Don’t Forget To Pay Residence Tax: What Every Foreigner Should Know

Living and working in Japan comes with various tax obligations, one of the most important being the resident tax. For many foreigners, understanding how and when to pay this tax can be confusing — especially when switching jobs or planning to leave Japan.

In HSB JAPAN‘s blog, we’ll walk you through everything you need to know about the resident tax system in Japan: who it applies to, how much you need to pay, how to make payments, and important procedures in special situations.

1. What Is Resident Tax in Japan?

Resident tax (住民税 – jūminzei) is a local tax imposed on individuals who have a domicile in Japan as of January 1 and earned income above a specific threshold during the previous year. This applies to all residents — including foreigners — even if they leave Japan after January 2.

Failure to pay this tax can have serious consequences, such as being unable to renew your visa or residency status in Japan.

2. How Is Resident Tax Calculated?

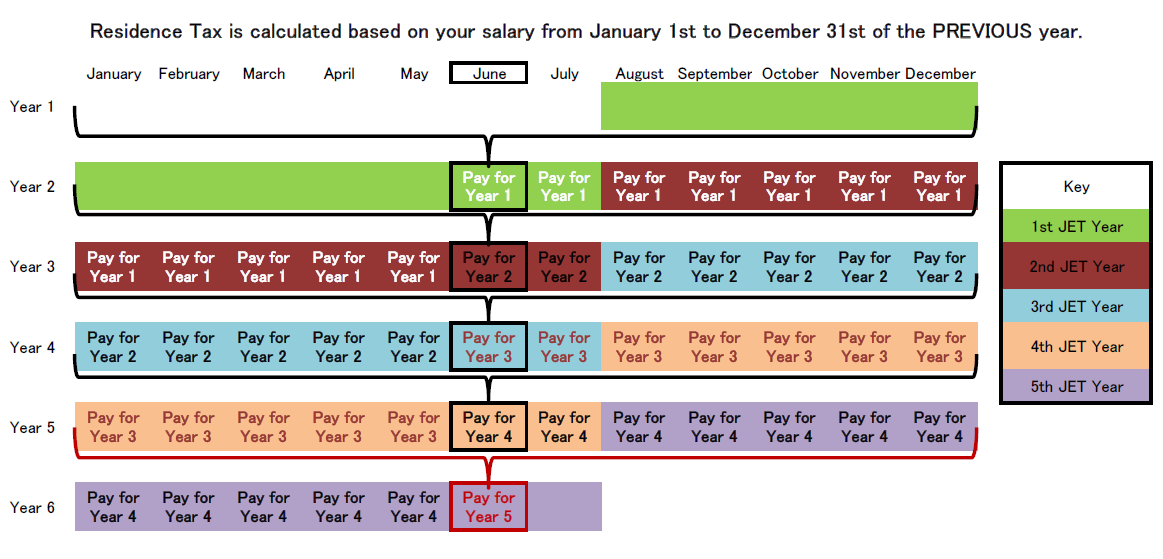

The amount of resident tax is based on the total income earned from January 1 to December 31 of the previous year. Your local municipal office will assess the tax amount and issue payment notices.

3. Methods of Paying Resident Tax

There are two main ways to pay resident tax in Japan:

3.1. Salary Deductions (Special Collection)

For employees working in a company, this is the default method. The company deducts the resident tax directly from the employee’s salary each month and remits it to the municipality. In this case, the employee does not need to deal with payment procedures directly.

3.2. Direct Payment (General Collection)

If you’re not working for a company or have left your employer, you will receive a payment slip from the municipal office around June. You must pay the amount shown directly at a financial institution.

4. Important Situations to Note

4.1. Leaving Your Employer

If you leave your job mid-year and your resident tax was being paid through salary deductions, there are two ways to settle your remaining tax balance:

-

Lump Sum Collection: Your employer deducts the remaining tax from your last paycheck or retirement allowance and pays it on your behalf.

-

General Collection: You will receive a payment slip and must pay the remaining amount yourself.

4.2. Leaving Japan

If you’re planning to leave Japan permanently and cannot pay the resident tax before departure, you must appoint a tax agent (税理士) to handle your tax affairs and inform your local municipal office. This is a legal requirement and essential to avoid issues with future re-entry or visa renewal.

5. FAQs About Resident Tax in Japan

Q1: Do I Have to Pay Resident Tax if I Lived in Japan as of January 1?

Answer:

Yes. If you had a domicile in Japan on January 1 and earned income during the previous year, you are legally obligated to pay resident tax. However, the amount may be reduced or exempted depending on your income or family circumstances.

Some international students or individuals from countries that have tax treaties with Japan may be eligible for exemptions. Contact your local municipal office for clarification.

Q2: How Do I Know Which Payment Method Applies to Me?

Answer:

If you are employed at a company, you are generally subject to the special collection method. By May 31 each year, your employer will provide a document titled:

“Notification of result and changes of the special collection tax notice to income earners”, detailing your resident tax status.

Q3: What Is the Procedure for Lump Sum Collection?

Answer:

If you leave your company between June 1 and December 31, you can choose to:

-

Request a lump sum collection, where the company deducts your unpaid resident tax from your last salary or retirement package.

-

Choose general collection, and receive a payment slip from the municipality.

If you leave the company between January 1 and May 31, the lump sum collection will be applied automatically or the special collection continues if your employer agrees.

Q4: Who Can Be a Tax Agent and How to Appoint One?

Answer:

A tax agent can be any resident in Japan — often a friend, family member, or professional accountant — who acts on your behalf in tax matters. Each municipality has different rules regarding qualifications and required documentation, so it’s best to consult your local municipal office directly.

Conclusion

Resident tax is a crucial part of living and working in Japan, and understanding your obligations can save you from legal and financial trouble — especially during job changes or international moves. Be proactive: confirm your payment method, keep track of your municipal notices, and seek help when needed.

Need Help Navigating Resident Tax in Japan?

Whether you’re unsure about your payment status or preparing to leave Japan, getting expert guidance is essential. Contact HSB JAPAN – the trusted tax representative with over 15 years of experience supporting foreign residents in Japan.