Japan Resident Tax: Your Expat Calculation Guide

Navigating the Japanese tax system can feel like solving a complex puzzle, especially when terms like “Juminzei” come up. If you’re an expat working in Japan, understanding your Resident Tax obligations is crucial. It’s different from the national income tax you might already be familiar with, and it plays a significant role in your annual finances. This guide is designed to demystify the process, helping you understand how your Resident Tax is calculated, who needs to pay it, and how to handle it.

We’ll break down the formula, explain key concepts like the previous year’s income and important deductions, and clarify the payment timeline. By the end of this article, you’ll have a clear picture of how Japan Resident Tax works and feel more confident managing your taxes here. Let’s dive in!

What is Resident Tax (Juminzei) in Japan?

Resident Tax, known as Juminzei (住民税) in Japanese, is a local tax levied by the prefecture and municipality where you officially reside as of January 1st each year. Think of it as your contribution to local services like schools, public infrastructure, welfare programs, and administrative services in your city or town.

Two Parts: Prefectural and Municipal Tax

Resident Tax is actually a combination of two taxes:

- Prefectural Resident Tax (都道府県民税, Todofukenminzei): Collected by your prefecture.

- Municipal Resident Tax (市町村民税, Shichosonminzei): Collected by your city, town, or village.

While they are separate taxes collected by different levels of local government, they are calculated together based on the same income information and usually paid together as a single amount.

Why Expats Need to Understand It

For many expats, Resident Tax often comes as a bit of a shock in their second year in Japan. This is because, unlike national income tax which is often deducted monthly from your salary based on estimates for the current year, Resident Tax is calculated based on your income from the *previous calendar year*. So, your first year might feel tax-light (only paying national income tax), but the second year brings the added burden of paying Resident Tax on the full income earned in your first year. Understanding the juminzei tax year Japan uses is crucial to avoid surprises.

Who Needs to Pay Resident Tax?

Whether or not you are liable for Japan Resident Tax depends on your residency status and where you lived as of a specific date.

The “Domicile” (住所, Jūsho) Concept

The key factor is having a “domicile” (住所, jūsho) or a place of residence in Japan as of **January 1st** of the current year. Your domicile is generally considered your principal place of living. For most expats with mid to long-term visas, this means being registered as a resident at a city or ward office.

The Crucial January 1st Date

This date is critical. If you arrived in Japan *after* January 1st of a given year and established residency, you will *not* be liable for Resident Tax for that specific year (based on the previous year’s income). Your obligation starts from the January 1st *following* your arrival. For example, if you moved to Japan in April 2023, you wouldn’t owe Resident Tax based on 2022 income (as you weren’t here on Jan 1, 2023). You *will* owe Resident Tax based on your 2023 income, payable starting in June 2024 (as you were resident on Jan 1, 2024).

How is Resident Tax Calculated? The Formula Explained

The calculation of your Resident Tax (Juminzei) is primarily based on your income from the *previous* calendar year (January 1st to December 31st). It involves a few key steps:

Step 1: Determine Your Gross Income

This is the total income you earned from all sources during the previous year before any deductions. For most expats, this is primarily employment income, but it can also include income from other sources like rental properties, business activities, etc.

Step 2: Subtract Income Deductions

Various deductions are subtracted from your gross income to arrive at your taxable income. These deductions account for basic living costs, social security contributions, and other eligible expenses. We’ll detail the common ones shortly.

