How to Claim Your Income Tax Refund in Japan in 2022

If you are foreigners who have lived in Japan for nearly a year, you may hear about the term “income tax refund” and wonder what it is and whether you are eligible to receive it.

This blog will give you a general understanding of income tax and how you can claim your income tax refund in Japan.

What is individual income tax in Japan?

First, you should know the definition of income tax because it’s one of the two main types of taxes you have to pay when living in Japan.

In general, income tax is the tax levied by the government depending on your annual income. Hence, the tax year is from January 1st to December 31st. Meanwhile, the due date for an income tax refund in Japan is normally on March 15th.

Particularly, the levy will be taken out of the paychecks of students, trainees, and workers for contracting businesses. If you are employed by a business without a written contract, you must self-declare your taxes and file them by March 15th.

Who has to pay income tax in Japan?

Everyone living in Japan must pay individual income tax according to law, except for people who have amounts of income below 130,000 yen per year.

On the other hand, other residents have to pay tax as follow:

- Permanent resident taxpayers: the tax is based on their income in Japan and nationwide.

- Non-permanent resident taxpayers: they are taxed on all of their income, excluding foreign-source income (including, potentially, certain capital gains) that is not paid into or remitted to Japan, as well as, potentially, a portion of their foreign-source income.

Who could be entitled to get an income tax refund in Japan?

In three situations, you are allowed to get an income tax refund in Japan.

- You have been a foreigner working in Japan for more than a year with an amount of income more than 130,000 yen per year.

- Your legal spouse is a Japanese person.

- You send remittances back to family dependents in your home country. The more dependents you have to take care of, the more income tax refund in Japan you receive.

How to claim your income tax refund in Japan

It is a significantly important step as we can show you how you can claim your income tax refund in Japan yearly. All you have to do is go to the tax office and prepare adequate documents, including:

