Tax Refund and Tax Deduction When Attending Furusato nozei

Furusato nozei is not basically a type of tax to pay, instead, it’s a regime in which the residents can distribute their effort in building and developing local regions in Japan through personal monetary donations. In addition, they will also get back the local specialties, like fruits, food, and others, from that locality as a thank-you gift.

However, when engaging in the Furusato nozei, have you ever wondered about the amount of reduced income tax or whether you can get a residence tax refund in Japan?

As a result, in this blog, we will take a further look at the regulations for a tax deduction and refund for Furusato nozei’s participants.

What can you receive when taking part in Furusato nozei?

Besides the thank-you gifts which the local regions give you, you can also get a residence tax deduction according to the amount of money you donated which will be subtracted from 2000 yen.

In addition, you may also be eligible for a refund of a portion of the individual income tax you have paid.

Types of tax deduction and tax refund in Japan in Furusato nozei

In general, there are two types of tax deduction and tax refund in Japan when a taxpayer decides to join the Furusato nozei regime.

- Contribution to up to 5 localities: If you attend Furusato nozei in more than 5 local regions, you will receive a residence tax deduction and individual income tax refund in Japan.

- Contribution to less than 5 localities: In contrast, if you make a contribution to no more than 5 localities, you will only get a residence tax deduction.

Normally, to get a residence tax deduction and income tax refund in Japan, Furusato nozei’s participants must file a tax declaration.

Individual income tax refund in Japan

As mentioned above, you can only get an individual income tax refund in Japan if you engage in Furusato nozei in up to 5 localities. Still, to get a tax refund in Japan, tax declaration procedures are required.

After filing a tax declaration, the refund money will be transferred to your bank account in around one month or one month and a half.

For instance, if you make the declaration procedures on February 15th, then the estimated time you will get your cashback will be at the beginning of March.

Residence tax deduction

First and foremost, you should make clear that individual income tax can be refunded; on the other hand, the residence tax cannot. Instead, it will only be deducted.

In addition, the maximum amount of money deducted is basically based on your monthly income; hence, it will vary for different residents. At the limit, the tax deducted is calculated as the amount of monetary contribution minus 2000 yen.

Besides, the deducted residence tax will be valid for the next year after you attend Furusato nozei.

For instance, you register for Furusato nozei in 2017 and file for tax declaration procedures in February 2018. Then, the tax department will send your tax information to the locality. It also means you will get your residence tax deducted from June 2018 to May 2019.

Finally, when starting the residence tax collection in June, the local tax department will send you a notification form, where you can check the amount of tax deduction. Otherwise, you can check it out in the monthly salary form.

Final thoughts

In general, when attending the Furusato nozei regime, there are several benefits, as you can receive plenty of local gifts, a residence tax deduction, and an income tax refund in Japan.

We hope that all of the information above can help resolve some of your inquiries regarding tax deductions and a tax refund in Japan.

Contact us via our website or Facebook page to get more useful information.

Comprehensive Requirements for Japan Tax Refund in 2022

In “How to Claim Your Income Tax Refund in Japan in 2022,” we show you what an income tax refund is, who is entitled to receive it, and what documents you need to send in an application.

Still, you may wonder if you have to follow any requirements with the documents to get your application accepted.

Hence, in this blog, we will delineate the detailed conditions for the documents you submit to successfully get a Japan tax return.

What is a japan tax refund?

A tax refund is a payment made to a taxpayer to cover any overpayments made to the state governments.

While refunds are frequently seen by taxpayers as a windfall or a lucky break, they frequently represent what amounts to an interest-free loan that the taxpayer paid to the government.

Why should you submit for a Japan tax refund?

Taxpayers receive refunds for a variety of reasons or may even owe the government money in some circumstances.

When too much money is withheld from their taxes, the taxpayer gets a refund at the end of the year. If you overspend your estimated taxes and are self-employed, you also receive a Japan tax refund.

