What is Gensen? A Simple Guide to Reading the Gensen Paper

Many workers in Japan often wonder what Gensen is, how to obtain it, or why they haven’t received it despite years of working. Don’t worry! HSB JAPAN is here to help decode the issues surrounding the Gensen document. This paper is essential for verifying your income and taxes deducted, and it’s important for tax refunds or other financial matters in Japan. Let us guide you through all the details you need to know!

What is Gensen?

At the end of each year, workers in Japan receive a document detailing their total income and tax deductions. This is called the Gensen Choshu Hyo. It serves as a tax document within Japan’s system, showing the income and taxes paid, and is often used by companies and individuals to verify income and taxes to the authorities.

In December, workers get this document which includes company address, personal details, total amount received, tax deductions, and insurance. It is essential for processing nenkin and tax refunds when returning to Vietnam.

Importance Information on Gensen

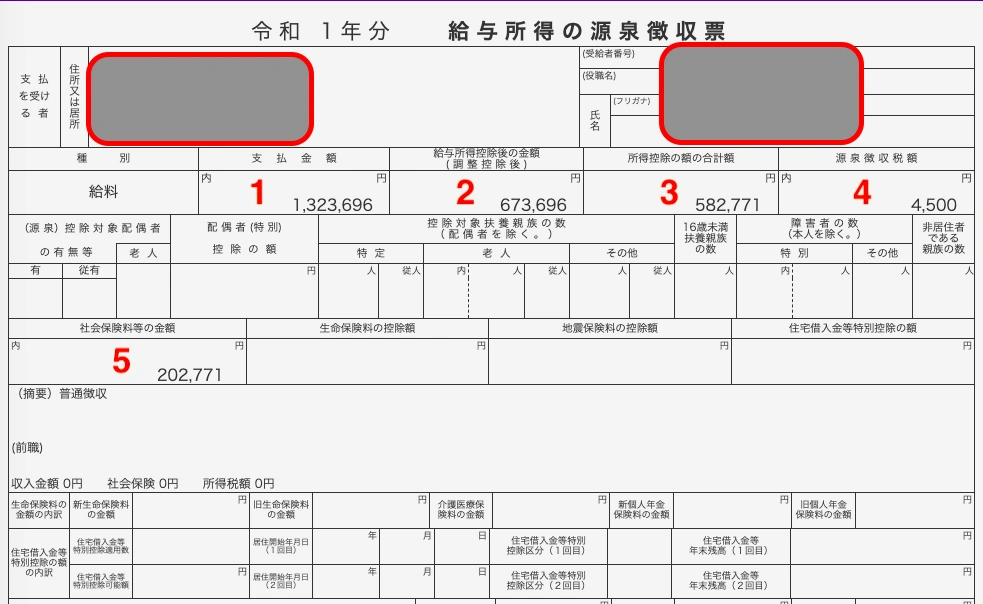

- Total Income (支払金額): This refers to the total income received from the company, including salary, bonuses, housing allowances, etc.

- Taxable Income After Deductions (給与所得控除後の金額): This amount is the income after deductions for necessary work-related expenses, which are not subject to tax. The total income from the first section is reduced by these allowable deductions.

- Total Other Income Deductions (所得控除の額の合計額): This includes various tax-exempt deductions:

- Spouse Deduction (配偶者控除): For a non-working spouse or a spouse earning less than 1.03 million yen annually.

- Dependent Deduction (扶養控除): For dependents like parents or in-laws, typically reducing taxable income by 380,000 yen per dependent.

- Spouse Special Deduction (配偶者特別控除): For a spouse with earnings between 1.03 million and 1.6 million yen.

- Life Insurance Deduction (生命保険料の控除額): For life insurance premiums.

- Earthquake Insurance Deduction (地震保険料の控除額): For earthquake insurance premiums.

- Total Taxes Paid (源泉徴収税額): Reflects the taxes you have paid, calculated based on taxable income.

- Total Social Insurance Payments (社会保険料等の金額): Includes health insurance, pension insurance, unemployment insurance, and workers’ compensation.

Additional Industry Terms:

- 勤怠(きんたい): Attendance

- 所定 (しょてい): Standard working days for the month

- 出勤 (しゅっきん): Days worked

- 休出 (きゅうしゅつ): Working on a holiday

- 欠勤 (けっきん): Absences (sick leave, personal reasons, etc.)

- 遅刻時間 (ちこくじかん): Late arrival hours

- 早退時間 (そうたいじかん): Early leave hours

- 私用外出 (しようがいしゅつ): Personal time out during working hours

- 年休 (ねん) or 有休 (ゆうきゅう): Paid vacation days

- 年休残 (ねんきゅうざん): Remaining vacation days

- 病欠 (びょうけつ): Sick leave

- 出勤時間 (しゅっきんじかん): Work hours

- 残業時間 (ざんぎょうじかん): Overtime hours

- 深夜時間 (しんやじかん): Late-night work hours

- 休日時間 (きゅうじつじかん): Work on a holiday

Other terms include various allowances and deductions such as housing, commuting, overtime, and taxes like health insurance, pension, unemployment, and income tax.

Is the Gensen Important?

The Gensen is essential for claiming a tax refund and is required for applying for Nenkin (pension) refunds. For individuals who earn above 1.03 million yen annually and have dependents, it helps reduce taxes through deductions.

What to Do if You Lose Your Gensen Paper?

If you lose your Gensen, contact your employer’s administrative or accounting department to request a replacement.

How to Apply for Tax Refund with Gensen

To claim Tax Refund, submit the Gensen along with other required documents like your alien registration card, household registration, and transfer forms.

HSB JAPAN’s Tax Representative service allows you to authorize them as your tax representative to handle procedures at the tax office on your behalf. This ensures that you can easily claim your third Nenkin refund even while abroad.

Conclusion

This guide covers essential information on reading and calculating a Japanese payslip, which is crucial for all foreign trainees in Japan. Make sure to remember these details!

As mentioned earlier, resident and income taxes are significant deductions, but there are ways to claim refunds or reductions. Contact HSB Japan’s tax refund services for detailed guidance.