HOW TO GET THE RESIDENCE TAX EXEMPTION IN 2023

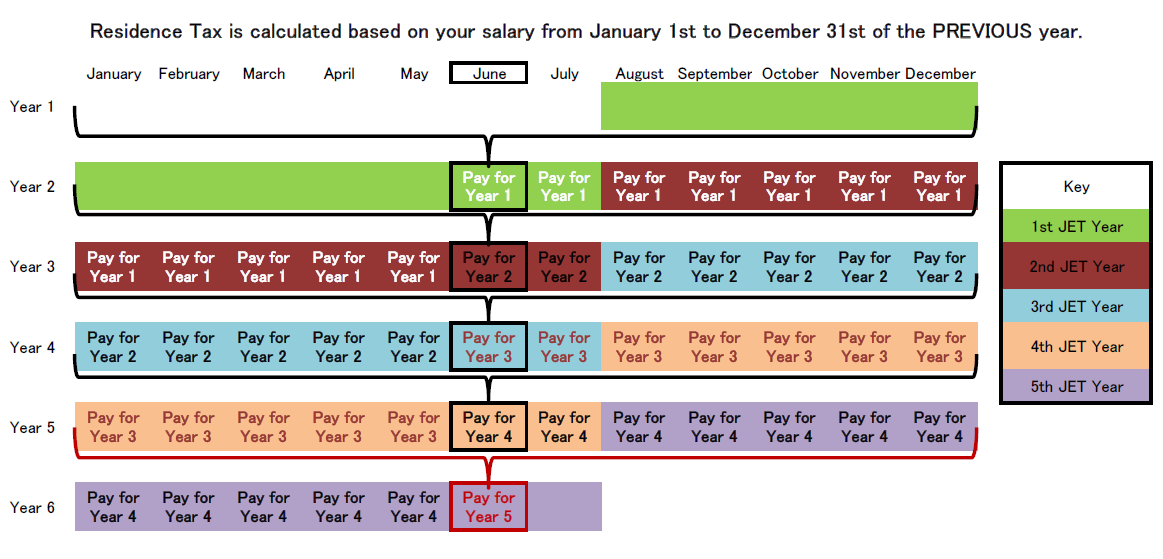

For many foreign employees residing in Japan, understanding the nuances of local taxes can be a daunting task. Particularly, the residence tax, which is often a significant annual expense, poses a challenge. However, 2023 brings an opportunity for these expatriates to apply for a residence tax exemption, potentially easing their financial burden.

The eligibility for this exemption and the percentage of tax relief granted is directly linked to the individual’s total personal income earned in the previous year, 2022 in this case. This correlation underscores the importance of maintaining accurate financial records and being aware of one’s income status.

To efficiently navigate this process, foreign workers in Japan need to be meticulous in preparing and submitting several key documents. These documents play a crucial role in determining eligibility and the extent of the exemption. The required documents include:

- Beneficiaries Registration Form: This form is a critical component of the application process. It officially registers the applicant for consideration under the tax exemption program.

- Certificate of Relationship with the Dependent: Applicants must provide proof of their relationship with any dependents mentioned in the registration form. This is essential to validate claims for exemptions based on financial responsibilities for dependents.

- Proof of Financial Support: An invoice or bank statement confirming the monthly financial contribution towards the dependent’s upkeep is required. This document serves as evidence of ongoing financial obligations, which can significantly impact the exemption status.

- Choosing a Reliable Money Transfer Bank: For foreign workers supporting dependents back in their home countries, selecting a reputable bank for international money transfers is crucial. This choice ensures that financial support is sent reliably and efficiently, which is essential for maintaining eligibility for tax exemptions.

While the process might seem complex, it’s a strategic move for foreign workers aiming to optimize their financial situation in Japan. It’s not just about reducing the immediate financial strain but also about understanding and adapting to the local tax environment.

For those unfamiliar with the Japanese tax system or who find the documentation process overwhelming, seeking professional advice is recommended. Tax consultants or financial advisors can provide personalized guidance, ensuring that all requirements are met accurately and efficiently.

In summary, the residence tax exemption in Japan for 2023 is a significant opportunity for foreign employees to alleviate some of their tax burdens. By understanding the requirements, diligently preparing the necessary documentation, and possibly seeking expert advice, foreign workers in Japan can navigate this process successfully and benefit financially.

Contact HSB JAPAN to get the Residence Tax Exemption