Still, you might think of this additional revenue as free money, but in reality, it’s more like a loan you gave the IRS without charging interest. If you overestimate your tax liability, you will owe money to the government.

However, you can only get a Japan tax refund if you’ve never applied for a tax reduction.

How can you submit for a Japan tax refund

If you’re a foreigner living in Japan for about one year, you can file and get your Japan tax return in two ways, through the tax department (Zeimusho) and local administration. Or, you can ask somebody for help.

Through the tax department (Zeimusho)

If you decide to handle this process on your own, you can conduct it on the Internet or directly come to the local Tax Department (Zeimusho) or People’s Committee according to where you currently live. They will show you detailed instructions to easily follow.

Ask for help

You can ask your company’s legal officer to apply for a Japan tax refund on your behalf. All you have to do is to provide them with adequate personal documents to make the procedure run smoothly.

Currently, one of the most trustworthy and top-rated services is that of HSB JAPAN. The staff will give you comprehensive assistance in submitting for a Japan tax refund as well as resolve any of your inquiries regarding this topic.

Otherwise, you can join HSB JAPAN’s Facebook fan page to discuss more Japanese tax refunds and pensions with other foreigners residing in Japan.

Pay taxes in Japan

First and foremost, you must pay two types of taxes when living in Japan. They are individual income tax and residence tax. However, to do this, your annual income must be over 130,000 yen according to Japanese law and currency. Otherwise, you cannot pay taxes and receive a Japan tax return.

Prepare adequate documents to submit for a Japan tax refund

To claim a tax refund in Japan, you will be required to submit some obligatory documents. We will now list them out and explain to you why.

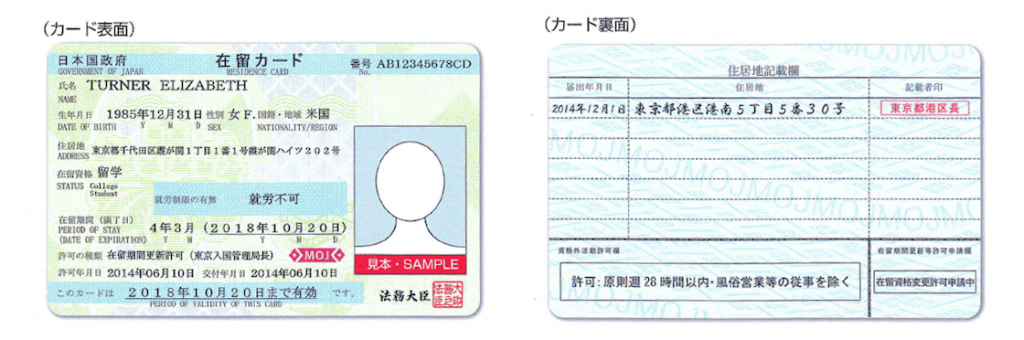

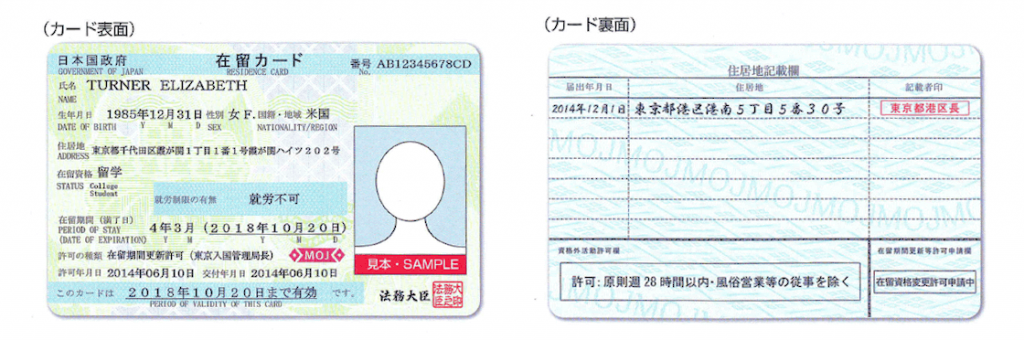

Resident card

You must submit a photocopy of your resident card with both the front and back sides.

