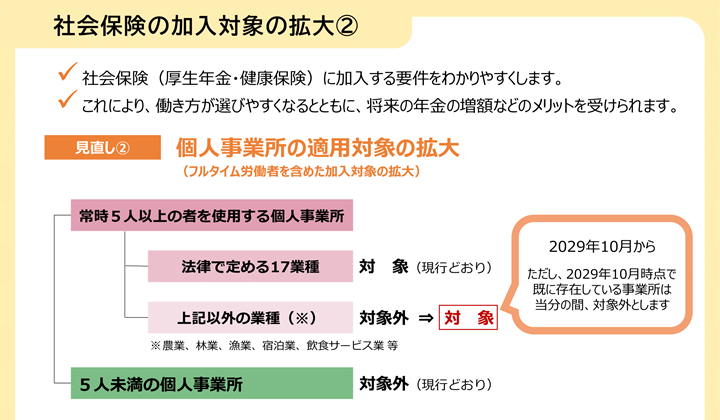

Additionally, the scope of sole proprietorships required to enroll in social insurance will be broadened.

Currently, only sole proprietorships employing five or more people in 17 legally designated industries are subject to social insurance. From October 2029, in principle, all sole proprietorships employing five or more people will be subject to coverage, regardless of industry.

However, transitional measures will exclude existing businesses at the time of enforcement in October 2029 for a certain period.

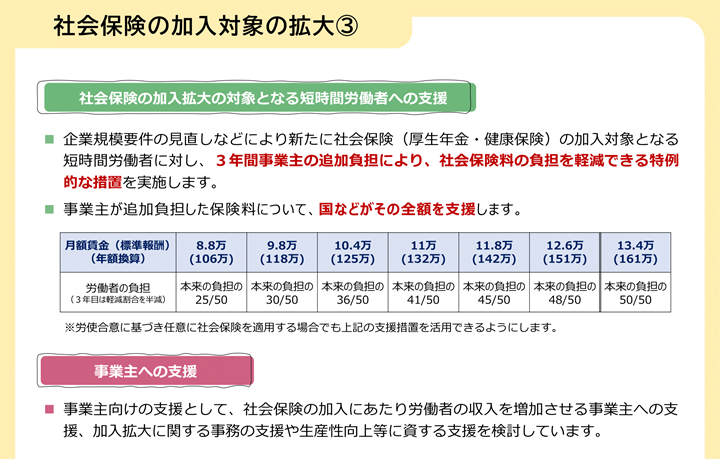

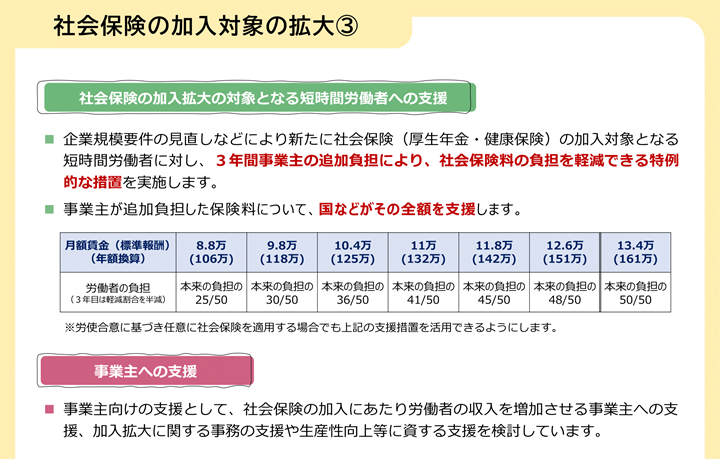

Support measures for newly covered individuals and employers are also being considered, but it should be noted that these may be temporary.

As support for employers, a program is being considered to provide career advancement subsidies (up to 750,000 yen per employee) to those who increase employee income through longer working hours or wage raises. This is planned for implementation within fiscal 2025.

For workers, a special, temporary transitional measure will be introduced to reduce their insurance premium burden to a government-set ratio for three years, aiming to reduce adjustments in working hours to avoid insurance costs.