Common Income Deductions

These reduce the amount of income subject to the income-based tax rate:

- Basic Deduction (基礎控除, Kiso Kojo)

- Employment Income Deduction (給与所得控除, Kyuyo Shotoku Kojo) – for salary earners

- Social Insurance Premiums Deduction (社会保険料控除, Shakai Hokenryo Kojo)

- Medical Expense Deduction (医療費控除, Iryohi Kojo)

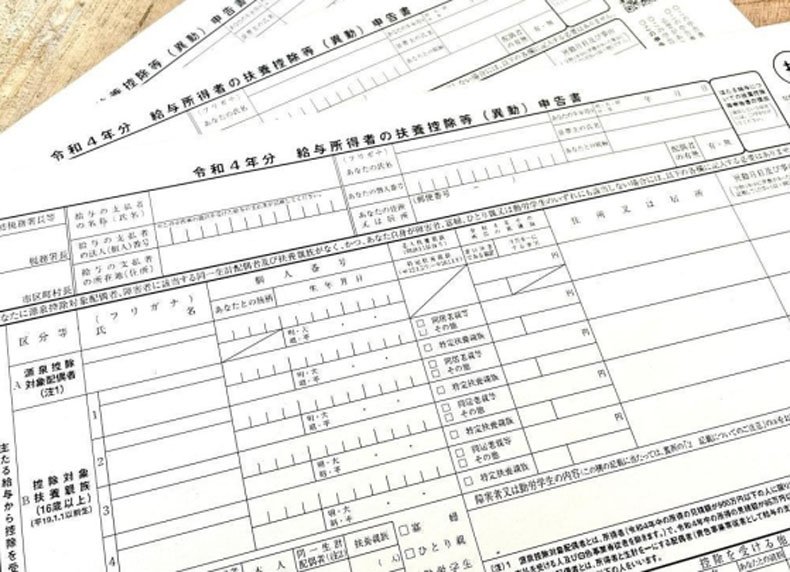

- Dependent Deduction (扶養控除, Fuyo Kojo)

- And more…

Step 3: Arrive at Your Taxable Income

The result of Gross Income minus Income Deductions is your Taxable Income (課税所得, Kazei Shotoku).

Taxable Income = Gross Income - Income Deductions

Step 4: Apply the Tax Rate

Resident Tax consists of two components applied to residents:

Per Capita Rate (均等割, Kintōwari)

This is a fixed, flat fee applied equally to all residents regardless of their income level (above a minimum threshold). It’s typically around ¥5,000 – ¥6,000 per year (¥3,500 Prefectural, ¥1,500 Municipal, though this can vary slightly by location and temporary surcharges). This is a small, base amount.

Income Rate (所得割, Shotokuwari)

This is the main part of the tax, calculated based on your Taxable Income from Step 3. The standard rate is typically 10% (6% Prefectural, 4% Municipal) applied to your Taxable Income. Note that this is generally a flat rate *on the taxable income base*, unlike the national income tax which has progressive rates.

Income-based Tax = Taxable Income × Standard Tax Rate (typically 10%)

Your total Resident Tax is the sum of the Per Capita Rate and the Income Rate.

Total Resident Tax = Per Capita Rate + Income Rate

Want a professional eye on your Japanese taxes? Understanding deductions is key to reducing your tax burden. Learn more about optimizing your expat tax situation.

Important Deductions You Should Know

Taking advantage of eligible deductions can significantly reduce your Resident Tax burden. Here are some of the most common ones relevant to expats:

Basic Deduction (基礎控除)

A fixed amount subtracted from everyone’s income, provided their total income is below certain thresholds. The amount can vary slightly based on your income level but is a standard deduction most people can claim.

Employment Income Deduction (給与所得控除)

This is an automatic deduction for employees, meant to account for expenses related to working. The amount is calculated based on your gross employment income and is often automatically applied by your employer or during your tax filing.

Social Insurance Premiums Deduction (社会保険料控除)

Premiums paid for Japanese social insurance (health insurance, pension contributions like厚生年金 – Kosei Nenkin or 国民年金 – Kokumin Nenkin) are fully deductible from your income for tax purposes. This is a significant deduction for most employed expats.

Medical Expense Deduction (医療費控除)

If your total medical expenses for the household in a year exceed a certain amount (generally ¥100,000 or 5% of your total income, whichever is lower), you can deduct the excess amount (up to ¥2 million). Keep all your receipts!

