Maternity Allowance in Japan : An Easy Guide For Foreigners

Becoming a parent is an incredibly exciting time! If you’re a foreign worker living in Japan, navigating the local social security system to understand the benefits you’re entitled to can feel a bit overwhelming. One crucial benefit for expectant mothers is the Maternity Allowance in Japan, known in Japanese as Shussan Teatekin (出産手当金).

This guide is designed to make understanding the Maternity Allowance in Japan simple and straightforward for foreign residents like you. We’ll break down what it is, who qualifies, how much you might receive, how to apply, and clear up common confusion with other benefits.

Let’s dive in!

What is the Maternity Allowance (出産手当金 Shussan Teatekin)?

The Maternity Allowance (Shussan Teatekin) is a cash benefit provided through Japan’s public health insurance system. Its primary purpose is to compensate for the loss of income experienced by expectant mothers who take time off work before and after giving birth. Think of it as income replacement during your maternity leave.

It’s essential to understand that this benefit is distinct from the Childbirth and Childcare Lump-Sum Grant (Shussan Ikuji Ichijikin 出産育児一時金), which is a separate payment intended to help cover the high costs associated with childbirth itself. We’ll explain the difference later in this guide. The Maternity Allowance specifically supports your daily living expenses while you are unable to work due to pregnancy and childbirth.

Who is Eligible for Maternity Allowance in Japan?

Eligibility for the Maternity Allowance in Japan primarily depends on your health insurance status through your employer.

Health Insurance Requirement

You must be enrolled in Employee’s Health Insurance (健康保険 Kenko Hoken, often referred to as Shakai Hoken 社保). This is the health insurance system typically provided through your workplace if you are a regular employee.

- If you are enrolled in National Health Insurance (国民健康保険 Kokumin Kenko Hoken): Generally, individuals covered by National Health Insurance (like self-employed people, students, or those not working full-time) are not eligible for the Maternity Allowance (Shussan Teatekin). Instead, they are usually covered by the Childbirth and Childcare Lump-Sum Grant. This is a key point.

Employment Status

You must be employed and insured by your company’s health insurance society (a branch of Shakai Hoken) at the time you begin your maternity leave.

- Important Note if you leave your job: In some cases, if you were continuously enrolled in Shakai Hoken for at least one year and leave your job, you might still be eligible for the Maternity Allowance if your maternity leave starts within a certain period after leaving. However, specific conditions apply, so it’s best to confirm directly with your former health insurance society.

Leave Period Requirement

You must actually be taking time off work due to your pregnancy and childbirth. The allowance covers the days you are unable to work during the designated maternity leave period.

How Much Can You Receive?

The amount of Maternity Allowance you receive is calculated based on your standard monthly wage.

The Calculation Formula

The basic formula for calculating the daily amount is:

(Your Standard Monthly Wage / 30 Days) x 2/3

- Standard Monthly Wage: This is usually an average of your standard remuneration (like salary and certain allowances, but not typically bonuses) over the last 12 months before your maternity leave started.

- The 2/3 factor means you receive about 66.7% of your daily wage.

Example Calculation

Let’s say your average standard monthly wage over the past 12 months was ¥300,000.

Daily Standard Wage: ¥300,000 / 30 days = ¥10,000

Daily Maternity Allowance: ¥10,000 x 2/3 ≈ ¥6,667

You would then receive approximately ¥6,667 for each eligible day of maternity leave. This method provides a portion of your usual income.

When Is the Maternity Allowance Paid?

Understanding the payment timeline is important for financial planning during your maternity leave in Japan.

Payment Period (Before and After Childbirth)

