How to get pension exemption in Japan?

Nenkin Exemption Japan: Get Your Pension Payment Waived

Welcome, expats living and working in Japan! Navigating the administrative side of life here, especially finances, can sometimes feel overwhelming. One aspect that often raises questions is the mandatory National Pension system, known as Kokumin Nenkin (国民年金). While contributing is essential for your future and eligibility for various benefits, sometimes financial circumstances make paying the monthly fee a challenge. The good news? Japan has a system in place called Nenkin exemption (or pension waiver) that can provide much-needed relief. This guide is specifically for you, the expat community, to understand how to navigate this process.

In this post, we’ll break down everything you need to know about getting a nenkin exemption in Japan. We’ll cover who is eligible, the different types of waivers available, the step-by-step application process, required documents, and the potential impact on your future. Our goal is to make this complex topic easy to understand and empower you to take the right steps if you’re facing financial difficulty. Let’s dive in!

Understanding the Japan National Pension System

First, a quick recap. The Japan National Pension (Kokumin Nenkin) is a mandatory social insurance system. Generally, all residents aged 20 to 60 must contribute, regardless of nationality. These contributions are the basis for receiving a basic pension (kiso nenkin) in retirement. It also provides coverage in case of disability or death, offering disability pensions or survivor pensions to eligible individuals or their families.

For company employees, your pension contributions are usually handled automatically through your employer as part of the Employees’ Pension Insurance (Kosei Nenkin), which includes the basic Kokumin Nenkin. However, if you are self-employed, a student, unemployed, or in certain other situations, you are likely enrolled directly in the Kokumin Nenkin system and receive monthly bills you need to pay yourself.

What is Nenkin Exemption (Pension Waiver)?

Nenkin exemption is a formal system that allows individuals facing financial hardship to have their mandatory National Pension contributions reduced or waived entirely for a specific period. It is *not* the same as simply not paying your bills. Applying for and receiving an exemption ensures that your period of non-payment is officially recognized, offering several key benefits compared to simply defaulting on payments (which we’ll discuss later).

The system recognizes that life can bring unexpected challenges – job loss, illness, low income, or being a student with limited funds. The goal of the waiver system is to maintain your connection to the pension system and allow you to continue accumulating contribution periods, even when you can’t afford the full payment.

Who is Eligible for Nenkin Exemption?

Eligibility for Japan pension waiver for foreigners and Japanese citizens alike is primarily based on income and specific life circumstances. The criteria are set by the Japan Pension Service (Nihon Nenkin Kikou). Here are the main categories that often qualify:

Low Income or Unemployment

This is the most common reason for eligibility. If your previous year’s *annual income* falls below a certain threshold, you may be eligible for a full or partial exemption. The exact threshold depends on the number of dependents in your household. This applies if you are self-employed, unemployed, or working part-time with income below the minimum threshold for mandatory employee insurance.

If you’ve recently lost your job and are receiving unemployment benefits, you may also be eligible, often under slightly different conditions that consider your current lack of income.

Students

Japan has a special system called the “Special Payment System for Students” (Gakusei Tokurei Seido). If you are enrolled in an eligible educational institution and are under 60, you can apply to have your pension payments deferred. This isn’t a full waiver initially, but defers payment until a later date, allowing you to focus on your studies. While deferred, the period is still counted towards your eligibility for disability or survivor pensions, but you would need to pay the deferred amounts later to have them counted towards your retirement pension amount.

Youth (Under 30)

For individuals under 30 who are not students but are facing financial difficulty, there’s a “Special Payment System for Youth” (Wakamono Nofu Yuyo Seido). Similar to the student system, this allows you to defer payments, offering temporary relief while maintaining certain pension rights.

Disaster or Hardship

In cases of natural disaster, significant illness, injury, or other unavoidable circumstances causing severe financial hardship, you may also be eligible for an exemption.

Key Insight for Expats: The eligibility criteria apply equally to foreign residents who are mandatory contributors to the National Pension. Your nationality does not prevent you from applying for or receiving a nenkin exemption if you meet the income or status requirements.

Need help determining your eligibility? While this guide provides general information, your specific situation and income thresholds can vary. The best next step is to consult the official resources or visit your local office.

Types of Nenkin Exemption Available

The exemption isn’t always an all-or-nothing situation. Depending on your income level and household situation, you may qualify for different levels of waiver:

- Full Exemption (全額免除 – Zen’gaku Menjo): Your payment is reduced to ¥0 for the approved period. The full period is counted towards the required contribution period for receiving a basic pension and qualifies you for disability/survivor pensions. However, the amount of future basic pension you receive will be reduced by half for the period exempted.

- Partial Exemption (一部免除 – Ichibu Menjo): You pay a reduced amount (e.g., 1/4, 1/2, or 3/4 of the standard fee). The contribution period is counted, and your future basic pension amount is adjusted based on the portion you paid and the portion exempted.

