Tax Refund in Japan: A Guide for Foreign Workers

If you’re a foreign worker in Japan, whether you’re a student, intern, or engineer, you are required to pay two main types of taxes: Income Tax (Shotokuzei 所得税) and Residence Tax (Juminzei 住民税). By optimizing your understanding of tax refund in Japan, residence tax, and income tax, you can ensure you are not overpaying and make the most of the benefits available.

Below is a simple breakdown of these taxes and how you can apply for a tax refund in Japan.

1. Income Tax (Shotokuzei 所得税)

What is Income Tax? Income tax in Japan is calculated based on your total annual income. If your income exceeds approximately ¥1,030,000 (around 103 man) per year, you will be required to pay this tax. The more you earn, the higher your income tax liability.

At the end of the year, your employer will summarize your actual income and calculate the actual income tax owed, performing the Nenmatsu Chosei (year-end tax adjustment). This process compares the amount of tax already withheld during the year with the actual tax liability based on your total income for the year. If there is a discrepancy, you will either receive a refund or be asked to pay any additional taxes due.

2. Residence Tax (Juminzei 住民税)

What is Residence Tax?

Residence tax, also known as “municipal tax” or “local tax,” is a tax imposed by the local government to fund social welfare and public services like education, waste management, fire services, etc. This tax is applicable to anyone who earns more than ¥1,000,000 (100 man) per year, regardless of whether they are a student, employee, or foreign worker.

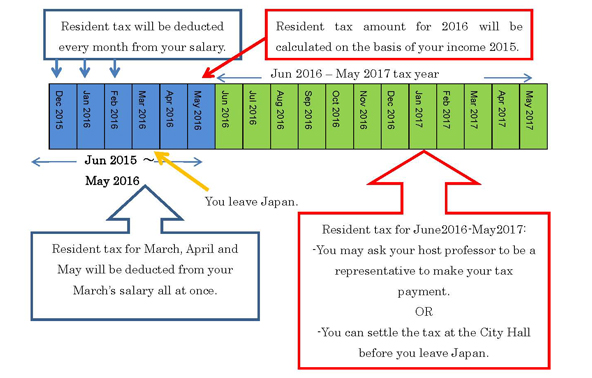

Residence tax is based on your income from the previous year. For newcomers in Japan, if you arrive during your first year, your income for the previous year will be considered as ¥0, so you won’t be required to pay this tax in your first year. However, in the second year, local authorities will calculate the residence tax based on your income from the previous year. This tax is collected starting in June of the following year.

Important Notes on Residence Tax:

- Residence tax is calculated based on the income earned during the previous year (from January 1 to December 31). Therefore, taxes will be due in the local government of your residence as of January 1 of the following year.

- If you change your residence after January 1, the residence tax for the year will still be calculated for the location where you were registered as a resident on January 1.

Example: If you were living in City A on January 1, 2019, and then moved to City B in February 2019, your residence tax for 2019 will be due in City A. The residence tax for City B will start in 2020.

Can You Receive Tax Bills from Both Locations?

No, generally, only the local government where you were registered as a resident on January 1 will collect your residence tax. If you have not updated your address after moving, your previous municipality may continue to send you tax bills. Be sure to register your new address promptly to avoid confusion and ensure that you pay the correct amount.

3. Tax Refund for Foreign Workers in Japan

How to Apply for a Tax Refund (Income and Residence Tax)?

The Japanese government allows individuals to apply for a tax refund or exemption if they meet certain conditions, such as sending money for the support of family members living abroad.

Eligibility for Tax Refunds:

Any taxpayer (regardless of nationality) who has sent money to support family members not residing in Japan may qualify for tax deductions or exemptions. The family members eligible for support are typically those within 6 generations, including spouses and relatives within 3 generations.

Support Conditions:

- Spouse: Send between 5-10 man annually.

- Children aged 16 to 30: Send between 5-10 man annually.

- Elderly over 70: Send between 5-10 man annually.

- Adults aged 30 to 70: Send at least 3,8 man annually.

4. Important Points to Remember

- Tax Refund Procedures: You can apply for tax refunds while still residing in Japan, or even after returning to your home country (Vietnam, for example). However, to apply for a refund for both Income Tax and Residence Tax, it’s recommended to complete the procedure while you are still in Japan.

- Tax Refund Deadline: The refund process is applicable for the last 5 years of tax payments.

- Refund Amount: The amount refunded depends on how many people you support. The more family members you support, the larger the refund.

- Transfer to Vietnamese Accounts: Please note that transfers made to your own bank account in Vietnam will not count as support for family members in Japan.

Conclusion

Japan’s tax system can be complex, but with the right information and proper procedures, you can apply for tax refunds and save money. The taxes in Japan can be quite high, so it’s crucial to understand these procedures and take advantage of any eligible tax refund opportunities.

If you need assistance or are ready to apply for a tax refund, contact HSB Japan’s trusted and professional tax refund services for expert guidance. Call us at 03-5937-2465 for more information or to schedule a consultation.