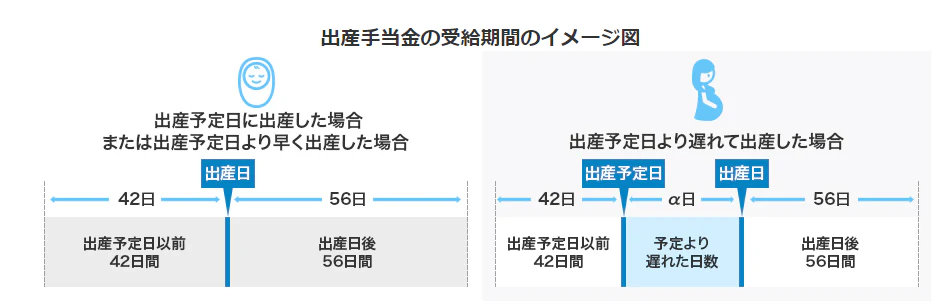

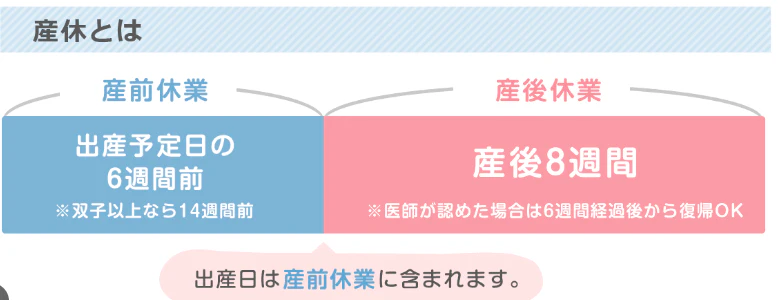

The Maternity Allowance covers the period you are on leave, which is generally:

- Before Childbirth: Up to 42 days (6 weeks) before the scheduled due date.

- After Childbirth: Up to 56 days (8 weeks) after the actual date of childbirth.

If you have a multiple birth (like twins), the period before childbirth is extended to 98 days (14 weeks). The days covered are only those within these periods where you are not working due to your condition or childbirth.

Payment Schedule

The Maternity Allowance is typically not paid as a single lump sum upfront. Instead, you usually apply for the benefit covering a past period of leave.

Often, the payment is made after you have completed the period of leave for which you are applying (e.g., you might apply for the period before birth after the baby is born, and the period after birth after you return to work or the 56 days are up). Some health insurance societies may allow applications for shorter, partial periods. The payment process can take several weeks after your application is submitted and approved.

How to Apply for the Maternity Allowance

The application process usually involves coordination between you, your employer, and your health insurance society. Understanding how to apply simplifies the steps.

Application Through Your Employer

This is the most common method.

- Get the Application Form: Obtain the Shussan Teate application form from your employer or directly from your health insurance society.

- Fill Out Your Section: Complete your personal details and information about your leave dates.

- Employer’s Section: Your employer needs to fill out a section confirming your employment details, wages, and leave dates.

- Doctor’s Certification: Your doctor (or midwife) needs to fill out a section certifying your pregnancy, scheduled due date, and the actual date of birth (after the baby is born).

- Submission: Submit the completed form and necessary supporting documents (see below) to your employer, who will then forward it to the health insurance society, or submit it directly yourself if that’s your society’s process.

Direct Application

In some cases (e.g., if you left your job but remain eligible), you might apply directly to the health insurance society. You would need to obtain the forms and arrange for the employer and doctor sections to be completed before submitting.

Required Documents

While specific requirements can vary slightly by health insurance society, you will generally need:

- Maternity Allowance Application Form (Shussan Teatekin Shikyu Shinseisho)

- Your Health Insurance Card (健康保険被保険者証 Kenko Hoken Hi-hokensha Sho)

- Certification from your doctor/midwife

- Certification from your employer

- Proof of identity (e.g., Residence Card – 在留カード Zairyu Card)

- Bank account details for payment

- Other documents as required by your specific health insurance society (e.g., a copy of your mother and child handbook – 母子手帳 Boshi Techo, or proof of the birth date)

Ensure you check the specific requirements listed on the application form or your health insurance society’s website. Having your documents ready speeds up the process.

Maternity Allowance vs. Childbirth & Childcare Lump-Sum Grant (出産育児一時金)

This is a frequent point of confusion!

- Maternity Allowance (Shussan Teatekin): As we’ve discussed, this is income replacement during maternity leave, paid via your (or your spouse’s) Employee’s Health Insurance. It’s based on your wages.

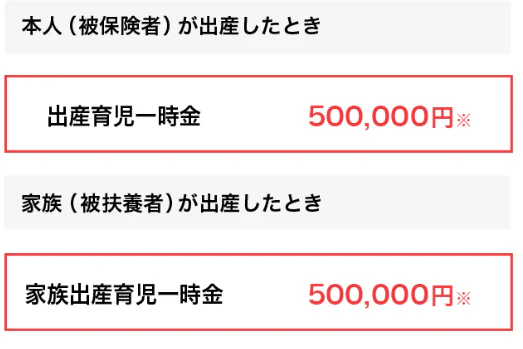

- Childbirth and Childcare Lump-Sum Grant (Shussan Ikuji Ichijikin): This is a payment designed to help cover the costs of childbirth. As of recent updates, the amount is typically ¥500,000 per child. It is paid to anyone enrolled in Japan’s public health insurance system, whether Shakai Hoken or Kokumin Kenko Hoken. This benefit is usually paid directly to the hospital through a direct payment agreement, so you only pay the difference if costs exceed ¥500,000.