Dependent Deduction (扶養控除)

You can claim deductions for qualifying dependents (spouse, children, parents) who meet certain income and age requirements, provided they reside with you or send regular remittances if living overseas. This is particularly relevant for expats with families.

Other Potential Deductions

Donations (including Furusato Nouzei – ふるさと納税), life insurance premiums, earthquake insurance premiums, and certain housing loan deductions can also potentially reduce your taxable income for Resident Tax calculation.

When and How Do You Pay Resident Tax?

Understanding the timeline and payment methods is key to managing your Resident Tax obligations.

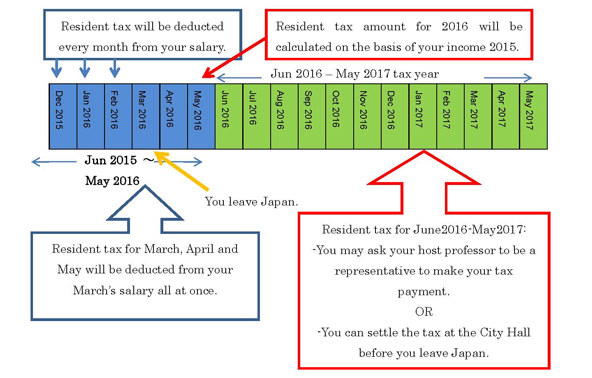

The Tax Year vs. Payment Year

As mentioned, Resident Tax is based on your income from the *previous* calendar year (Jan 1 – Dec 31). However, the payment cycle for this tax runs from June of the current year to May of the following year.

Payment Methods: Special Collection vs. Ordinary Collection

How you pay depends primarily on your employment status:

Special Collection (給与からの特別徴収, Kyūyo kara no Tokubetsu Chōshū)

This is the most common method for company employees. Your employer calculates your Resident Tax liability and automatically deducts it from your monthly salary over 12 installments (June to May). They then pay this amount to your local municipality on your behalf. This is convenient as it happens automatically.

Ordinary Collection (普通徴収, Futsū Chōshū)

If you are self-employed, retired, or your employer doesn’t handle special collection, you will likely receive tax bills directly from your local municipality. These bills usually arrive in June and can be paid in a lump sum or in four installments (typically end of June, August, October, and January of the following year). You are responsible for making these payments yourself via bank transfer, convenience store payment, or other methods specified on the bill.

Deadlines to Remember

For Special Collection, payments are automatic monthly deductions (June-May). For Ordinary Collection, be mindful of the four installment deadlines listed on your tax bills. Missing a deadline can result in late fees.

Confused about your tax bills? Get expert guidance tailored for expats. Request a consultation to understand your Resident Tax payments.

Quick Takeaways

- Resident Tax (Juminzei) is a local tax for prefectures and municipalities.

- It’s based on your income from the previous calendar year (Jan 1 – Dec 31).

- Liability is determined by your residence status on January 1st.

- Calculated based on Taxable Income (Gross Income minus Deductions).

- Consists of a small Per Capita Rate and a larger Income Rate (usually 10% on taxable income).

- Key deductions (Basic, Employment, Social Insurance, Medical) reduce your taxable income.

- Paid via Special Collection (monthly salary deduction, June-May) or Ordinary Collection (quarterly bills, typically June, Aug, Oct, Jan).

FAQs about Resident Tax in Japan

Is Resident Tax the same as Income Tax in Japan?

No, they are different. National Income Tax (所得税, Shotokuzei) is paid to the national government based on progressive tax rates applied to your current year’s income (often through monthly withholding). Resident Tax (Juminzei) is paid to your local municipality and prefecture based on your *previous* year’s income, generally at a fixed rate on taxable income, plus a small per capita fee. Understanding the distinction is key for expats.

When do I start paying Resident Tax after arriving in Japan?

You start paying Resident Tax based on your income from the *first full calendar year* (Jan 1 to Dec 31) in which you are a resident as of January 1st. For example, if you arrive in April 2023, you weren’t here on Jan 1, 2023, so you won’t pay Resident Tax based on 2022 income. You *were* here on Jan 1, 2024, so you will start paying Resident Tax based on your 2023 income, with payments typically beginning in June 2024.