It is extremely necessary as your resident card displays information about your name, address, length of stay, and other details. So, make sure you don’t forget this!

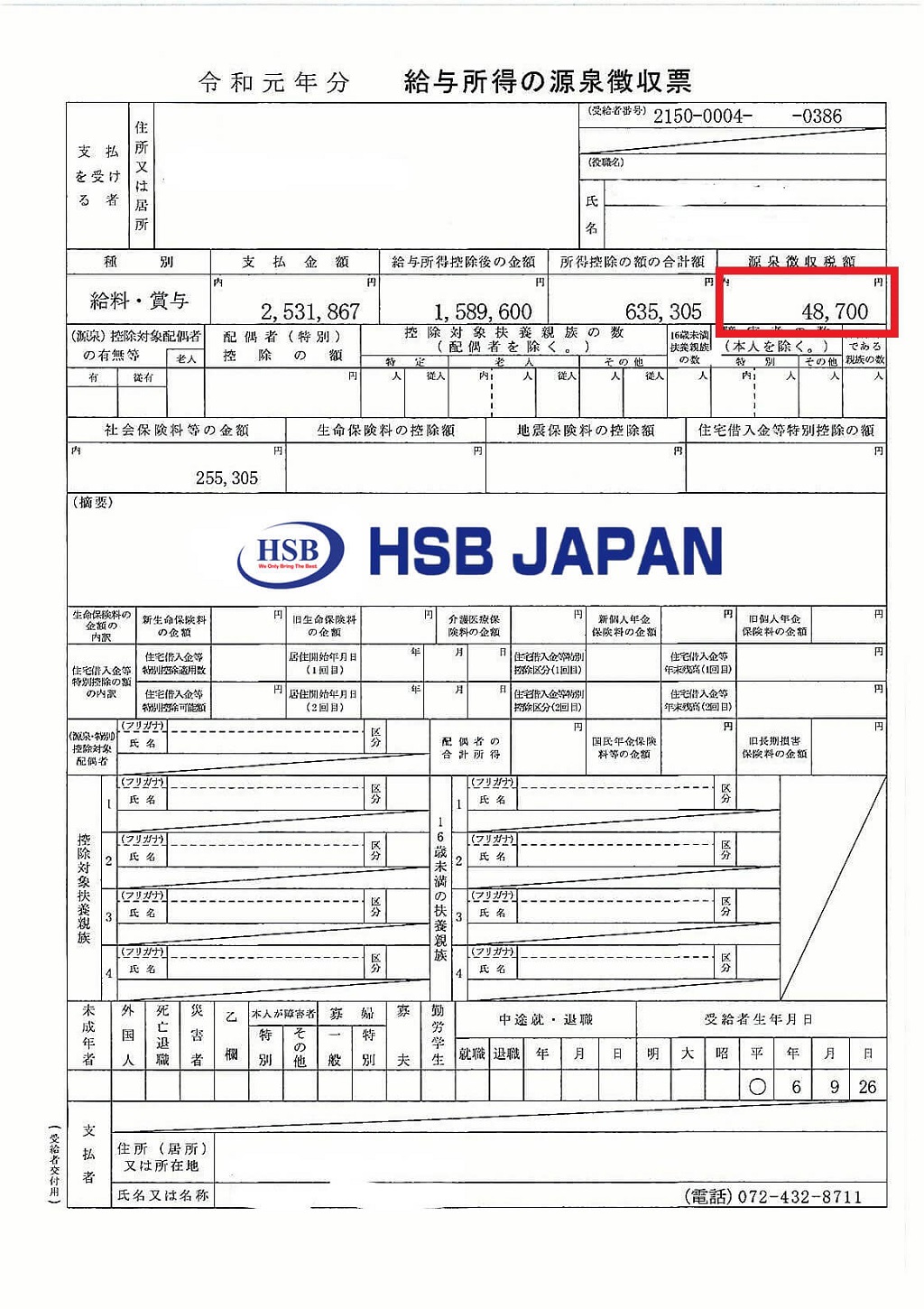

Gensen

Gensen, or gensenchoshuhyou, is a withholding tax slip in English.