You are generally eligible for BOTH benefits if you are enrolled in Employee’s Health Insurance (Shakai Hoken). One replaces lost income, the other helps pay hospital bills. Understanding this distinction is key.

Important Notes for Foreign Residents

Navigating Japanese bureaucracy can be tricky, especially with language barriers.

- Confirm with Your Specific Health Insurance Society: Each health insurance society (e.g., association-managed – 組合健保 Kumiai Kenpo, or Japan Health Insurance Association-managed – 協会けんぽ Kyokai Kenpo) might have slightly different procedures or required documents. Check their official website (use translation tools if necessary) or contact their service center.

- Communicate with Your Employer: Your employer’s HR or administrative staff are usually familiar with the process and can provide guidance and the necessary forms. They will also need to complete part of the application.

- Don’t Delay Application: Start the application process as soon as you are eligible for a payment period to avoid delays in receiving the funds.

- Keep Copies: Make copies of all application forms and documents you submit for your records.

Integrating this benefit into your financial planning requires understanding these specific points.

Quick Summary: Key Points

- What: Income replacement (Shussan Teatekin) during maternity leave.

- Who: Primarily for those enrolled in Employee’s Health Insurance (Shakai Hoken).

- How Much: Approx. 2/3 of your standard daily wage before leave.

- When Paid: Covers up to 42 days before and 56 days after birth. Payment is typically processed after the leave period ends, not in advance.

- How to Apply: Usually via your employer, submitting forms certified by you, your employer, and your doctor.

- Vs. Lump Sum: Different from the Childbirth & Childcare Lump-Sum Grant (Shussan Ikuji Ichijikin), which helps cover hospital costs. You can get both if eligible for Shakai Hoken.

FAQs

Here are answers to some frequently asked questions about the Maternity Allowance in Japan.

Is Maternity Allowance Taxable Income?

Generally, Maternity Allowance (Shussan Teatekin) is non-taxable income in Japan.

What Happens if I Quit My Job During Pregnancy?

If you were enrolled in Shakai Hoken for at least one consecutive year before leaving your job and your maternity leave starts within a specific timeframe (usually within 6 months) after leaving, you might still be eligible. However, conditions apply, and you would need to apply directly to your former health insurance society. Confirm your eligibility after leaving.

Can My Husband Apply for Maternity Allowance?

No, the Maternity Allowance (Shussan Teatekin) is a benefit for the mother who is taking maternity leave due to her pregnancy and childbirth, as it replaces her lost income. There is a separate benefit for fathers taking childcare leave (Ikuji Kyugyo Kyufu-kin – Childcare Leave Benefit), which is part of the employment insurance system, not the health insurance system.

Is the Allowance Paid Monthly or As One Payment?

It’s typically paid after the application covering a specific period of leave is submitted and processed. This often means you might receive payments covering the pre-birth period and post-birth period separately, or even as one payment covering the entire leave after you return to work, depending on when you apply.

Am I Eligible if I Had a Miscarriage or Stillbirth?

Yes, if you were on maternity leave (starting from 42 days before the scheduled due date) and experienced a miscarriage or stillbirth after 85 days of pregnancy (4 months), you are generally eligible for the Maternity Allowance for the period of leave taken, typically up to 56 days after the event.

Conclusion

The Maternity Allowance in Japan is a valuable benefit designed to provide financial support during your maternity leave. While the system might seem complex initially, understanding the basics – especially that it’s an income replacement for Shakai Hoken members and different from the childbirth cost grant – is the key.

By preparing your documents and coordinating with your employer and health insurance society, you can navigate the application process smoothly. Don’t hesitate to seek clarification if you’re unsure about any steps.

If you’re a foreign resident in Japan and have questions about the Maternity Allowance, navigating the health insurance system, or any other social security procedures for your family, HSB JAPAN is here to help. Our team understands the unique challenges faced by foreign workers and can provide expert guidance in English. Please don’t hesitate to reach out to us for personalized support and clarify any doubts you may have about your specific situation and benefits in Japan.