- Payment Deferral (納付猶予 – Nofu Yuyo): This applies mainly to the Student and Youth systems. You don’t pay the contribution during the approved period. The period *is* counted for disability/survivor pension eligibility. However, it is *not* counted towards your retirement pension amount *unless* you choose to pay the deferred amounts later (within 10 years).

Choosing the right type, or understanding which one you qualify for, is crucial. Even partial payment is better for your future pension amount than a full exemption, assuming you can afford it.

The Application Process: Step-by-Step

Wondering how to apply for nenkin exemption? The process generally involves your local municipal office (ward office or city hall) and the Japan Pension Service.

- Identify Your Office: Go to the National Pension section of your local ward office (kuyakusho) or city hall (shiyakusho).

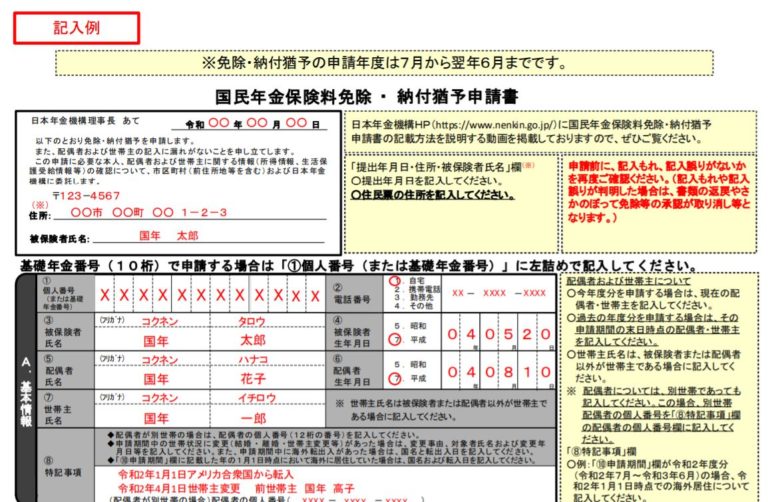

- Obtain the Application Form: Ask for the “Application for National Pension Contribution Exemption/Payment Postponement” (国民年金保険料免除・納付猶予申請書 – Kokumin Nenkin Hokenryo Menjo/Nofu Yuyo Shinseisho). These forms are primarily in Japanese. It’s highly recommended to bring a Japanese-speaking friend, colleague, or translator if your Japanese is not strong.

- Fill Out the Form: Provide details about yourself, your household (spouse’s income is also considered if applicable), and your income situation. Be accurate and honest.

- Gather Required Documents: (See next section for details). Have everything ready.

- Submit the Application: Hand in the completed form and documents at the office. They may ask you clarifying questions.

- Wait for Notification: Your application will be reviewed by the Japan Pension Service. This can take anywhere from a few weeks to a couple of months. You will receive an official notification by mail stating whether your application was approved, the period of exemption/deferral, and the type (full, partial, or deferral).

You can usually apply for exemption for the current fiscal year (April to March) and often retroactively for periods within the last 2 years. If your situation changes significantly during the year (e.g., you lose your job), you can apply mid-year.

What Documents Do You Need?

While requirements can vary slightly depending on your specific situation and local office, here are the common documents for pension exemption Japan:

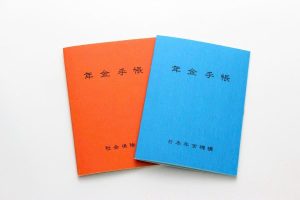

- Your National Pension Handbook (年金手帳 – Nenkin Techo) or any document showing your basic pension number.

- Proof of identity (Residence Card, passport, etc.).

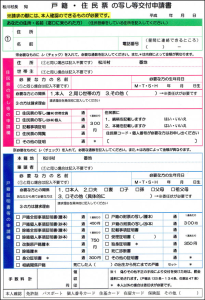

- Your Residence Certificate (住民票 – Jyuminhyo) – though sometimes the office can access this internally.

- Documents proving your income/financial situation:

- If low income/unemployed: Tax documents from the previous year (e.g., Tax Payment Certificate – 納税証明書 – Nozei Shomeisho, or Tax Exemption Certificate – 課税証明書/非課税証明書 – Kazei Shomeisho/Hikazei Shomeisho). If recently unemployed, proof of job separation and eligibility for unemployment benefits.

- If student: Your Student ID (学生証 – Gakuseisho) or enrollment certificate.

- If other hardship: Documents supporting your situation (e.g., medical certificate, disaster victim certificate).

- (If applicable) Documents related to your spouse’s income.

It’s always wise to check your local ward office’s website or call them in advance to confirm the exact documents required for your situation. Bringing originals and copies is usually a good practice.

Benefits and Drawbacks of Getting an Exemption

Getting a nenkin exemption is a formal process with pros and cons compared to simply not paying.

Benefits:

- Financial Relief: The most immediate benefit is freeing up funds when you are facing hardship.