2. Revision of the In-Employment Old-Age Pension System

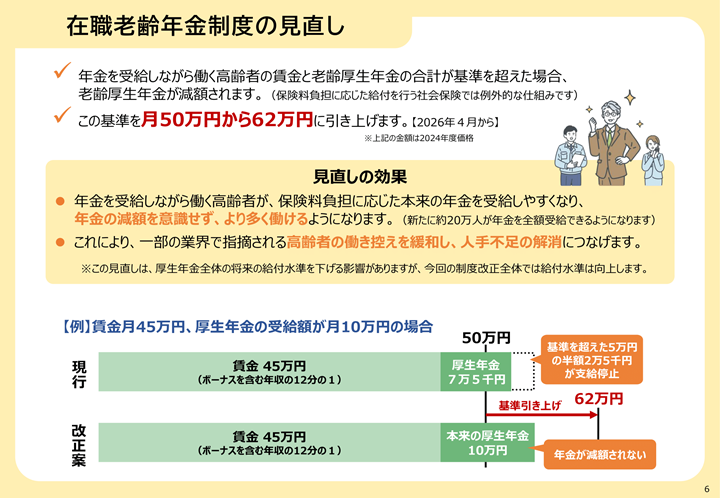

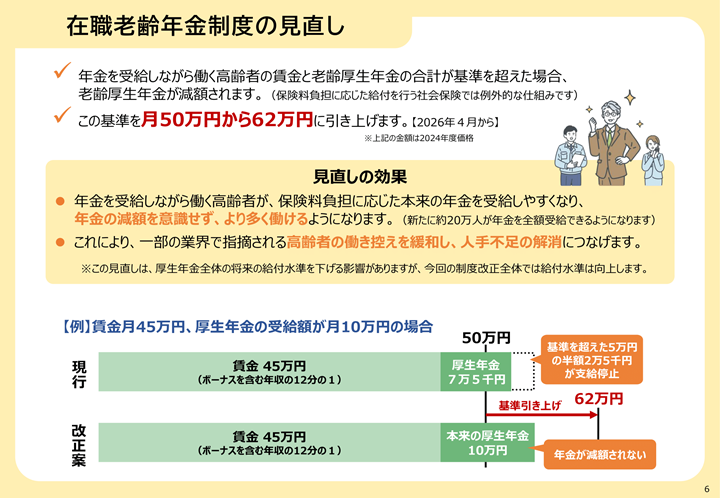

With the increasing number of elderly people working while receiving pensions and to address labor shortages, the government will revise the in-employment old-age pension system.

The in-employment old-age pension system reduces pension payments for elderly workers who earn a certain level of wages. Under the current system, if the combined amount of an elderly worker’s monthly wages (including one-twelfth of annual bonuses) and their Employees’ Pension exceeds 500,000 yen, half of the excess amount is deducted (pension payment is reduced).

Under the proposed revision, the income threshold for pension reduction will be raised from the current 500,000 yen to 620,000 yen. This new threshold is designed with the assumption of individuals who continue working while receiving a pension and earn wages comparable to the average salary of people in their 50s.

This revision is scheduled to take effect from April 2026.