Particularly, a gensen will be an extremely crucial document if you want to send in an application to get a Japan tax refund. It will display and prove your personal earnings and withheld taxes throughout the year.

In addition, there are some requirements related to your withholding tax slip that you should carefully prepare:

- You will not be able to get a Japan tax refund if gensen doesn’t show the amount of tax withheld from your salary.

- The picture of gensen must include full information (year, your company’s name and address, employee’s name, etc.)

- Only the gensen taken directly from your company is official accepted.

Remittance history

Remittances are money transfers to family or friends in your home countries. These payments play an important role in the lives of many people, supporting families and communities.

Therefore, if you want to apply for a Japan tax refund, you must include these documents as they will prove to the tax office the information you submitted. It includes who you sent remittances to, how much, and the date of transactions.

Moreover, the number of dependents you have also affects the amount of Japan tax refund you receive. For instance, with 1 dependent, you can get a tax refund for income tax at 19,300 Yen and residence tax at 35,500 Yen per year.

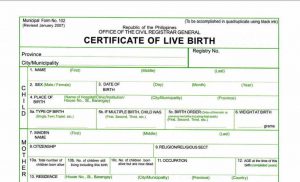

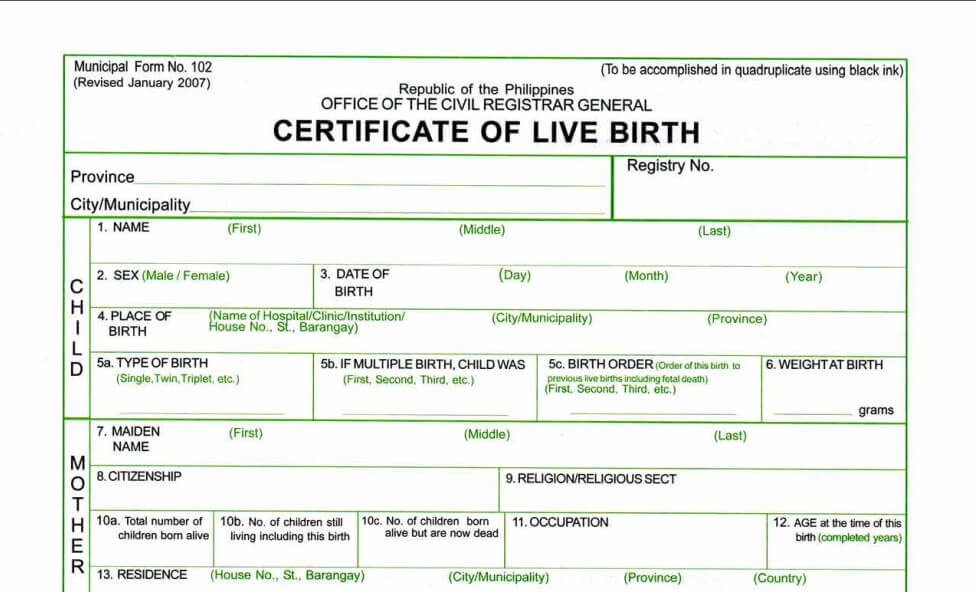

Birth Certificates

A birth certificate is a document that lists the full name, date of birth, place of birth, parent’s full name, and other identifying information of a person. It is typically issued by the government agency responsible for vital records. So, why do you need to submit your and your family members’ birth certificates?

That is to prove your relationship with the dependents. For instance, the tax office will check your parents’ information on your birth certificate if you send them remittances.

However, some of the other tax offices may require you to submit your parents’ marriage certificate so that they can check for further validity.

Cash card bank certificates

When you are living in Japan, you can get a Japan tax refund of your individual income and residence tax by using a Cash Card.