- Maintains Contribution Period: Crucially, exempted periods are counted towards the minimum 10 years needed to be eligible for a basic pension upon retirement. Simply not paying does NOT count these periods.

- Eligibility for Disability/Survivor Pensions: If you become disabled or pass away during the exempted period, you (or your family) may still be eligible for the respective pension payments, provided you meet certain contribution criteria before the exemption. If you just didn’t pay, you lose this coverage.

- Avoids Penalties: Applying for and receiving an exemption means you avoid late fees, reminder notices, and potential forced collection actions that can occur if you simply ignore the bills.

Drawbacks:

- Lower Future Pension Amount: While exempted periods count towards eligibility, they typically result in a lower monthly *basic pension* payment in retirement compared to paying the full contribution. Full exemption reduces the future pension amount for that period by half (for the basic pension portion). Payment deferral periods don’t count towards the retirement amount unless paid later.

- Need to Reapply: Exemptions are usually granted for one fiscal year (April-March) or less. You generally need to reapply annually or when your situation requires it.

Unique Perspective: For expats, maintaining your contribution period through exemption can be vital. Even if you don’t plan to retire in Japan, the system allows for a “Lump-sum Withdrawal Payment” if you leave Japan permanently after contributing for at least 6 months (though the maximum payout period is 5 years). Having approved exemption periods counts towards the *total period* required for eligibility for this lump sum, even if those specific exempted months don’t increase the payout amount itself. It’s significantly better than having gaps due to non-payment.

After the Exemption: What You Need to Know

Once your application is approved, you will receive an official notification. Keep this document safe!

- Exemption Period: Note the start and end dates of your approved exemption or deferral period.

- Reapplication: If your financial situation doesn’t improve by the end of the period, remember to reapply before the next fiscal year (usually starting April 1st) or when prompted.

- Change in Circumstances: If your income significantly increases during the exempted period, you are technically supposed to notify the Pension Service, though many people wait until the next application cycle.

- Catch-Up Payments (追納 – Tsuino): You have the option to pay the exempted or deferred amounts within 10 years of the exemption/deferral date. Paying these amounts retroactively increases your future basic pension amount to what it would have been had you paid originally. There might be a small interest added after a certain period (usually the third year).

Receiving an exemption is a temporary measure. Planning for how you will handle your pension contributions once your situation improves, potentially by utilizing the catch-up payment system, is a wise financial strategy for maximizing your future benefits.

Considering catch-up payments or have questions about your future pension? While this guide covers exemptions, planning for retirement in Japan can be complex. Consider seeking professional financial advice tailored to expats.

Quick Takeaways

- Nenkin Exemption is a formal process to reduce or waive National Pension payments for those facing financial hardship.

- Eligibility is primarily based on low income, student status, or unemployment, applying to expats just like Japanese citizens.

- There are types like Full Exemption, Partial Exemption, and Payment Deferral (for students/youth).

- Apply at your local ward office (kuyakusho) or city hall (shiyakusho) with required documents like income proof and pension handbook.

- Exemption helps maintain your contribution period and eligibility for disability/survivor pensions, unlike simply not paying.

- The main drawback is potentially lower future pension payment upon retirement compared to full contribution.

- You can often apply retroactively (up to 2 years) and have the option to pay exempted amounts later to boost your future pension.

Frequently Asked Questions (FAQs)

Can I get a Japan pension waiver for foreigners if I just arrived and have no income?

Yes, if you are newly arrived, over 20, and have no income or very low income in Japan, you are likely eligible based on the low-income criteria. You’ll need to apply at your local ward office and provide documentation showing your current financial status or lack thereof.

How does partial exemption affect my future pension payment?

Partial exemption means you pay a percentage (e.g., 1/4, 1/2, 3/4) of the standard contribution. The portion you pay contributes fully to your future pension amount. The exempted portion counts towards your contribution period (for eligibility), but the exempted part reduces the amount of the future basic pension proportionate to the waiver percentage.

Is applying for nenkin exemption mandatory if I can’t pay?

No, applying is not mandatory, but it is highly recommended. Simply not paying leads to penalties, potentially forced collection, and means those months do not count towards your pension eligibility or benefits like disability/survivor coverage. Applying for exemption is the proper legal way to handle inability to pay.

How long does it take to hear back after I apply for nenkin exemption?

The processing time varies, but it typically takes 1 to 3 months to receive the official notification by mail from the Japan Pension Service (Nihon Nenkin Kikou). Be patient and make sure your registered address is correct.

Can I apply for exemption for past periods I didn’t pay?

Yes, you can generally apply for retroactive exemption for periods within the last 2 years and 1 month. You’ll need to provide income documentation for those specific periods.

Conclusion

Dealing with mandatory payments like the National Pension when your finances are tight is stressful. However, ignoring your pension bills is rarely the best solution in Japan. The nenkin exemption system exists precisely to help individuals like you navigate these challenges without losing crucial pension coverage and eligibility.