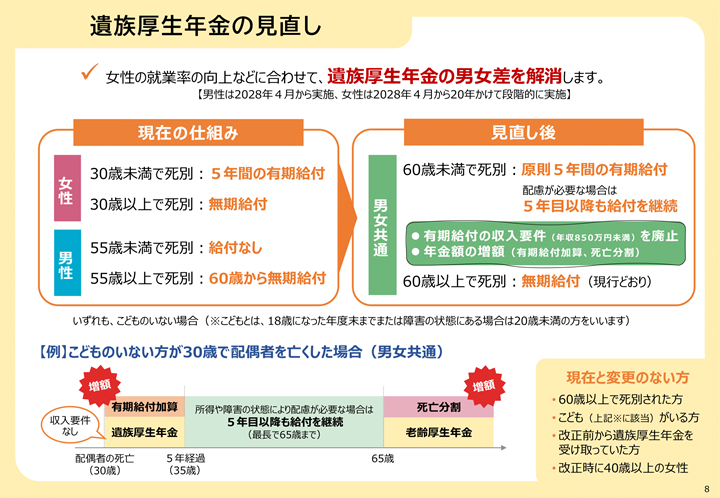

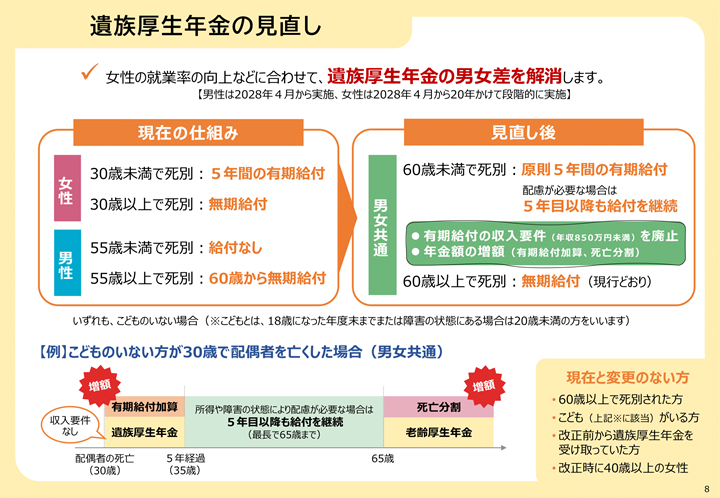

3. Revision of the Survivor’s Pension

The survivor’s pension is a pension received by surviving family members when a person insured under the Employees’ Pension Insurance or the National Pension system passes away. There are two types of survivor’s pensions: the Basic Survivor’s Pension (遺族基礎年金) and the Employees’ Survivor’s Pension (遺族厚生年金), which differ in eligibility requirements and who qualifies as a beneficiary.

The main goal of revising the Employees’ Survivor’s Pension is to eliminate gender disparities. Under the current system, there were differences between men and women regarding the eligibility conditions and benefit periods for spouses without children to receive the Employees’ Survivor’s Pension.

Under the revised system, spouses without children who are under 60 years old (wives or husbands between the ages of 20 and 50 without children under 18) will generally be eligible for a fixed-term benefit for five years. Additionally, men under 55 without children, who were previously excluded, will become newly eligible.

The system will also consider fixed-term beneficiaries by, for example, increasing old-age Employees’ Pension benefits through death-related pension division and introducing a new fixed-term benefit supplement. The income requirement will be removed, allowing recipients to receive benefits regardless of their earnings.

If necessary, there will be mechanisms to continue benefits beyond the five-year period. Those who already have the right to receive benefits, elderly people aged 60 or older, and spouses aged 20 to 50 with children under 18 will maintain their current benefit conditions. These changes will be phased in over 20 years starting from April 2028.

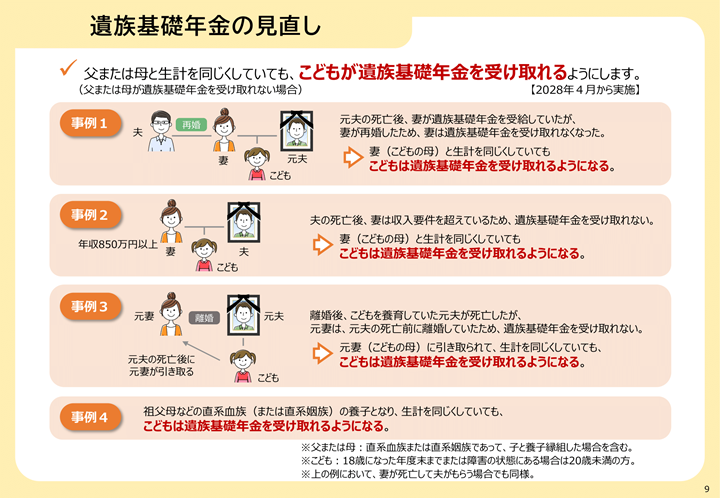

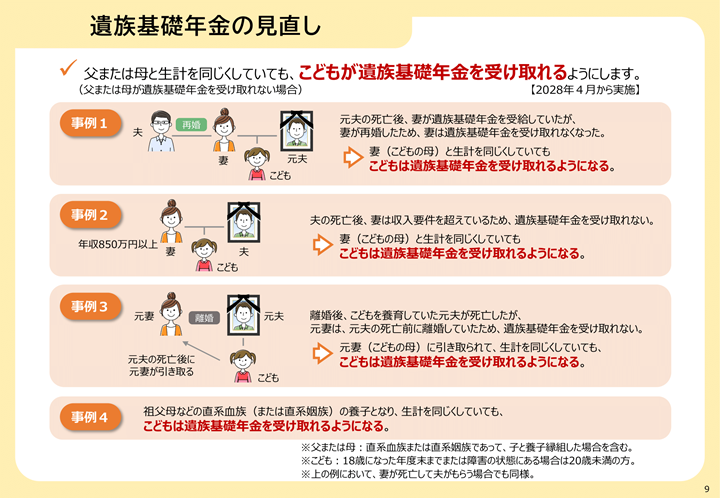

Regarding the Basic Survivor’s Pension, it will be revised so that children can receive benefits regardless of the circumstances of the caregiver.

This means that children eligible for the Basic Survivor’s Pension will be able to receive it without being affected by factors such as the remarriage of the surviving parent, the parent’s income exceeding the threshold, the child being adopted by a direct relative or similar, or the child being taken in by a former spouse after the parent’s death.