To do this, after presenting your remittance history and passport to the Japanese Tax Office, you will be able to get a Japan tax refund and the money will be transferred to the bank account you submitted.

Other requirements

Time for getting a Japan tax refund

If you’re looking to get a Japan tax refund, remember that the maximum amount of tax refund you can get is within the last 5 years. It means you can file for a Japan tax refund for each year separately, or you can just wait for about 5 years to withdraw a Japan tax refund in bulk.

If you have any questions about the tax refund process, or if you need help filing your return, contact us via the HSB JAPAN Website or Facebook, and we will answer all of your inquiries.

Remittances to dependents

If you have two or more dependents, you should send them remittances into separate bank accounts. Moreover, the name of the bank accounts must correspond with the dependents’ names you submitted.

In addition, you must have remittance receipts to get a Japan tax refund. It won’t be approved if you come back to your home country and give the money hand-in-hand to your dependents.

Although the more dependents you have to take care of, the more money you get back, you should not list too many dependents as it may be a sign of avoiding paying taxes. Instead, 4 dependents will be an appropriate number.

Final words

All in all, the process of withdrawing a Japan tax refund may not be as complicated and time-consuming as you might think. Just strictly follow the directions and you can get through it with ease.

How to Claim Your Income Tax Refund in Japan in 2022

If you are foreigners who have lived in Japan for nearly a year, you may hear about the term “income tax refund” and wonder what it is and whether you are eligible to receive it.

This blog will give you a general understanding of income tax and how you can claim your income tax refund in Japan.

What is individual income tax in Japan?

First, you should know the definition of income tax because it’s one of the two main types of taxes you have to pay when living in Japan.

In general, income tax is the tax levied by the government depending on your annual income. Hence, the tax year is from January 1st to December 31st. Meanwhile, the due date for an income tax refund in Japan is normally on March 15th.

Particularly, the levy will be taken out of the paychecks of students, trainees, and workers for contracting businesses. If you are employed by a business without a written contract, you must self-declare your taxes and file them by March 15th.

Who has to pay income tax in Japan?

Everyone living in Japan must pay individual income tax according to law, except for people who have amounts of income below 130,000 yen per year.

On the other hand, other residents have to pay tax as follow:

- Permanent resident taxpayers: the tax is based on their income in Japan and nationwide.

- Non-permanent resident taxpayers: they are taxed on all of their income, excluding foreign-source income (including, potentially, certain capital gains) that is not paid into or remitted to Japan, as well as, potentially, a portion of their foreign-source income.

Who could be entitled to get an income tax refund in Japan?

In three situations, you are allowed to get an income tax refund in Japan.

- You have been a foreigner working in Japan for more than a year with an amount of income more than 130,000 yen per year.

- Your legal spouse is a Japanese person.

- You send remittances back to family dependents in your home country. The more dependents you have to take care of, the more income tax refund in Japan you receive.

How to claim your income tax refund in Japan

It is a significantly important step as we can show you how you can claim your income tax refund in Japan yearly. All you have to do is go to the tax office and prepare adequate documents, including:

1. A photocopy of your residence card (both front and back sides).

2. A photocopy of your last-year withholding tax slip. However, if you have two or more jobs, you need to submit the corresponding number of withholding tax slips to get the right amount of income tax refund in Japan.

3. Any necessary document that can clearly state your relationships with the dependents to whom you send remittances. For example, birth certificates, legal marriage contracts, and others.

4. Your regular remittance receipts

In addition, you have to give them your bank account to receive the income tax refund in Japan after a few weeks.

Finally, to get further information about the income tax refund in Japan in more detail, you can contact HSB JAPAN for full support and consultation.

Final thoughts

All in all, we hope that all of the information above helps you have a brief understanding of the income tax refund in Japan. You can start applying and getting money right now by just following the instructions and preparing all of the required documents to avoid delays.

Contact us via Facebook: https://www.facebook.com/taxrefundinjapan