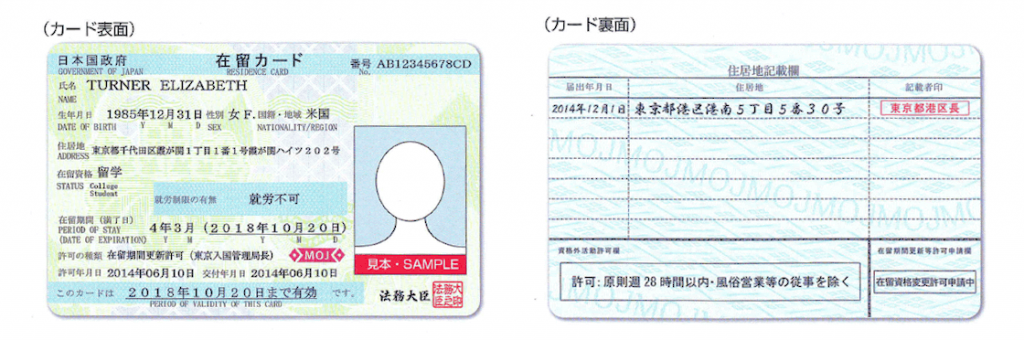

1. A photocopy of your residence card (both front and back sides).

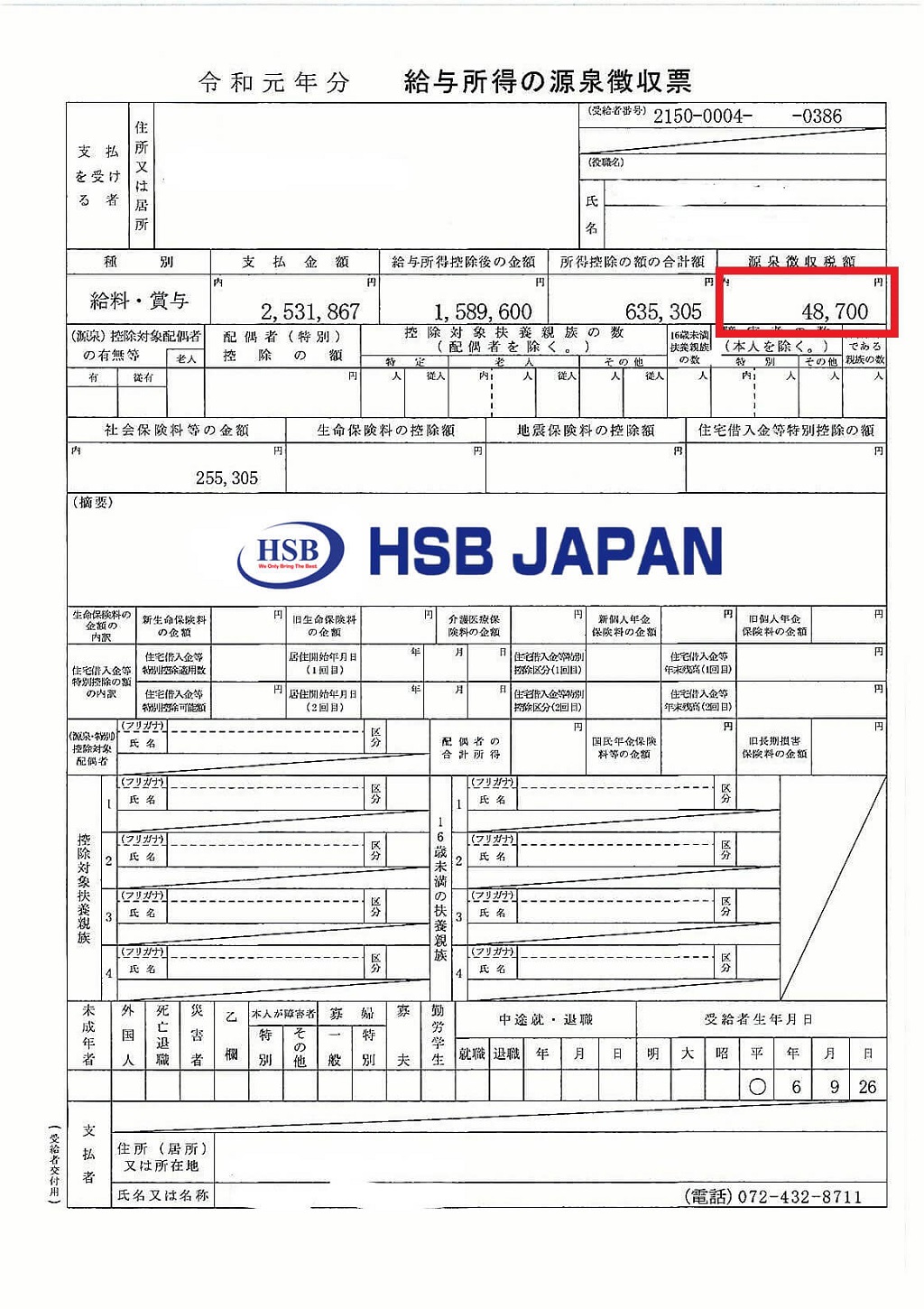

2. A photocopy of your last-year withholding tax slip. However, if you have two or more jobs, you need to submit the corresponding number of withholding tax slips to get the right amount of income tax refund in Japan.

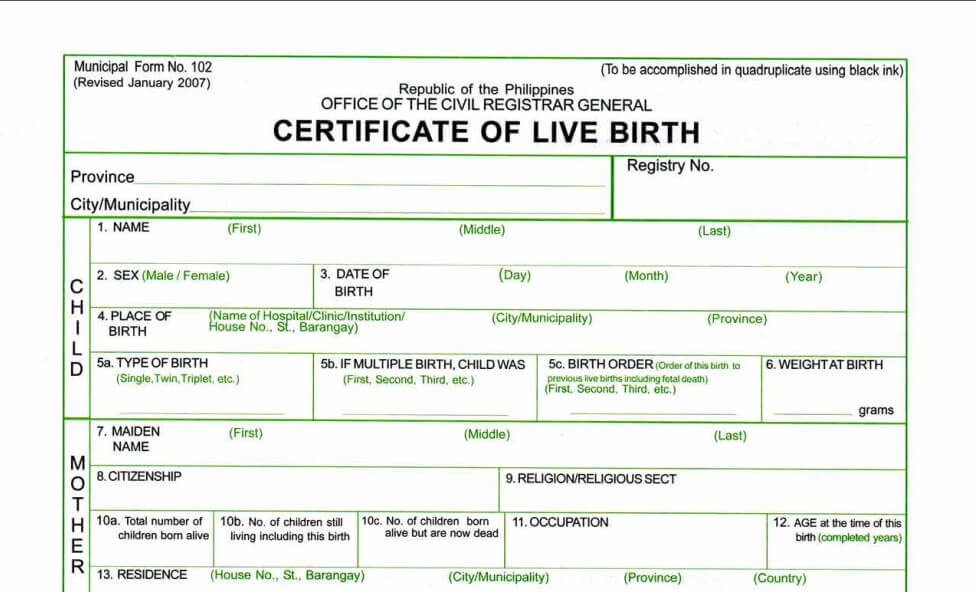

3. Any necessary document that can clearly state your relationships with the dependents to whom you send remittances. For example, birth certificates, legal marriage contracts, and others.

4. Your regular remittance receipts

In addition, you have to give them your bank account to receive the income tax refund in Japan after a few weeks.

Finally, to get further information about the income tax refund in Japan in more detail, you can contact HSB JAPAN for full support and consultation.

Final thoughts

All in all, we hope that all of the information above helps you have a brief understanding of the income tax refund in Japan. You can start applying and getting money right now by just following the instructions and preparing all of the required documents to avoid delays.

Contact us via Facebook: https://www.facebook.com/taxrefundinjapan