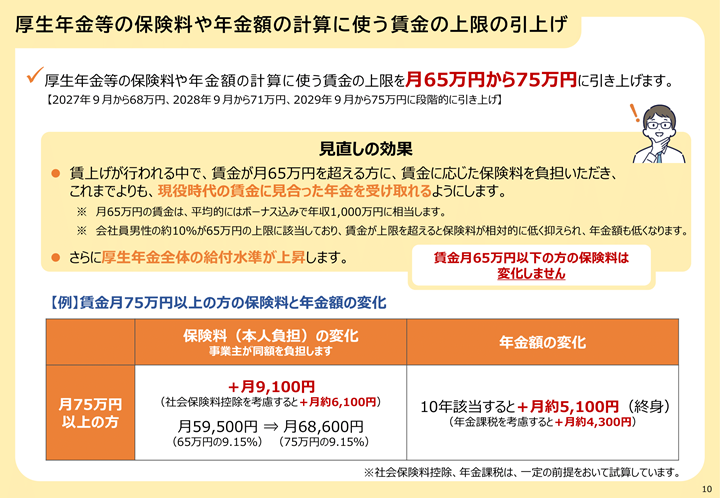

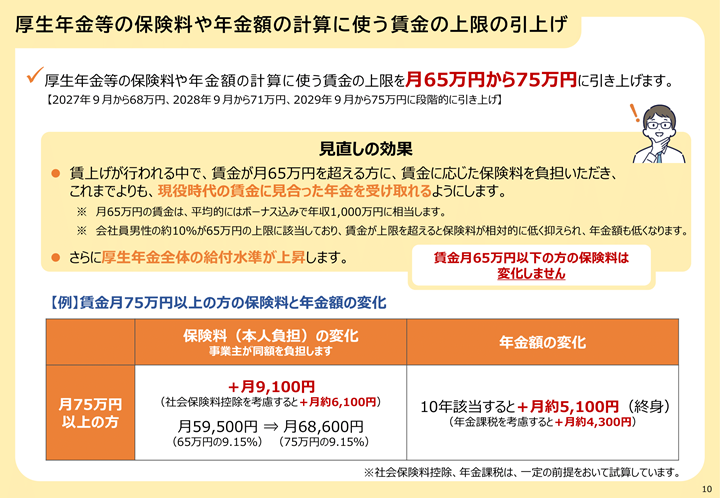

4. Raising the Wage Cap Used for Calculating Insurance Premiums and Pension Amounts

In the Employees’ Pension Insurance system, insurance premiums and pension amounts are basically calculated based on wages (remuneration). However, there is an upper limit set on the “standard monthly remuneration” used as the basis for these calculations.

Currently, the upper limit for the standard monthly remuneration is 650,000 yen. For those earning wages above this limit, the effective insurance premium rate relative to their actual wages has been lower.

The Ministry of Health, Labour and Welfare explains the purpose of this revision as: “to ensure contributions are made in accordance with wages and to enhance future pension benefits.”

Specifically, the upper limit of the standard monthly remuneration will be raised in stages. It will increase from the current 650,000 yen to 680,000 yen (starting September 2027), then 710,000 yen (September 2028), and finally 750,000 yen (September 2029).

While insurance premiums for individuals and companies falling under the new upper limits will increase, future pension benefits will also rise accordingly.