By understanding the eligibility criteria, knowing the application process, and being aware of the benefits (like maintaining your contribution period and eligibility for disability/survivor pensions) and drawbacks (like a potentially lower future pension amount), you can make an informed decision. Taking the proactive step to apply for a pension waiver is a responsible way to manage your financial situation in Japan while staying connected to the vital social security system.

Don’t let financial difficulties lead to larger problems down the road. If you are struggling to pay your National Pension contributions, explore the possibility of getting a nenkin exemption.

Ready to take the next step? Visit your local ward office or city hall’s National Pension section, or check the official Japan Pension Service website for detailed information and forms. Don’t hesitate to ask for assistance if needed!

References

- Japan Pension Service (Nihon Nenkin Kikou) – National Pension (English)

- Japan Pension Service (Nihon Nenkin Kikou) – Contribution Exemption/Payment Postponement (Japanese)

- Ministry of Health, Labour and Welfare (MHLW) – Policy Information (English)

Note: Official forms and the most detailed, up-to-date information are primarily available in Japanese. The English links provide an overview.

Found this guide helpful? We’d love to hear from you! Share your experience navigating the Nenkin exemption process in the comments below. What was your biggest challenge?

Please share this article with other expats who might benefit from understanding the nenkin exemption in Japan!

“`

Japan Cabinet Approves Pension Reform Bill: 1.06 Million Yen Income Cap Set for Debate in Parliament

On May 16, 2025, the Japanese Cabinet approved a bill to partially amend the National Pension Act and related laws, aiming to strengthen the pension system in response to social and economic changes. The bill will now move forward for deliberation in the National Diet.

This proposed reform seeks to address the increasingly diverse range of working styles, lifestyles, and family structures in Japan. Its goal is to enhance the pension system’s ability to ensure income security and stability in old age—for both current and future recipients. Below, we’ll break down the key points of the reform, including the scheduled dates for implementation.

Table of contents

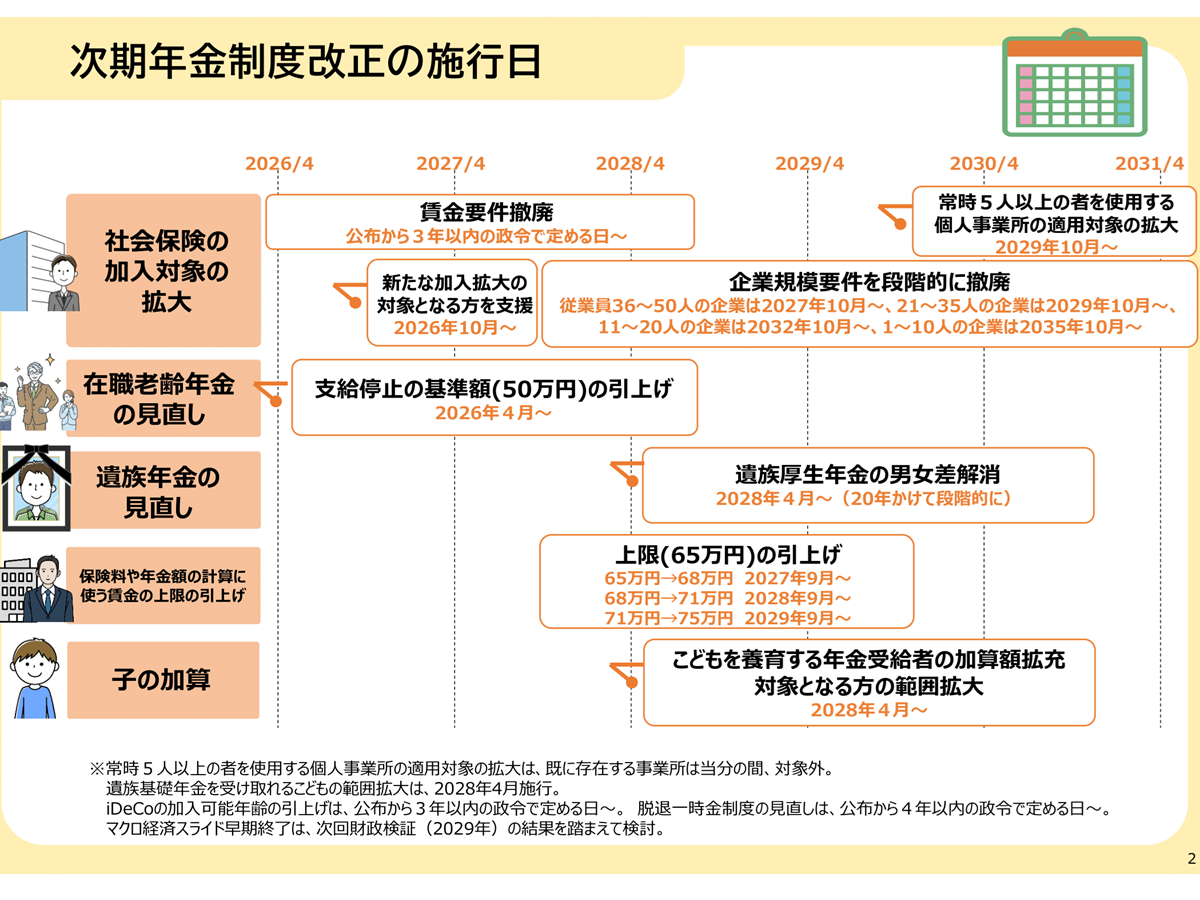

I. Overview of the Pension System Reform Bill and Implementation Dates

- Expansion of Social Insurance Coverage (Removal of the 1.06 Million Yen Income Cap)