Can I reduce my Resident Tax amount?

Yes, the primary way to reduce your Resident Tax is by claiming eligible income deductions. Ensuring all applicable deductions like the basic deduction, social insurance premiums, medical expenses, and dependent deductions are properly accounted for in your tax filing or year-end adjustment will lower your taxable income, thereby reducing the income-based portion of your juminzei calculation.

What happens if I leave Japan before the tax year ends?

If you leave Japan permanently and cease to be a resident before January 1st of the following year, you generally will not be liable for Resident Tax for the tax year that starts in June based on the income from the year you leave. However, depending on when you leave, you may still need to pay any outstanding Resident Tax from previous years or appoint a tax representative (納税管理人, Nozei Kanrinin) to handle your tax obligations, including potentially filing a final tax return and paying taxes on income earned up to your departure date.

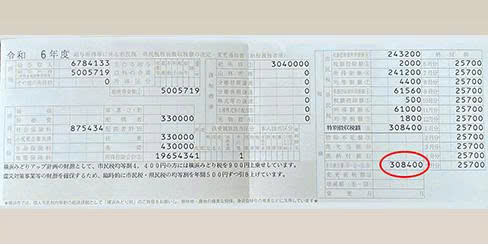

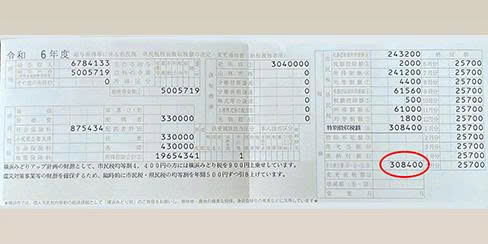

Where can I find my Resident Tax calculation details?

If you pay via Special Collection, your employer should provide you with a document (usually around June) detailing the annual amount and monthly deductions. If you pay via Ordinary Collection, you will receive a tax notice (納税通知書, Nozei Tsūchisho) in June from your local municipality that shows the total amount, the breakdown between prefectural and municipal tax, and usually includes details about how the amount was calculated based on your previous year’s income and applied deductions. This is where you can see the specifics of your how to calculate resident tax Japan result.

Conclusion

Understanding how your Resident Tax is calculated in Japan is a key step towards managing your finances as an expat. While the system might seem daunting at first, remember that it’s fundamentally based on your previous year’s income minus eligible deductions. Knowing the calculation steps, the importance of the January 1st date, and your payment method (Special vs. Ordinary Collection) empowers you to navigate this part of the Japanese tax system with more confidence.

Don’t let Juminzei be a source of stress. By familiarizing yourself with the basics outlined in this guide, you’re well on your way to understanding your obligations. If your financial situation is complex or you have specific questions about deductions, don’t hesitate to seek professional advice tailored to expats. Taking proactive steps now can save you confusion and potential issues down the line.

Still have questions about your specific Japan Resident Tax situation? Get in touch with a qualified tax advisor specializing in expat taxes in Japan for personalized support. Find expat tax help here.

Was this guide helpful in understanding your Japan Resident Tax? Let us know in the comments! What was the most confusing part of Juminzei for you before reading this? Share this article with other expats who might benefit!

References

Please note that tax regulations can change. Always refer to official sources or consult a qualified professional for definitive advice.

- National Tax Agency of Japan (NTA) – https://www.nta.go.jp/english/index.htm (Provides official information, though details on local tax might be limited)

- JETRO (Japan External Trade Organization) – Living in Japan Guide: Taxes – https://www.jetro.go.jp/en/living/working/tax/ (Often includes general overviews of the tax system)

- Tokyo Metropolitan Tax Bureau – https://www.tax.metro.tokyo.lg.jp/english/index.html (Example of a local tax authority website, check your specific city/ward)

- Various expat resource websites and international accounting firm guides on Japan tax for foreigners.