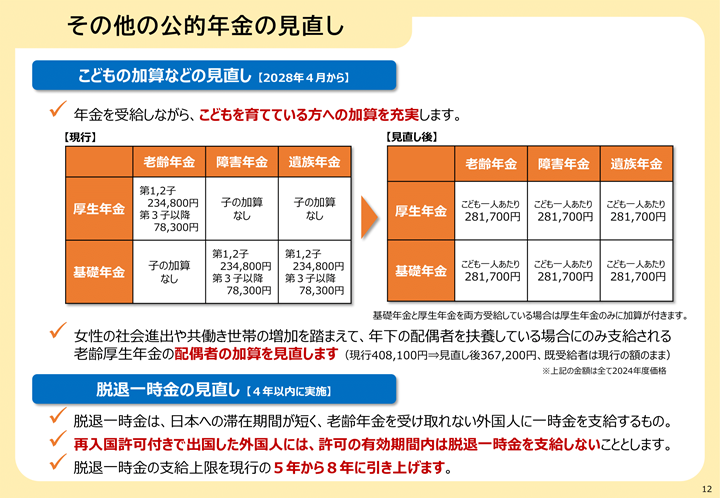

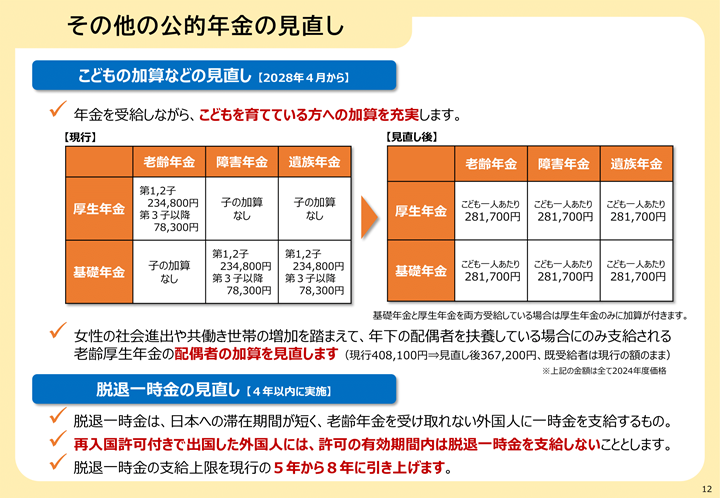

5. Revision of the Child Addition

The pension system includes a provision to increase the pension amount for pension recipients who are raising children. Under the current system, pension recipients with children already receive this addition, but the upcoming revision will raise the amount of the child addition.

Currently, based on the fiscal year 2024 annual amounts, the addition is 234,800 yen per year for the first and second child, and 78,300 yen per year for the third child and beyond. After the revision, the addition will be a uniform 281,700 yen per year for each child. This increase will apply also to those who are currently receiving pensions.

In addition, people who currently receive only the old-age basic pension, which did not include a child addition, will also become eligible for this addition. These revisions are scheduled to take effect from April 2028.

II. Other Major Revisions

In addition to the main revisions mentioned above, there are several other changes.

1. Revision of the Private Pension System

Regarding the individual-type defined contribution pension plan (iDeCo), under the current system, only National Pension insured persons who are not yet receiving the old-age basic pension or old-age benefits from iDeCo can join. Due to differences in working styles, there are variations in the upper age limits for joining.

To create a simpler and more understandable system, the eligibility requirements will be expanded. Specifically, the revision plans to allow people aged 60 and over but under 70—who wish to continue using iDeCo for building retirement assets and who are not yet receiving the old-age basic pension or iDeCo old-age benefits—to join or continue contributions to iDeCo.

2. Revision of the Lump-sum Withdrawal Payment System

The Lump-sum Withdrawal Payment system is designed with the specific circumstances of foreigners in mind, who often have short stays in Japan and whose insurance premium payments may not easily lead to receiving old-age pension benefits. The payment is made as a lump sum based on the insured period (with a current maximum payment period of 5 years), and receiving this payment cancels the insured period accrued up to that point.

However, considering the trend of longer stays by foreigners, there is discussion about raising the maximum payment period from the current 5 years to 8 years. Additionally, for foreigners who may spend their old age in Japan, if they leave the country with a re-entry permit, they will not be able to claim the Lump-sum Withdrawal Payment during the validity period of that permit.

3. Allowing Deferment of Old-Age Pension for Survivors’ Employees’ Pension Recipients

Until now, people receiving survivors’ employees’ pension (遺族厚生年金) were not allowed to defer the receipt of their own old-age pension. However, considering the increased employment of elderly people and from the perspective of allowing them the option to increase their pension benefits, it is planned to permit survivors’ employees’ pension recipients to apply for deferment of their old-age pension benefits. This revision is scheduled to be implemented in April 2028.

4. Extension of the National Pension Payment Deferral System

Until June 2030, eligibility for the deferral system has been determined based on the income of the individual and their spouse, regardless of the income of the household head they live with. This system allows for the deferred payments to be made later when the individual is actually able to pay the insurance premiums.

This time, the limited-time measure will be extended for an additional five years, allowing use of the system until June 2035.

5. Expansion of Eligibility for Voluntary Enrollment in the National Pension for Older Adults

For those without entitlement to the old-age basic pension, the system allowing voluntary enrollment in the National Pension after age 65 until the required qualification period is met will be expanded. The eligible birthdate range will be extended to include people born up to April 1, 1975, and the system will be extended accordingly.

6. Extension of the Deadline for Requesting Division of Pension Rights at Divorce

The deadline for requesting division of the Employees’ Pension Insurance records at the time of divorce will be extended from 2 years to 5 years. This change is in line with the extension of the statute of limitations for property division claims under civil law.