- Revision of the In-Employment Old-Age Pension System

- Changes to Survivor’s Pension System

- Increase in the Wage Cap Used to Calculate Premiums and Pension Amounts

- Revision of the Child Addition Benefit

II- Other Key Revisions

- Revisions to the Private Pension System

- Changes to the Lump-Sum Withdrawal Payment System

- Allowing Deferral of Old-Age Pension for Survivor’s Pension Recipients

- Extension of the National Pension Payment Grace Period

- Expansion of Eligibility for Voluntary Enrollment in the National Pension for Seniors

- Extension of the Deadline to Claim Pension Division at Divorce

I. Overview of the Pension System Reform Bill and Implementation Dates

According to the official website of the Ministry of Health, Labour and Welfare, the proposed amendments cover a wide range of areas, with the main points outlined as follows:

- Expansion of social insurance coverage (removal of the 1.06 million yen income cap)

- Revision of the in-employment old-age pension system

- Changes to the survivor’s pension system

- Increase in the wage cap used to calculate premiums and pension amounts

- Revision of the child addition benefit

It’s important to note that each of these changes has a different scheduled implementation date.

Regarding the purpose of the reform, the Ministry explains:

“The aim is to strengthen the functions of the pension system in light of social and economic changes by creating a system that is neutral to working styles and gender differences, and responsive to the diversification of lifestyles and family structures. At the same time, the reform seeks to ensure financial stability in old age through enhanced income redistribution and the expansion of private pension systems.”

1. Expansion of Social Insurance Coverage (Removal of the 1.06 Million Yen Income Cap)

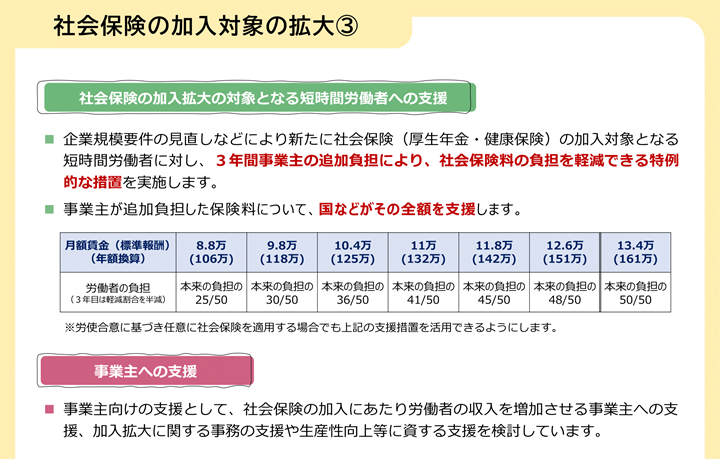

The government is reviewing the eligibility requirements for enrollment in Employees’ Pension Insurance and Health Insurance for part-time workers at small and medium-sized enterprises and for those working at sole proprietorships.

Until now, the conditions for part-time and short-hour workers to join social insurance included prescribed weekly working hours, monthly wages of 88,000 yen or more, employment at companies with more than 50 employees, and not being a student.

Under the current revision, these requirements will be simplified.

Specifically, the “wage requirement” (monthly earnings of 88,000 yen or more) will be abolished. This change responds to concerns over the so-called “1.06 million yen annual income barrier.” The timing of enforcement will be decided by a government ordinance within three years after the law is promulgated, based on the situation of regional minimum wage increases across the country.

In other words, once the wage requirement is removed, anyone working 20 hours or more per week will be eligible for social insurance coverage. However, since minimum wages continue to rise, trying to earn less than 88,000 yen per month while working 20 hours or more would mean earning an hourly wage of 1,015 yen or less. Considering ongoing minimum wage increases, this effectively means the wage requirement has already been practically abolished.

Next, the company size requirement will be gradually eliminated. Currently, only part-time workers at companies above a certain size are eligible for social insurance. This will be phased out over 10 years, so that ultimately, part-time workers who work 20 hours or more per week will be covered regardless of their employer’s size.

