Japan’s Health Insurance System: A Comprehensive Guide

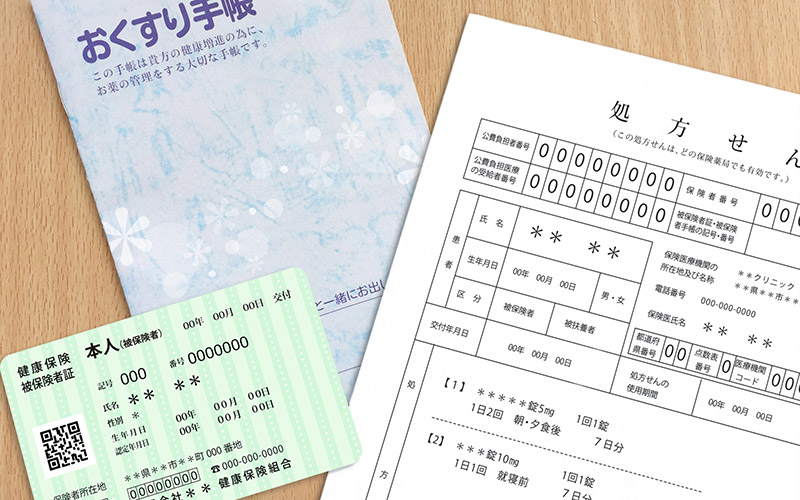

Japan’s healthcare system ensures “Universal Health Insurance Coverage,” mandating that every resident, from newborns to seniors, participates in public health insurance. This coverage also extends to foreign nationals residing in Japan for medium to long-term periods, including workers and students. HSB JAPAN is here to help you navigate and understand this comprehensive healthcare system.

Managed by the government or designated public organizations, the type of insurance you join depends on your employment status and workplace rather than personal choice. Below is a detailed guide to the various types of health insurance available in Japan.

1. National Health Insurance (NHI)

Who Should Join?

- Self-employed individuals.

- Foreign students studying in Japan.

Enrollment is conducted at the city, town, or village office (shi-cho-son).

Premiums

Premiums vary depending on your income from the previous year in Japan. New international students with no prior income in Japan typically pay the lowest premium. After enrollment, a payment slip will be sent to your address. You can pay the premium at convenience stores or banks.

Important: If you fail to pay the premium, your insurance card becomes invalid, and you’ll have to pay 100% of medical costs upfront at the hospital.

Example:

- With an insurance card: You pay 30% of a 10,000-yen medical bill (3,000 yen).

- Without an insurance card: You pay the full amount (10,000 yen).

Additional Benefits:

- High Medical Expense Coverage: If your monthly medical expenses exceed a set limit (subject to conditions), the insurance covers the excess amount.

- Childbirth Lump-Sum Allowance: You can receive approximately 400,000 yen upon the birth of a child.

2. Employee Health Insurance

Who Should Join?

Employees of companies and their families.

Your enrollment is handled by your employer, and your type of insurance depends on your workplace. Examples include:

- Large companies: Join specific health insurance societies.

- Private schools: Join Shigaku Kyosai.

- Other organizations: Join Kyokai Kenpo.

Premiums and Contributions

Premiums are deducted from your salary, and your employer contributes an equal amount. For instance, if 20,000 yen is deducted monthly from your salary, your employer pays an additional 20,000 yen to the insurance provider.

Key Benefits:

- Sickness Allowance: If you’re unable to work due to illness or injury (unrelated to work), you can receive approximately two-thirds of your salary after a three-day waiting period. This includes cases where you recover at home, provided you have a doctor’s certificate.

- Childbirth Allowance:

- Pre-birth leave: 42 days before the expected delivery date (98 days for twins).

- Post-birth leave: 56 days after childbirth.

- You can receive two-thirds of your salary during this period.

- High Medical Expense Coverage and Childbirth Lump-Sum Allowance: Similar to NHI.

- Parental Leave Allowance: Both parents can take leave, but only one can receive this benefit at a time, amounting to about 50% of their salary.

- Childcare Support: Up to one year after childbirth, this allowance supports parents who take time off work for child-rearing.

3. Labor Insurance

Labor insurance includes Employment Insurance and Worker’s Accident Compensation Insurance, which are mandatory for employees.

3.1 Employment Insurance

Benefits:

- Unemployment Benefits: Financial support during job search periods. Enrollment and claims are handled at Hello Work centers.

- Parental Leave Allowance: Available for up to one year after childbirth.

- Training Benefits: Financial aid for skill development or certifications to enhance employability.

3.2 Workers Accident Compensation Insurance

Coverage:

- Medical costs for injuries or illnesses sustained at work.

- Compensation for lost wages during recovery.

- Disability benefits if the injury results in long-term impairment.

- Death benefits for the family in case of fatal workplace accidents.

Keynote:

- The company covers the entire premium for this insurance.

- Be honest about workplace injuries to avoid legal consequences and ensure maximum benefits.

- Disability compensations are categorized into 14 levels, with severe cases receiving annual pensions and less severe cases receiving lump sums.

Conclusion

Japan’s health insurance system provides comprehensive coverage to ensure residents’ well-being. Whether you’re a student, a self-employed individual, or an employee, understanding the benefits and responsibilities associated with each type of insurance is crucial. Always ensure timely enrollment and premium payments to access these benefits when needed.

With over 15 years of experience, HSB JAPAN offers comprehensive support to interns in managing pensions, tax refunds, and labor rights in Japan. Contact us for expert guidance.