Therefore, if you do not intend to stay in Japan long-term, REGISTER TO CLAIM YOUR NENKIN (pension refund) IMMEDIATELY to avoid losing your rights due to a valid re-entry permit.

Contact HSB JAPAN — a trusted Nenkin representative in Japan — now for guidance on the procedures.

HSB JAPAN Co., LTD

〒130-0026

東京都墨田区両国1-3-12 (925両国第2ビル)

Email: tax_pension@hsbjapan.com

Tel / fax: 03-5937-2465

GET NENKIN FROM ONLY 9,500 YEN – THE BEST PRICE ON THE MARKET WITH A TEAM OF 15 YEARS OF EXPERIENCE

When living and working in Japan, besides enjoying salary benefits, allowances, and quality of life, Vietnamese workers in Japan must also fulfill mandatory obligations similar to Japanese citizens, such as paying income contributions and taxes. Among these obligations, Nenkin (pension system) is one of the most concerning topics for Vietnamese workers. So how can you reclaim your Nenkin at the best price? Let HSB JAPAN guide you through the process in this article!

1. What is Nenkin? How is Nenkin Calculated?

Nenkin (年金) is Japan’s pension system, which requires all workers, including foreign workers in Japan, to participate. If you work in Japan and have an income, you are obligated to pay Nenkin as per government regulations. The main purpose of Nenkin is to ensure a source of income for workers after retirement or when they are no longer able to work.

There are two types of Nenkin in Japan:

- Kokumin Nenkin (National Pension Insurance): For self-employed individuals, students, or those who are not covered by company insurance.

- Kousei Nenkin (Employees’ Pension Insurance): For employees working at companies or enterprises.

If you are a foreign worker who leaves Japan before reaching the required conditions for pension benefits, you may request a refund of part of your contributions. This process is called Lump-sum Withdrawal Payment.

Nenkin Coefficient Calculation

The amount of Nenkin you can reclaim depends on the number of months you contributed to the system. The calculation follows this table:

| Months Paid |

Months Used for Calculation |

Nenkin Coefficient |

| 6 – <12 |

6 |

0.5 |

| 12 – <18 |

12 |

1.1 |

| 18 – <24 |

18 |

1.6 |

| 24 – <30 |

24 |

2.2 |

| 30 – <36 |

30 |

2.7 |

| 36 – <42 |

36 |

3.3 |

| 42 – <48 |

42 |

3.8 |

| 48 – <54 |

48 |

4.4 |

| 54 – <60 |

54 |

4.9 |

| 60+ |

60 |

5.5 |

The amount you receive is calculated as follows:

Nenkin Refund Amount = Average Monthly Salary × Nenkin Coefficient

- Average Monthly Salary refers to your gross salary per month (before deductions such as insurance, tax, rent, utilities, etc.).

2. Conditions to Claim Nenkin

To apply for a Nenkin refund, you must meet the following conditions:

- No longer residing in Japan (your residence registration must be canceled).

- Have contributed to Nenkin for at least 6 months.

- Submit your application within 2 years from the date of departure from Japan.

- Not currently receiving pension benefits in Japan.

3. Nenkin Refund Process & Required Documents

The Nenkin refund process is divided into two stages: Nenkin First Payment & Nenkin Second Payment.

3.1 Nenkin First Payment

This is the initial refund of part of your contributions to the Japanese pension system.

Required documents:

- Copy of your passport (showing personal details, residence status, and Japan exit stamp).

- Bank account details (for receiving the refund).

- Nenkin Handbook (if available).

- Nenkin Refund Application Form.

Processing Time: 4-6 months after submitting the application to Japan.

3.2 Nenkin Second Payment

The second payment is the remaining 20% of your total Nenkin. When you receive the first payment, 20% is deducted as tax. You can reclaim this amount by applying for a tax refund.

Required documents:

- Tax Withholding Statement (Gensen Choushu Hyou).

- Authorization Letter for a representative in Japan (if you cannot process the application yourself).

- Tax Refund Application Form.

Processing Time: 2-4 months after completing the first refund process.

Important Note: You cannot apply for the second refund yourself. You must authorize a representative currently living in Japan to apply on your behalf.

Conditions to Claim Nenkin Second Payment

- The tax refund application must be submitted within 5 years of leaving Japan.

- The refund is only transferred to a bank account in Japan.

- A tax representative in Japan must be appointed.

- You must have successfully claimed Nenkin First Payment.

4. Get Your Nenkin Refund from Just 9,500 Yen with HSB JAPAN

If you don’t have time or find the process too complicated, HSB JAPAN provides a fast and accurate Nenkin refund service at a special price starting from just 9,500 yen – the best price on the market with exclusive benefits!