The eligibility expansion schedule is as follows:

-

Companies with 36 to 50 employees: from October 2027

-

Companies with 21 to 35 employees: from October 2029

-

Companies with 11 to 20 employees: from October 2032

-

Companies with 10 or fewer employees: from October 2035

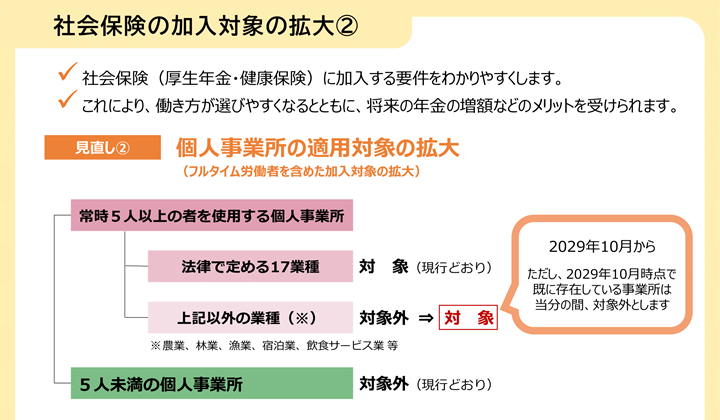

Additionally, the scope of sole proprietorships required to enroll in social insurance will be broadened.

Currently, only sole proprietorships employing five or more people in 17 legally designated industries are subject to social insurance. From October 2029, in principle, all sole proprietorships employing five or more people will be subject to coverage, regardless of industry.

However, transitional measures will exclude existing businesses at the time of enforcement in October 2029 for a certain period.

Support measures for newly covered individuals and employers are also being considered, but it should be noted that these may be temporary.

As support for employers, a program is being considered to provide career advancement subsidies (up to 750,000 yen per employee) to those who increase employee income through longer working hours or wage raises. This is planned for implementation within fiscal 2025.

For workers, a special, temporary transitional measure will be introduced to reduce their insurance premium burden to a government-set ratio for three years, aiming to reduce adjustments in working hours to avoid insurance costs.

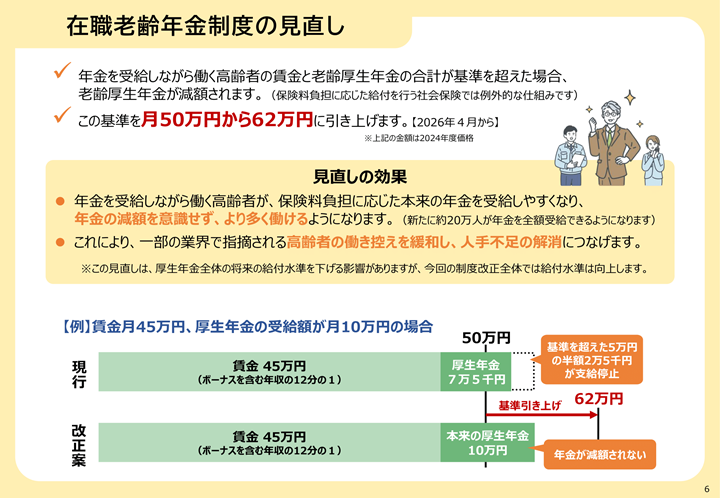

2. Revision of the In-Employment Old-Age Pension System

With the increasing number of elderly people working while receiving pensions and to address labor shortages, the government will revise the in-employment old-age pension system.

The in-employment old-age pension system reduces pension payments for elderly workers who earn a certain level of wages. Under the current system, if the combined amount of an elderly worker’s monthly wages (including one-twelfth of annual bonuses) and their Employees’ Pension exceeds 500,000 yen, half of the excess amount is deducted (pension payment is reduced).

Under the proposed revision, the income threshold for pension reduction will be raised from the current 500,000 yen to 620,000 yen. This new threshold is designed with the assumption of individuals who continue working while receiving a pension and earn wages comparable to the average salary of people in their 50s.

This revision is scheduled to take effect from April 2026.

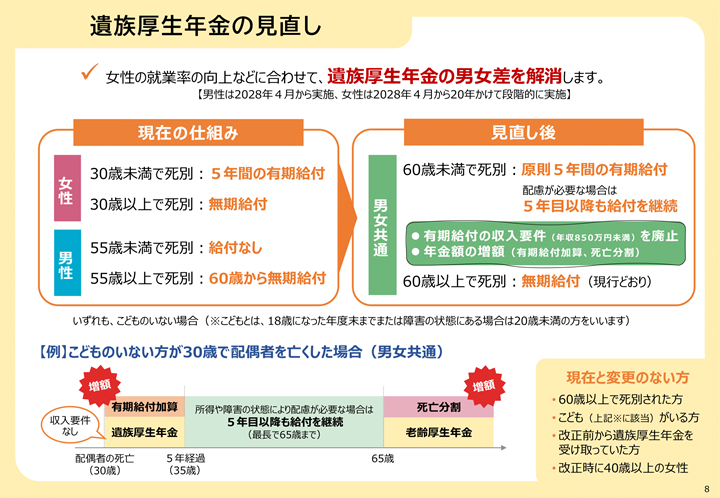

3. Revision of the Survivor’s Pension

The survivor’s pension is a pension received by surviving family members when a person insured under the Employees’ Pension Insurance or the National Pension system passes away. There are two types of survivor’s pensions: the Basic Survivor’s Pension (遺族基礎年金) and the Employees’ Survivor’s Pension (遺族厚生年金), which differ in eligibility requirements and who qualifies as a beneficiary.