Why Choose HSB JAPAN?

- Best Price Guarantee – From 9,500 yen, the most affordable rate.

- 15+ Years of Expertise – Deep understanding of Japan’s legal and tax system, ensuring a smooth and error-free process.

- Fast Processing – No delays, no rejected applications – we ensure you receive your refund on time.

- Transparent Fees – No hidden costs, full-package service for both Nenkin First & Second Payments.

- Dedicated Support – Our bilingual consultants (Japanese & Vietnamese) assist you from A-Z, answering all your concerns.

How to Apply with HSB JAPAN?

- Contact Us – Message or call for a free consultation.

- Prepare Documents – Receive detailed guidance on required paperwork.

- Submit Application – HSB JAPAN will process everything on your behalf.

- Receive Nenkin Refund – The refund will be directly transferred to your account.

Contact HSB JAPAN now for expert guidance and hassle-free Nenkin retrieval!

How to Get the Maximum Nenkin Refund from Japan?

How to Maximize Your Nenkin Refund from Japan? Discover the secrets to optimizing your contribution period and procedures with the support of HSB JAPAN to receive your full benefits quickly and safely.

1. What is Nenkin? Who Can Claim Nenkin Refunds?

Nenkin is Japan’s mandatory pension system for workers, including foreign employees. When you stop working in Japan, you can apply for a partial refund of the Nenkin contributions you have made.

Eligibility for Nenkin Refund:

- No longer residing in Japan.

- Have canceled insurance and residency before leaving Japan.

- Paid Nenkin contributions for at least 6 months.

- Submit the Nenkin refund application within 2 years of leaving Japan.

Nenkin Calculation Formula: Nenkin Refund = Average Monthly Salary × Nenkin Factor

| No. |

Contribution Period |

Nenkin Factor |

| 1 |

6 – less than 12 months |

0.5 |

| 2 |

12 – less than 18 months |

1.1 |

| 3 |

18 – less than 24 months |

1.6 |

| 4 |

24 – less than 30 months |

2.2 |

| 5 |

30 – less than 36 months |

2.7 |

| 6 |

36 – less than 42 months |

3.3 |

| 7 |

42 – less than 48 months |

3.8 |

| 8 |

48 – less than 54 months |

4.4 |

| 9 |

54 – less than 60 months |

4.9 |

| 10 |

60 months or more |

5.5 |

2. How to Maximize Your Nenkin Refund

2.1. Plan Your Contribution Period Wisely

2.1.1. Nenkin is calculated in multiples of 6 months. For example:

- If you contribute for 6-11 months, it is counted as 6 months.

- If you contribute for 35 months, it is counted as 30 months.

Ensure your contribution periods are 6, 12, 18, 24,… months to avoid losses.

2.1.2. Maximum Contribution Limit of 5 Years:

- You can receive a refund for a maximum of 60 months (5 years).

- Contributions beyond 5 years will only be refunded up to the 5-year limit.

- Once you reach 5 years, consider returning to your home country to claim your Nenkin refund before re-entering Japan for work.

2.2. Choose a Reliable and Professional Service

Handling the Nenkin refund process on your own can be time-consuming and challenging, leading to potential issues such as:

- Lost Documents: Even a minor mistake can delay the entire process.

- Rejected Applications: Lack of experience may result in applications not meeting the requirements.

- Complex Procedures: Figuring out the process yourself may take weeks or even months.

Be cautious of unreliable services, as you may risk losing both your first and second Nenkin refunds.

Warning signs of unreliable service providers:

- Requesting advance fees without properly processing applications.

- Delaying or refusing responsibility if the application is rejected.

- Lack of transparency in processing progress, leaving you uninformed about your application status.

- Disappearing after collecting the deposit, leaving you without support.

- Concealing information about the second Nenkin refund (20% tax refund), misleading you to believe the first refund is the full amount.

Why Choose HSB JAPAN?

With 15 years of experience, HSB JAPAN has successfully assisted over 50,000 cases in claiming pension lump sums and tax refunds in Japan. We take pride in being a reliable partner, helping Filipinos and other nationalities reclaim their rightful refunds quickly and hassle-free.

By choosing HSB JAPAN, you will receive the following:

Professional Support: Honest consultation and assistance with any challenges you may encounter.

Professional Support: Honest consultation and assistance with any challenges you may encounter.

Transparent Process: Simple, clear, and always on time.

Transparent Process: Simple, clear, and always on time.

Comprehensive Document Preparation: Save time and effort with our expert support.

Comprehensive Document Preparation: Save time and effort with our expert support.

Low Fees: No hidden charges, with everything clearly explained upfront.

Low Fees: No hidden charges, with everything clearly explained upfront.

100% Success Rate: Ensuring you receive the maximum amount you deserve.

100% Success Rate: Ensuring you receive the maximum amount you deserve.

Choose HSB JAPAN to protect your financial rights safely and effectively!

Nenkin Refund in Japan: Everything You Need to Know About Japan’s Pension System

Understanding and navigating Japan’s pension system can be tricky, but if you’ve worked in Japan and contributed to Nenkin, you may be entitled to a refund. By working with a trusted service like HSB JAPAN, you can ensure that your Nenkin refund process is as smooth and efficient as possible. Whether you need assistance with your pension lump sum or have questions about your eligibility, HSB JAPAN – we’re here to help!

What is Nenkin? Key Facts About Japan’s Pension System

Nenkin (年金) refers to Japan’s pension insurance system, which is a mandatory contribution for anyone living and working in Japan. The system ensures that people are supported financially in their old age. The system consists of three main types of pensions, each designed for different groups of people.

All residents aged 20 and above are required to participate in the Nenkin scheme, regardless of nationality. However, the specific type of Nenkin someone participates in depends on their employment status and income level. Below is a quick overview of the three main types of Nenkin insurance:

1. Kokumin Nenkin (National Pension)

This is the basic pension system and is mandatory for all Japanese residents aged 20 to 60 years, regardless of their nationality.

- Eligibility: Students, freelancers, self-employed individuals, and those not covered by other pension plans.

- Contribution: Around 16,000 yen per month (fixed amount), regardless of income.

- Note: Those who are not planning to apply for permanent residency may choose not to participate.

2. Kousei Nenkin (Employees’ Pension Insurance)

This pension scheme applies to people working as full-time employees (seishain) in companies.

- Contribution: The amount is deducted directly from employees’ salaries each month.

- Employer Contribution: Both the employee and employer contribute 50% each.

3. Kyousai Nenkin (Mutual Aid Pension)

This pension scheme is for public employees, teachers at private schools, and some other specific groups.

Can You Get a Nenkin Refund?

Yes, it is possible to claim a refund for the Nenkin contributions you have made, but there are certain conditions. If you are a non-Japanese citizen who worked in Japan but are no longer a resident, you may be eligible for a refund.

Eligibility for a Nenkin Refund

To apply for a Nenkin refund, you must meet the following criteria:

- Non-Japanese nationality (you are not a Japanese citizen).

- Contributed for more than 6 months but less than 10 years.

- No longer reside in Japan: You must apply for the refund within two years of leaving Japan.

- No ongoing contributions: You must stop contributing to Nenkin at the time you submit your refund application.

How to Apply for a Nenkin Refund

If you meet the eligibility requirements, you can apply for a Nenkin refund after leaving Japan. Here’s how the process typically works:

1. Prepare the Necessary Documents

- Send the required documents to a service provider (like HSB JAPAN) for processing.

- You can send documents via email or through their Facebook page to save time.

2. Application Process

Once your documents are submitted, the processing team will prepare your refund application and submit it to the Japan Pension Service. The entire process is usually divided into two payment stages:

- Stage 1: Receive 80% of the total refund amount, usually within 4-6 months.

- Stage 2: The remaining 20% is refunded after another 2-4 months.

3. Payment Methods

- Stage 1: The Japan Pension Service sends the refund directly to your bank account in Japan.

- Stage 2: HSB JAPAN acts as a representative and receives the final refund, then transfers it to your designated account after deducting a service fee (8% of the Stage 2 refund).

Where to Get Help for Nenkin Refunds?

HSB JAPAN is a leading provider of Nenkin refund services in Vietnam. We specialize in helping former workers in Japan—whether you were an intern, engineer, or on a specific visa—retrieve your Nenkin contributions. We offer professional assistance even if you’ve lost your pension book, have outstanding contributions, or encounter other issues.

Why Choose HSB JAPAN?

- 15 years of experience with more than 15,000 successful cases handled.

- Fast and convenient: We prepare and submit your documents the same day.

- Guaranteed refund: We ensure you receive 100% of your Nenkin refund (Stage 1 & Stage 2).

- Transparent pricing: No hidden fees; our service fees are fixed and clear from the start.

- Customer support: We are available 24/7 to assist with any issues until you receive your full refund.

For fast and reliable service, contact HSB JAPAN today to get your Nenkin refund started!