The main goal of revising the Employees’ Survivor’s Pension is to eliminate gender disparities. Under the current system, there were differences between men and women regarding the eligibility conditions and benefit periods for spouses without children to receive the Employees’ Survivor’s Pension.

Under the revised system, spouses without children who are under 60 years old (wives or husbands between the ages of 20 and 50 without children under 18) will generally be eligible for a fixed-term benefit for five years. Additionally, men under 55 without children, who were previously excluded, will become newly eligible.

The system will also consider fixed-term beneficiaries by, for example, increasing old-age Employees’ Pension benefits through death-related pension division and introducing a new fixed-term benefit supplement. The income requirement will be removed, allowing recipients to receive benefits regardless of their earnings.

If necessary, there will be mechanisms to continue benefits beyond the five-year period. Those who already have the right to receive benefits, elderly people aged 60 or older, and spouses aged 20 to 50 with children under 18 will maintain their current benefit conditions. These changes will be phased in over 20 years starting from April 2028.

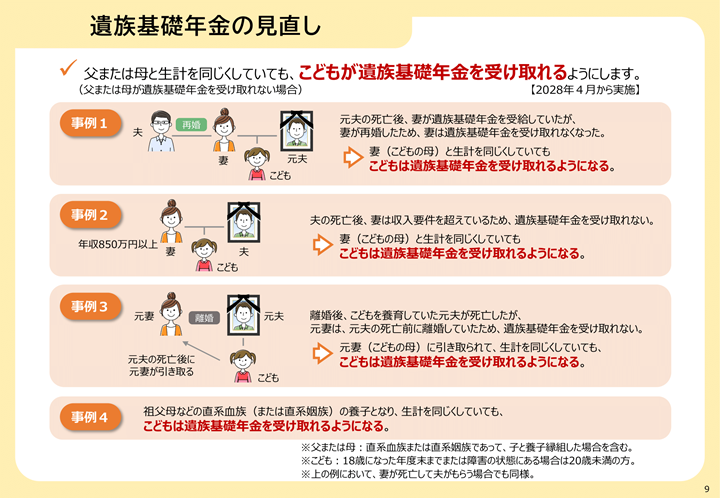

Regarding the Basic Survivor’s Pension, it will be revised so that children can receive benefits regardless of the circumstances of the caregiver.

This means that children eligible for the Basic Survivor’s Pension will be able to receive it without being affected by factors such as the remarriage of the surviving parent, the parent’s income exceeding the threshold, the child being adopted by a direct relative or similar, or the child being taken in by a former spouse after the parent’s death.

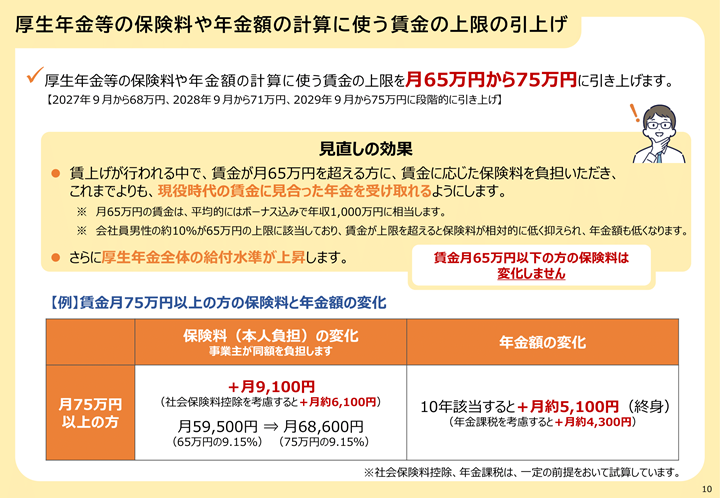

4. Raising the Wage Cap Used for Calculating Insurance Premiums and Pension Amounts

In the Employees’ Pension Insurance system, insurance premiums and pension amounts are basically calculated based on wages (remuneration). However, there is an upper limit set on the “standard monthly remuneration” used as the basis for these calculations.

Currently, the upper limit for the standard monthly remuneration is 650,000 yen. For those earning wages above this limit, the effective insurance premium rate relative to their actual wages has been lower.

The Ministry of Health, Labour and Welfare explains the purpose of this revision as: “to ensure contributions are made in accordance with wages and to enhance future pension benefits.”

Specifically, the upper limit of the standard monthly remuneration will be raised in stages. It will increase from the current 650,000 yen to 680,000 yen (starting September 2027), then 710,000 yen (September 2028), and finally 750,000 yen (September 2029).

While insurance premiums for individuals and companies falling under the new upper limits will increase, future pension benefits will also rise accordingly.

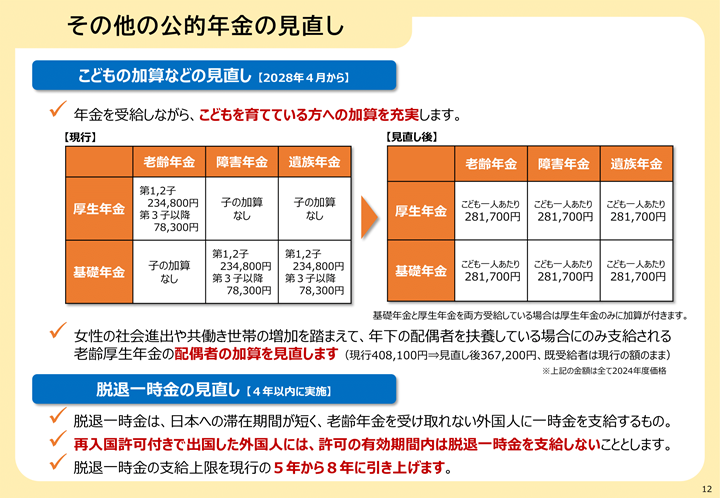

5. Revision of the Child Addition

The pension system includes a provision to increase the pension amount for pension recipients who are raising children. Under the current system, pension recipients with children already receive this addition, but the upcoming revision will raise the amount of the child addition.

Currently, based on the fiscal year 2024 annual amounts, the addition is 234,800 yen per year for the first and second child, and 78,300 yen per year for the third child and beyond. After the revision, the addition will be a uniform 281,700 yen per year for each child. This increase will apply also to those who are currently receiving pensions.

In addition, people who currently receive only the old-age basic pension, which did not include a child addition, will also become eligible for this addition. These revisions are scheduled to take effect from April 2028.

II. Other Major Revisions

In addition to the main revisions mentioned above, there are several other changes.

1. Revision of the Private Pension System

Regarding the individual-type defined contribution pension plan (iDeCo), under the current system, only National Pension insured persons who are not yet receiving the old-age basic pension or old-age benefits from iDeCo can join. Due to differences in working styles, there are variations in the upper age limits for joining.

To create a simpler and more understandable system, the eligibility requirements will be expanded. Specifically, the revision plans to allow people aged 60 and over but under 70—who wish to continue using iDeCo for building retirement assets and who are not yet receiving the old-age basic pension or iDeCo old-age benefits—to join or continue contributions to iDeCo.

2. Revision of the Lump-sum Withdrawal Payment System

The Lump-sum Withdrawal Payment system is designed with the specific circumstances of foreigners in mind, who often have short stays in Japan and whose insurance premium payments may not easily lead to receiving old-age pension benefits. The payment is made as a lump sum based on the insured period (with a current maximum payment period of 5 years), and receiving this payment cancels the insured period accrued up to that point.

However, considering the trend of longer stays by foreigners, there is discussion about raising the maximum payment period from the current 5 years to 8 years. Additionally, for foreigners who may spend their old age in Japan, if they leave the country with a re-entry permit, they will not be able to claim the Lump-sum Withdrawal Payment during the validity period of that permit.

3. Allowing Deferment of Old-Age Pension for Survivors’ Employees’ Pension Recipients

Until now, people receiving survivors’ employees’ pension (遺族厚生年金) were not allowed to defer the receipt of their own old-age pension. However, considering the increased employment of elderly people and from the perspective of allowing them the option to increase their pension benefits, it is planned to permit survivors’ employees’ pension recipients to apply for deferment of their old-age pension benefits. This revision is scheduled to be implemented in April 2028.

4. Extension of the National Pension Payment Deferral System

Until June 2030, eligibility for the deferral system has been determined based on the income of the individual and their spouse, regardless of the income of the household head they live with. This system allows for the deferred payments to be made later when the individual is actually able to pay the insurance premiums.

This time, the limited-time measure will be extended for an additional five years, allowing use of the system until June 2035.

5. Expansion of Eligibility for Voluntary Enrollment in the National Pension for Older Adults

For those without entitlement to the old-age basic pension, the system allowing voluntary enrollment in the National Pension after age 65 until the required qualification period is met will be expanded. The eligible birthdate range will be extended to include people born up to April 1, 1975, and the system will be extended accordingly.

6. Extension of the Deadline for Requesting Division of Pension Rights at Divorce

The deadline for requesting division of the Employees’ Pension Insurance records at the time of divorce will be extended from 2 years to 5 years. This change is in line with the extension of the statute of limitations for property division claims under civil law.

Therefore, if you do not intend to stay in Japan long-term, REGISTER TO CLAIM YOUR NENKIN (pension refund) IMMEDIATELY to avoid losing your rights due to a valid re-entry permit.

Contact HSB JAPAN — a trusted Nenkin representative in Japan — now for guidance on the procedures.